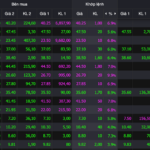

Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1 billion shares, equivalent to a value of more than 31.3 trillion VND; the HNX-Index reached over 98.2 million shares, equivalent to a value of more than 2.3 trillion VND.

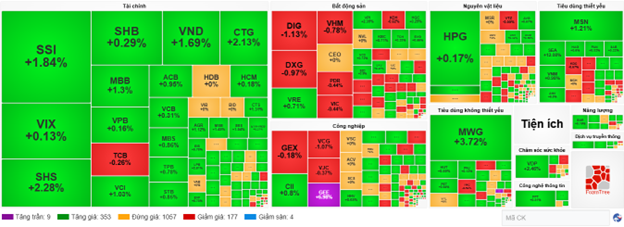

The VN-Index opened the afternoon session with a favorable trend as buyers gradually regained control, helping the index surge past the 1,700-point mark and closing in the green at the end of the session. In terms of influence, VHM, VCB, CTG, and VNM were the most positively impactful stocks on the VN-Index, contributing over 8.6 points. Conversely, VIC, TCB, LPB, and FPT faced selling pressure, reducing the index by more than 3.1 points.

| Top 10 stocks impacting the VN-Index on October 8, 2025 (in points) |

Similarly, the HNX-Index showed an optimistic trend, positively influenced by stocks such as KSV (+1.24%), CEO (+2.05%), SHS (+1.14%), and PVS (+1.25%).

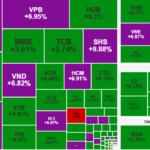

At the close, the market rose by 0.63%, with green dominating most sectors. The non-essential consumer sector led the market with a 1.12% increase, primarily driven by MWG (+3.59%), FRT (+2.38%), DGW (+0.49%), and HHS (+4.09%). The real estate and essential consumer sectors followed with gains of 0.92% and 0.78%, respectively. Conversely, the information technology sector saw a significant decline of 0.96%, mainly due to FPT (-1.05%), DLG (-0.35%), and VEC (-8.89%).

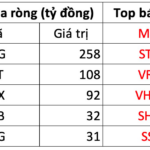

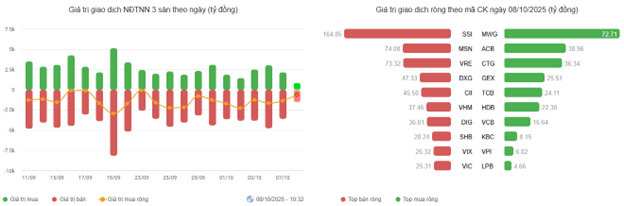

In terms of foreign trading, foreign investors turned net buyers with over 154 billion VND on the HOSE, focusing on GEX (264.1 billion), MWG (254.85 billion), HPG (179.59 billion), and VCB (130.45 billion). On the HNX, foreign investors were net sellers with over 62 billion VND, concentrated in IDC (47.63 billion), CEO (15.73 billion), PLC (2.44 billion), and MST (1.59 billion).

| Foreign net buying and selling trends |

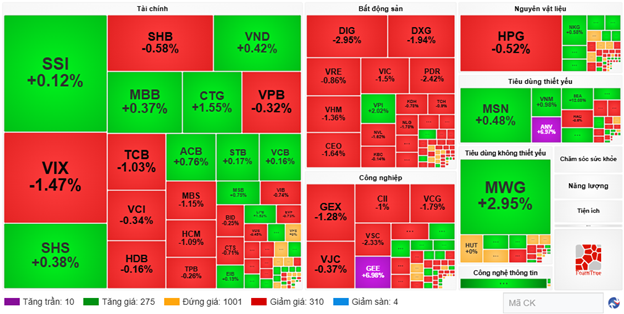

Morning Session: Red Returns

The upgrade effect wasn’t strong enough to sustain the rally, and the market cooled down toward the end of the morning session. At the mid-session break, the VN-Index fell by 1.63 points to 1,683.67 points, while the HNX-Index remained at the reference level, reaching 272.96 points. The number of declining stocks gradually increased, with 314 stocks falling and 285 rising.

Among the top 10 stocks influencing the VN-Index, the Vingroup duo, VIC and VHM, had the most negative impact, reducing the index by 2.4 points and 1.3 points, respectively. Conversely, CTG was the standout performer, contributing a 1-point increase.

| Top 10 stocks positively impacting the VN-Index in the morning session of October 8, 2025 (in points) |

Divergence dominated, with most sectors fluctuating within narrow ranges. The non-essential consumer sector temporarily led the market, primarily due to contributions from leading stocks such as MWG (+2.82%) and FRT (+0.84%), while other stocks generally remained at the reference level or declined slightly.

Additionally, the industrial sector traded actively, with buying pressure concentrated in stocks like HVN (+1.75%), MVN (+2.7%), VTP (+1.36%), and GEE, which hit the upper limit. However, several stocks saw notable adjustments, including GEX (-1.28%), VCG (-1.79%), CII (-1%), VGC (-2.22%), VSC (-2.33%), and SJG (-5.61%).

