FTSE Russell Upgrades Vietnam to Secondary Emerging Market Status

|

This achievement is attributed to the strong leadership of the Government, the Prime Minister, and the Ministry of Finance; the close coordination of the State Bank of Vietnam and relevant ministries; the collaboration of stock exchanges, VSDC, market participants, and media outlets; as well as the invaluable support from the World Bank, FTSE Russell experts, and global investment institutions, as emphasized in the SSC’s official statement.

The Upgrade Marks the Beginning of a New Development Phase

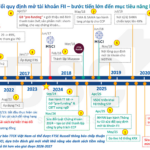

The SSC also affirmed that this upgrade marks the beginning of a new development phase, requiring deeper and broader reforms to achieve long-term goals. As the state securities regulator, the SSC pledged to continue working closely with FTSE Russell to ensure a smooth transition according to the roadmap.

“The SSC is committed to implementing comprehensive measures to maximize access for domestic and international investors, while enhancing the legal framework, modernizing infrastructure, and digitizing processes. These efforts aim to foster a more transparent, efficient, and globally integrated Vietnamese securities market,” stated the market regulator.

What Do Securities Firms Say?

Following FTSE Russell’s announcement, several securities firms shared their perspectives on this significant event.

SSI Securities Corporation noted that FTSE Russell has officially reclassified Vietnam’s stock market from Frontier Market to Secondary Emerging Market, effective September 21, 2026.

According to SSI, this upgrade reflects the concerted efforts of regulators and market participants in aligning with international standards and attracting institutional investment.

“While there are still issues to address before Vietnamese stocks are formally included in FTSE’s emerging market index in September 2026, SSI believes these challenges are feasible to resolve before the FTSE evaluation deadline. Addressing these issues will create a more favorable and transparent legal environment, better supporting market participants,” SSI added.

The firm emphasized that this upgrade is not an endpoint but a starting point for deeper integration into the global financial system. It is the result of meaningful collaboration between FTSE Russell and Vietnamese regulators, aimed at developing a robust capital market to support Vietnam’s long-term economic goals.

Meanwhile, Vietcap Securities commented: “FTSE Russell’s decision to upgrade Vietnam to Secondary Emerging Market (aligning with our expectations) follows Vietnam’s inclusion on the watchlist for potential upgrades since September 2018.”

According to Anthony Le, Deputy Director of Institutional Brokerage at Vietcap: “With this upgrade, Vietnam now joins the same category as larger markets such as China, India, Saudi Arabia, and Indonesia.”

Vietcap views this milestone as a testament to the SSC’s commitment to meeting FTSE Russell’s index criteria and as a harbinger of new growth potential for Vietnam’s market. The upgrade will enable access for a new group of investors previously restricted from investing in Vietnam. International securities firms estimate that net foreign investment could reach $6-8 billion, or even $10 billion under optimistic scenarios. These estimates include both active and passive fund flows, with active funds contributing the majority.

The upgrade to Secondary Emerging Market status will take effect on Monday, September 21, 2026, subject to the outcome of the March 2026 interim review. Implementation is expected to occur in phases, with details to be announced in the FTSE Equity Country Classification Review Results in early April 2026.

– 08:15 08/10/2025

Vietnam Airlines Appointed Lead Investor for Three Cargo Projects Worth Over VND 5.6 Trillion at Long Thanh Airport

The Ministry of Construction has issued three decisions, numbered 1630, 1631, and 1632/QĐ-BXD (dated September 30, 2025), approving Vietnam Airlines (HOSE: HVN) as the investor for three aviation logistics projects at Long Thanh International Airport. The preliminary total investment for these projects is estimated at 5.602 trillion VND.

Vietnam’s Ascent to Global Financial Hub Status

Aspiring to establish Vietnam as a compelling and sustainable global financial hub not only unlocks opportunities to attract international capital but also serves as a critical test of its institutional framework, infrastructure, and capacity to foster an environment that is truly livable, workable, and investable.