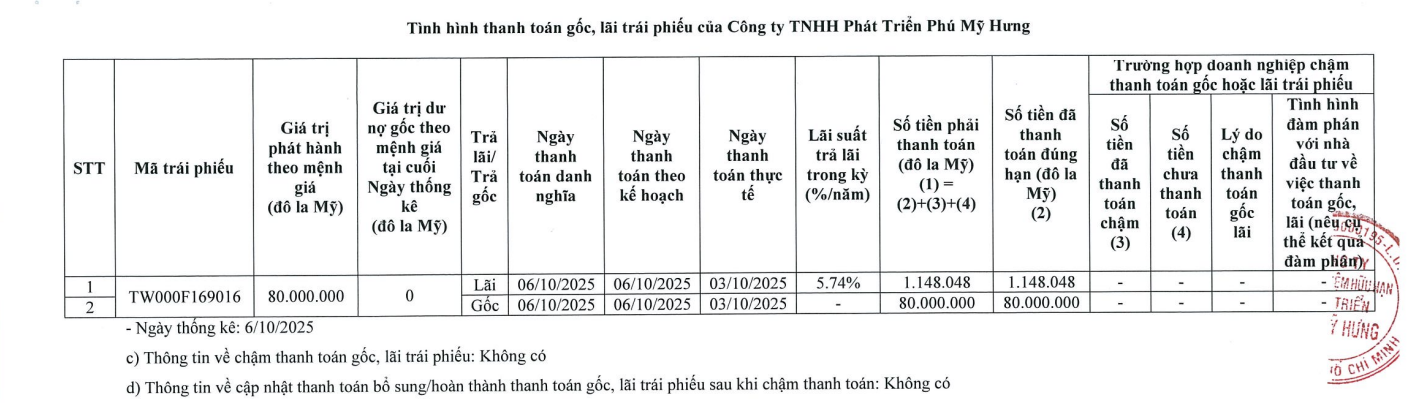

According to the Hanoi Stock Exchange (HNX), Phu My Hung Development LLC (Phu My Hung) has recently announced the repayment status of its bond principal and interest.

On October 6, 2025, Phu My Hung successfully repaid VND 80 billion of the principal and over VND 1.1 billion in interest for the bond TW000F169016, fully settling this tranche.

Source: HNX

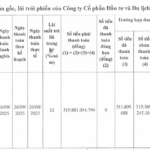

Regarding Phu My Hung’s bonds, in the first half of 2025, the company repaid a total of approximately VND 31 billion for 8 interest payment periods across three bond tranches: PMH.300.2019, PMH.1700.2019.01, and PMH.1700.2019.02.

All three bond tranches were issued in 2019 with a total issuance value of VND 2,000 billion. The outstanding principal balance as of June 30, 2025, stands at VND 867 billion.

In addition to these domestic bonds, Phu My Hung also issued an international bond tranche, PMH.150.2021, with a value of USD 150 million. This bond was issued in the Taiwanese market on December 29, 2021, with a 5-year term, maturing on December 29, 2026.

Phu My Hung is a leading real estate developer in Southern Vietnam, renowned for its long-standing presence in the market. The company is the developer of the Phu My Hung Urban Area in Ho Chi Minh City.

The Phu My Hung Urban Area spans 2,600 hectares. Currently, Phu My Hung is developing five urban clusters covering over 600 hectares, including: Zone A – New Urban Center (409 hectares); Zone B – University Village (95 hectares); Zone C – High-Tech Center (46 hectares); Zone D – Logistics Center I (85 hectares); and Zone E – Logistics Center II.

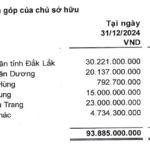

As of June 30, 2025, the company’s equity capital stands at VND 10,470 billion, a decrease of VND 2,185 billion compared to the same period last year.

Total liabilities as of June 30, 2025, increased by VND 1,069 billion to VND 23,412 billion, 2.24 times the equity capital. This includes bank loans of VND 5,686 billion and bond issuance debt of VND 7,558 billion (comprising VND 863 billion from domestic issuances and VND 6,695 billion from international issuances). Additionally, Phu My Hung has other payable liabilities amounting to nearly VND 10,168 billion.

The net profit for the first half of 2025 reached nearly VND 971 billion, a decline of approximately 29% compared to the same period in 2024.

HBS Stock of Hoa Binh Securities Placed Under Trading Restrictions

Due to the delayed submission of the 2025 semi-annual financial report, which exceeded the 45-day deadline, HBS shares of Hoa Binh Securities have been placed under trading restrictions effective October 8, 2025.