The Sweet Fruits of a Seed-Sowing Journey

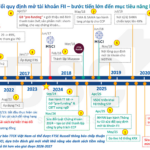

Previously, Vietnam was added to the watchlist in September 2018. Since then, significant progress has been made, such as the implementation of Non-Pre-Funded Trading (NFP) and the failed trade processing procedure in November 2024, which improved payment and access for foreign investors (FII).

FTSE Russell established a formal review process (OBR) for evaluation, based on the FTSE Country Equity Classification Framework. The rating organization emphasized addressing limitations in global broker access to build trust and reduce risks.

As a result, the upgrade was confirmed, effective from September 21, 2026, subject to an interim review in March 2026. The implementation will be phased, following consultations with stakeholders. FTSE Russell will continue monitoring and publish detailed plans in March 2026.

Mr. Son emphasized that the upgrade from Frontier to Secondary Emerging Market by FTSE Russell is a significant milestone, enabling Vietnam to integrate more deeply into the global financial system.

Mr. Tran Hoang Son – Market Strategy Director, VPBank Securities

|

Based on the experience of similar countries (such as Saudi Arabia and Kuwait), Vietnam’s stock market is expected to receive several positive impacts. First, an increase in foreign investment inflows. Assuming all stocks in the FTSE Vietnam Index are included in FTSE’s Emerging Markets Index, VPBank Securities estimates that passive and active capital inflows into Vietnam could reach approximately 3–7 billion USD after the upgrade takes effect.

Of this, around 1.5 billion USD would come from passive funds if Vietnam accounts for 0.5% of the FTSE EM index weight, while total assets from active funds are five times that of ETFs (according to FTSE).

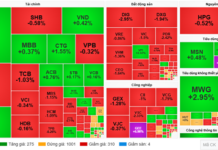

Second, improved market liquidity and efficiency. Removing the Pre-funding requirement will encourage institutional investors to participate, increasing daily trading value to 2–3 billion USD, fostering more stable market development, and reducing volatility.

Third, enhancing Vietnam’s economic image and position in the region. As one of the more mature growing economies in ASEAN, Vietnam will become more attractive to major investors (such as pension funds and ETFs), while strengthening its position in international trade negotiations and attracting higher-quality FDI.

Fourth, driving economic and corporate growth. Larger capital inflows will support companies in accelerating IPOs and new listings, increasing market goods and expanding capitalization. The stock market will become a more effective capital mobilization channel, contributing to the GDP growth target of over 8% in 2025 and double-digit growth from 2026–2030. This will also encourage companies to enhance reforms, improve operational standards, and strengthen corporate governance capabilities.

Overall, the upgrade not only brings financial benefits but also promotes structural reforms, helping Vietnam move closer to its goal of becoming a high-income country by 2045.

A New Journey with Many Challenges

To fully meet MSCI standards (which are stricter than FTSE) and maintain Emerging Market status, the Prime Minister issued Decision 2014 approving the plan to upgrade Vietnam’s stock market (in September 2025), with a four-phase roadmap until 2030. This roadmap ensures sustainability, focusing on international cooperation and implementation oversight to maintain a stable position in the emerging market region.

According to the stock market development strategy until 2030, Vietnam’s stock market capitalization will reach 100% of GDP (approximately 300 billion USD) by 2025 and 120% of GDP by 2030, up from the current 70–100% of GDP. This will be supported by GDP growth of 6.5–8% per year and capital mobilization through IPOs and the equitization of state-owned enterprises.

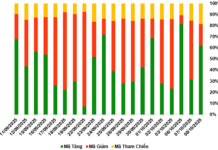

Regarding liquidity (average daily trading value), it is expected to increase significantly due to the upgrade and reforms. During 2025–2026, it will rise from the current 860 million USD to 1.5–2 billion USD per session, driven by foreign capital inflows of 3–5 billion USD from FTSE and KRX upgrades. From 2027–2030, it will reach 3–5 billion USD per session, with the number of securities accounts increasing from 15 to over 20 million. Key drivers include an increase in listed companies (from 1,600 to 2,000), new products (derivatives, ETFs), and FDI in green technology/logistics.

According to VPBank Securities experts, increased liquidity will help the stock market become a primary capital channel, supporting sustainable economic growth. However, mechanisms to monitor capital flows are necessary to mitigate risks during global volatility.

– 19:00 08/10/2025

VinaCapital: Post-Upgrade, Vietnam’s Stock Market Targets 120% of GDP by 2030

FTSE Russell has officially announced the upgrade of Vietnam’s stock market from Frontier to Secondary Emerging status, effective Monday, September 21, 2026, contingent upon the outcome of the March 2026 review.

Vietnam’s State Securities Commission: Market Upgrade Marks the Beginning of a New Development Phase

According to the State Securities Commission (SSC), this event marks a significant milestone, showcasing the robust growth of Vietnam’s stock market. It reflects the comprehensive reform efforts undertaken by the entire securities industry in recent years, aligning with the directives of the Party and the State to develop a transparent, modern, and efficient stock market that meets the highest international standards.

Vietnam’s Ascent to Global Financial Hub Status

Aspiring to establish Vietnam as a compelling and sustainable global financial hub not only unlocks opportunities to attract international capital but also serves as a critical test of its institutional framework, infrastructure, and capacity to foster an environment that is truly livable, workable, and investable.