Quietly partnering with Vietnam’s real estate giants, Nomura Real Estate Development has poured billions of USD into mega-projects, positioning Vietnam as a key international market. However, behind these large-scale deals lies a cautious investment strategy and a long-term vision.

Since entering the Vietnamese market in 2015, Nomura Real Estate has engaged in a diverse portfolio, encompassing over 30,000 residential units and numerous commercial properties. The conglomerate’s strategy focuses on collaborating with top-tier local players.

In the Southern market, particularly Ho Chi Minh City, Nomura’s joint venture with Mitsubishi has invested a total of nearly VND 13,000 billion (approximately VND 10,460 billion for The Beverly Solari and VND 2,482 billion for The Origami) to develop two sub-zones within the Vinhomes Grand Park urban area. This was achieved by acquiring 80% of the capital in two legal entities: MV1 Vietnam Real Estate Business LLC and MV Vietnam Real Estate Business JSC.

Zen Plaza, Ho Chi Minh City

Zen Plaza, Ho Chi Minh City

Also in Ho Chi Minh City, Nomura’s joint venture collaborated with Phu My Hung to develop the Phu My Hung Midtown project through the project company Phu Hung Thai.

Beyond residential projects, Nomura has made its mark in the Grade A office segment in central Ho Chi Minh City with properties like Zen Plaza and a 24% stake in the Sun Wah Tower.

Vinhomes Royal Island, Hai Phong

Rendering of Vinhomes Royal Island in Hai Phong

In the Northern market, Nomura has also recorded significant deals. The most notable is the Vinhomes Royal Island project in Hai Phong, where the group invested over VND 9,300 billion. In Hanoi, the group partnered with Ecopark to develop the Swan Lake Onsen sub-zone and collaborated with CapitaLand Development on the luxury project The Senique Hanoi.

Notably, the joint venture with Phu My Hung on the Hong Hac City urban area project in Bac Ninh highlights Nomura’s investment scale. In this deal, Phu My Hung transferred 49% of the project-owning entity’s shares to Nomura Real Estate Asia. The project spans nearly 200 hectares with a total expected investment of USD 1.1 billion.

The “Choose Wisely” Project Implementation Approach

Nomura’s strategy in Vietnam is to “choose wisely”: partnering with leading local players to leverage existing land funds and brands. However, these are not mere financial investments.

Vingroup Chairman Pham Nhat Vuong and Nomura Real Estate Chairman at the MoU signing ceremony. Photo: VHM

Vingroup Chairman Pham Nhat Vuong and Nomura Real Estate Chairman at the MoU signing ceremony. Photo: VHM

Data shows that Nomura often holds a controlling stake in joint venture entities, notably 80% in Vinhomes’ major projects (Royal Island, Grand Park) and 42.2% in the Phu My Hung Midtown joint venture.

Vietnam’s Role in the Parent Group

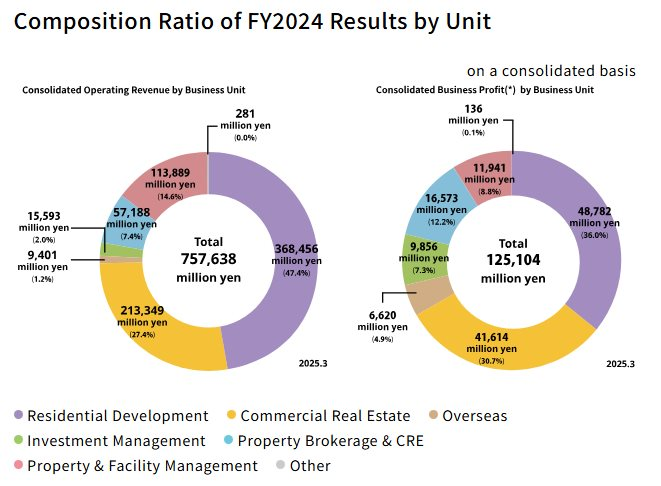

Revenue and Profit Structure by Business Segment of Nomura Real Estate Holdings. Source: Nomura Real Estate Holdings

Revenue and Profit Structure by Business Segment of Nomura Real Estate Holdings. Source: Nomura Real Estate Holdings

The role of the Vietnamese market was emphasized by Nomura’s senior leadership. During a press conference on April 24, 2025, Mr. Daisaku Matsuo, COO of Nomura Real Estate Holdings, provided detailed insights: “While Vietnam will remain a key profit driver for the fiscal year ending March 2028, we also expect property sales revenue in London and the US to contribute to profits.” Financial data shows this segment recorded a profit of JPY 6.6 billion in the latest fiscal year, with a target of JPY 4-5 billion annually over the next three years.