Conversely, the real estate sector was the most negatively impacted this morning, with stocks such as VIC (-1.5%), VHM (-1.36%), VRE (-0.86%), NVL (-1.62%), DXG (-1.94%), NLG (-1.78%), DIG (-2.95%), and PDR (-2.42%) all in the red.

Source: VietstockFinance

|

Foreign investors continued to sell, with a net value of 954 billion VND across all three exchanges. Selling pressure was concentrated in SSI, with a value of 174.57 billion VND. Meanwhile, VIX led the net buying list with a value of 94.44 billion VND.

| Top 10 stocks in foreign net buying and selling in the morning session of October 8, 2025 |

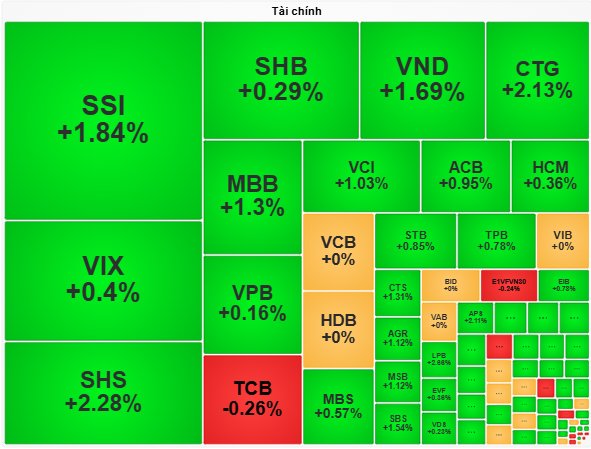

10:30 AM: Capital Flows into Financial and Blue-Chip Stocks, VN-Index Stays Green

Investor sentiment continued to improve as key indices maintained their green trend, accompanied by increased trading volume compared to the previous session. Capital continued to flow into financial sector stocks and the VN30.

In the securities sector, four stocks significantly impacted the VN-Index: SSI (+1.96%), VND (+1.69%), VCI (+1.03%), and HCM (+0.36%). The banking sector also contributed, with CTG (+2.33%), MBB (+1.3%), ACB (+0.95%), and STB (+0.85%).

Source: VietstockFinance

|

Essential consumer stocks also spread green, despite slight divergence among industry leaders. Notable gainers included VNM (+1.14%), MSN (+1.09%), SBT (+0.41%), QNS (+0.21%), and ANV (+4.98%).

However, the real estate sector was the only one with a contrasting trend, with red dominating. Stocks such as VIC, VHM, KDH, and DXG saw slight declines of less than 1%. The remaining stocks were stable, with VRE, BCM, KBC, and TCH maintaining green, though gains were insignificant.

Overall market breadth favored buyers, with over 350 stocks rising and around 170 falling. The VN-Index increased by more than 8.2 points to 1,693 points, the HNX-Index rose by 0.62% to around 274 points, and the UPCoM-Index gained 0.06%.

Source: VietstockFinance

|

Total trading volume across all three exchanges exceeded 445 million units, corresponding to over 13.3 trillion VND. A downside was that foreign investors remained net sellers with over 643 billion VND, concentrated in SSI, MSN, and VRE.

Source: VietstockFinance

|

Market Open: Strong Capital Inflow Amid Upgrade News

Following yesterday’s decline and reduced liquidity, the VN-Index opened strongly this morning, with green dominating the market. This surge was fueled by the official announcement from FTSE Russell in the early hours of October 8, 2025, regarding Vietnam’s upgrade from Frontier to Secondary Emerging market status, effective September 2026.

This news positively contributed to the overall rally, particularly in the financial, materials, and information technology sectors.

The financial sector saw positive momentum, with leading stocks rising sharply from the opening bell. SSI gained nearly 3%, followed by VIX and VND, which increased by 1.73% and 2.74%, respectively.

The materials sector also contributed to the market’s vibrancy, with green dominating. Notable gainers included GEE, which hit the upper limit, HHV (+1.29%), HAH (+0.72%), and ACV (+0.36%).

Additionally, several blue-chip stocks quickly aligned with the market’s upward trend, including MWG (+1.15%), FPT (+0.52%), and MSN (+0.36%).

– 15:20 08/10/2025

Vietstock Daily 09/10/2025: Ready to Break New Highs?

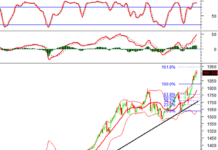

The VN-Index rallied following a session of tug-of-war trading, forming a Long Lower Shadow candlestick pattern. The MACD indicator has issued a fresh buy signal as it crossed above the Signal line, while the Stochastic Oscillator continues its upward trajectory, reinforcing the recovery momentum. Should these signals persist, the likelihood of surpassing the September 2025 peak (around 1,700-1,711 points) will strengthen in upcoming sessions.

What Scenarios Await the Stock Market Before and After the Upgrade Announcement?

The VN-Index briefly touched the 1,700-point milestone before retreating, as trading liquidity dwindled amid investor caution ahead of the highly anticipated market upgrade announcement.

Foreign Investors Extend Sell-Off Streak, Net Selling Over $43 Million, While Countering with $11 Million Buy on Blue-Chip Stock

Foreign investors’ net selling activities have significantly impacted the market, with a substantial net outflow of 1.393 trillion VND across the board.