On the morning of October 8th, Vietnam time (following the closure of the U.S. stock market on October 7th), FTSE Russell released its September 2025 Country Classification Report. Vietnam’s stock market has officially been upgraded from Frontier to Secondary Emerging status.

Shortly after the announcement, SSI Chairman Nguyen Duy Hung shared on his personal Facebook page: “The upgrade is just the beginning. What matters most is competing fairly within FTSE and progressing toward MSCI.”

Earlier, at the Annual General Meeting held on September 25th, Mr. Hung confidently predicted the market upgrade would occur in early October. However, the SSI Chairman emphasized that the upgrade is not a “magic solution” but rather a step toward greater goals.

“Many view FTSE’s recognition as a ‘magic solution,’ but I disagree. Don’t expect the market to surge dramatically just because of an external organization’s decision. I see the upgrade as a ‘certification’ that our market has aligned with international standards,” said Nguyen Duy Hung.

According to the expert, the market cannot transform overnight simply because of the upgrade announcement. The elevation reflects a long-term process of preparation and improvement. The announcement itself can only draw external attention and recognition. The key lies in fostering trust to ensure the market’s continued growth, providing foreign funds and investors with a compelling reason to increase their investment in Vietnam.

SSI’s leadership emphasized that the upgrade is a collective achievement of the government, the Ministry of Finance, and all market participants. Numerous policy and mechanism changes have been implemented, benefiting both the market and investors.

In its announcement, FTSE Russell stated that Vietnam’s upgrade to Secondary Emerging status will be implemented in phases. FTSE Russell will monitor Vietnam’s progress and consult with the international investment community ahead of the March 2026 review, ensuring the upgrade proceeds as scheduled in September 2026.

This historic milestone marks over a decade of comprehensive reforms in Vietnam’s stock market. FTSE Russell’s recognition opens the door to attracting billions of dollars in foreign investment, strengthening the market’s connection to global capital flows.

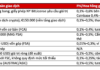

According to estimates from several securities firms, net foreign investment could reach $6–8 billion, or even $10 billion under optimistic scenarios. These projections include both active and passive fund flows, with active funds expected to dominate.

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

HSBC Forecasts Foreign Capital Inflow to Vietnam at $3.4–10.4 Billion Post-Upgrade

At dawn on October 8th, FTSE Russell announced the upgrade of Vietnam’s stock market to Secondary Emerging Market status. This reclassification will officially take effect on September 21, 2026, following the mid-year review in March 2026.

Vietstock Daily 09/10/2025: Ready to Break New Highs?

The VN-Index rallied following a session of tug-of-war trading, forming a Long Lower Shadow candlestick pattern. The MACD indicator has issued a fresh buy signal as it crossed above the Signal line, while the Stochastic Oscillator continues its upward trajectory, reinforcing the recovery momentum. Should these signals persist, the likelihood of surpassing the September 2025 peak (around 1,700-1,711 points) will strengthen in upcoming sessions.

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.