To achieve this goal, the group plans to invest approximately JPY 150 billion (nearly USD 1 billion) in international markets from 2025 to 2027, with Vietnam being a key focus. However, Nomura’s leadership remains cautious.

Mr. Daisaku Matsuo stated, “We will strive to diversify the profit structure of our international business across countries like the UK and the Philippines, rather than relying solely on Vietnam.” Similarly, CEO Satoshi Arai noted that investors should evaluate international project results over a three-year cycle, as the small number of projects could cause fluctuations if assessed on a single-year basis.

About Nomura Real Estate and Its Operational Structure

BLUE FRONT SHIBAURAN project overlooking Tokyo Bay. Source: Nomura Real Estate Holdings

BLUE FRONT SHIBAURAN project overlooking Tokyo Bay. Source: Nomura Real Estate Holdings

The group’s operations are clearly structured. Nomura Real Estate Holdings (established in 2004) is the parent company, responsible for strategy and consolidated business results, led by CEO Satoshi Arai and COO Daisaku Matsuo. Directly executing projects in Vietnam is Nomura Real Estate Development, the group’s core operating subsidiary with a history dating back to 1957.

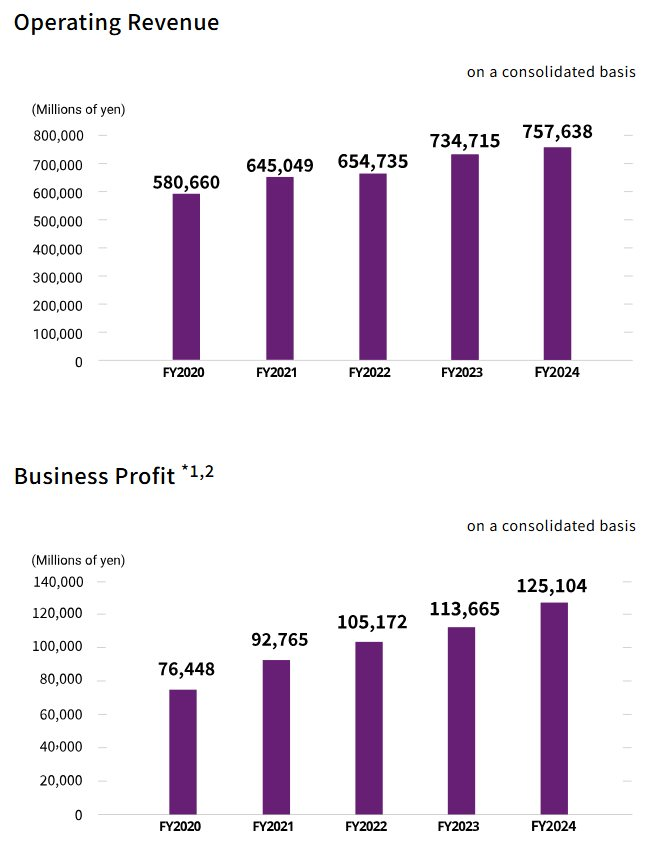

Source: Nomura Real Estate Holdings

Source: Nomura Real Estate Holdings

The foundation for Nomura’s international investment activities is the robust financial strength of the parent group. Over the past five fiscal years (2020–2024), Nomura Real Estate Holdings recorded stable results with an average annual revenue of JPY 686.8 billion and an average operating profit of JPY 64.9 billion. In the latest fiscal year ending March 2025, the parent group reported revenue of JPY 757.6 billion and an operating profit of JPY 125 billion.

Unveiling the Current State of the Mega Project That Brought Down Former Dong Nai Leaders

A series of former leaders in Dong Nai province have been prosecuted for investigation into violations related to the 125-hectare King Bay mega-project.

Hot News: FTSE Russell Upgrades Vietnam to Emerging Market Status

After more than seven years of anticipation, investors have finally witnessed a historic moment as FTSE Russell officially upgraded Vietnam to emerging market status.

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.