Shifting Consumer Trends Towards Safe Food

The meat consumption market in Vietnam is undergoing a significant transformation. Previously, most products sold were unbranded meat, primarily through traditional channels. However, in recent years, consumers have become increasingly concerned about safety, quality certifications, and clear traceability of origins.

Experts attribute this shift to urbanization and heightened consumer awareness, particularly among the younger generation and modern families. Buyers are now willing to pay a premium for reputable brands or products with QR codes for traceability.

This shift presents substantial growth opportunities for companies with closed-loop value chains, reputable brands, and advanced technology. Masan MEATLife (UPCOM: MML) is a pioneer in introducing European-standard chilled meat technology to Vietnam with its MEATDeli products, catering to the growing trend of “clean eating, healthy living” among consumers.

Advantages of European Chilled Meat Technology and Brand Reputation

Masan MEATLife, a subsidiary of Masan Group (Hose: MSN), applies chilled technology across its entire production process: from slaughtering, cutting, packaging, to distribution. Chilled meat is produced under strict conditions, maintaining temperatures between 0–4°C throughout all stages, from slaughtering and cutting to transportation and distribution. This process not only extends shelf life but also preserves freshness, nutritional value, and ensures food safety.

Masan MEATLife’s two chilled meat processing complexes in Hà Nam and Long An are equipped with state-of-the-art production lines supplied by Marel, a leading Dutch company in slaughtering and meat processing equipment. The entire production process adheres to European chilled meat technology and complies with the BRC Global Standard for Food Safety, established by the British Retail Consortium. Holding this certification ensures that MML’s products meet stringent standards for safety, transparency, and traceability.

Supply Chain Technology and Modern Retail Ecosystem

Alongside processing technology, MML focuses on optimizing distribution through WiNARE, an intelligent supply chain management solution developed by Masan. This technology enables the company to forecast demand, optimize inventory, reduce waste, and enhance operational efficiency.

In Ho Chi Minh City, within just four months (May–August 2025), the meat category’s spoilage rate decreased by nearly 2% of revenue, saving tens of billions of dong monthly. Shelf availability (DR) increased from 80% to nearly 90%, while maintaining optimal inventory levels.

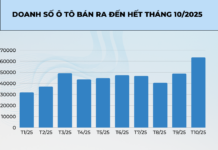

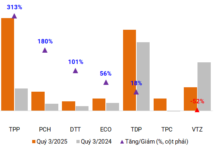

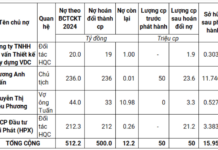

Beyond technology, MML benefits from its integration with over 4,200 WinMart and WinMart+ retail stores. In August 2025, Masan MEATLife recorded positive business results, with a sales volume of 14,007 tons, up 12.9% year-on-year. Net revenue reached 999 billion VND, a 11.1% increase, reflecting stable demand and growing contributions from modern retail channels. Operational efficiency improved significantly, with EBIT reaching 50 billion VND, up 42.9%, and net profit surging to 35 billion VND, a 60.5% increase.

At the group level, Masan (HOSE: MSN) reported that in the first nine months of 2025, its net profit after tax before minority interests (NPAT Pre-MI) exceeded 90% of the base scenario’s profit plan for 2025. As a key component of Masan’s consumer-retail ecosystem, MML significantly contributed to these positive results.

Despite the opportunities presented by modern consumer trends and advantages in technology and distribution, the meat industry faces significant challenges. Competition is intensifying as both domestic and international companies accelerate investments, while raw material and operational costs remain unpredictable. Scaling up requires substantial financial resources and increasingly complex supply chain management. Additionally, traditional shopping habits persist, slowing the transition to branded, quality-standardized products. These factors demand that companies balance growth, efficiency, and consumer trust.

In this context, Masan MEATLife (MML) is expected to sustain growth, driven by consumer preference for safe, branded, and traceable meat. With a diverse product portfolio ranging from chilled to processed meat, and a distribution network of over 4,200 WinCommerce stores, MML is well-positioned to expand its market presence while optimizing costs. Long-term, the company has the potential to lead Vietnam’s branded meat industry.

Box: Masan Group (HoSE: MSN) is one of Vietnam’s leading consumer-retail companies, dedicated to providing essential, high-quality products and services to domestic and international consumers. Masan’s ecosystem spans multiple high-growth sectors: fast-moving consumer goods (Masan Consumer with Chin-Su, Nam Ngư, Omachi, Kokomi, Wake-Up 247), branded meat (Masan MEATLife with MEATDeli, Ponnie, Heo Cao Bồi), retail (WinCommerce with WinMart, WinMart+), tea and coffee (Phúc Long Heritage), and advanced materials (Masan High-Tech Materials).

“Budget Mooncakes Ignored at $1.25, While Premium $33 Variants Fly Off Shelves”

As the Mid-Autumn Festival approaches, the mooncake market in Ho Chi Minh City is reaching its peak. While small stalls offer promotions like “buy one, get three free” or “3 for 100,000 VND” and still struggle to attract buyers, major brands are bustling with customers, even without offering any discounts.

Is Modern Technology and Retail Reshaping the Food Industry?

From growing food safety concerns to the rising demand for convenience, Vietnam’s meat market is undergoing a transformative shift. Beyond the foundational market demand, what key factors will empower branded processed meat companies to leverage their strengths and surge ahead in an increasingly competitive landscape?