Milestones on the Journey to Market Upgrade

At the “Cafe with Securities” livestream hosted by SSI Securities, Mr. Pham Luu Hung, Chief Economist and Director of SSI Research, stated that FTSE Russell’s decision to upgrade Vietnam’s market to secondary emerging status significantly alleviated foreign investors’ concerns. It also highlighted the regulatory bodies’ coordination and flexibility throughout the preparation process.

He emphasized that all issues arising in the final stages were swiftly resolved, paving the way for the official upgrade announcement—a highly positive development for the market.

Reflecting on the upgrade preparation journey, Mr. Hung noted numerous foundational changes.

Since November last year, Vietnam implemented a non-prefunding trading mechanism and eliminated consular legalization requirements for foreign investor account openings, significantly streamlining market entry procedures.

Additionally, Decree 155 was amended to include crucial provisions on listing activities, shortening the time from IPO to listing, and clarifying foreign ownership ratios.

Another significant milestone was the KRX system launch, a “turning point” for Vietnam’s stock market. Mr. Hung shared that before the KRX system’s operation, foreign investors were more skeptical about its implementation than Vietnam’s upgrade prospects. However, post-launch, transaction delays decreased significantly, approaching regional levels, bolstering foreign investor confidence.

Compared to other upgraded countries, Vietnam is far from the bottom tier. Mr. Hung is confident that post-upgrade, Vietnam’s stock market will quickly rise to the mid-tier of emerging markets and has the potential to lead in the future as scale and depth improve.

Long-Term Appeal of Vietnam’s Stock Market

Addressing concerns about frontier market index-tracking funds selling upon Vietnam’s upgrade, Mr. Hung believes this is unlikely in the short term. Few funds use the FTSE Frontier Index, so selling pressure is minimal. Moreover, the upgrade takes effect on September 21, 2026, allowing ample time for gradual portfolio adjustments without significant market impact.

Commenting on Vietnam’s stock market attractiveness, Mr. Hung stressed that the upgrade is just one factor in capital market development. Regulators and market participants are enhancing market depth, with IPOs playing a key role. Large IPOs like TCBS have catalyzed not only securities stocks but also overall market liquidity.

As more large enterprises list, alongside market growth, foreign capital inflows are expected to increase. The upgrade confirms Vietnam’s emerging market standards, but long-term appeal also stems from quality stocks, economic growth, and vibrant new listings.

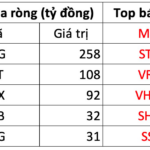

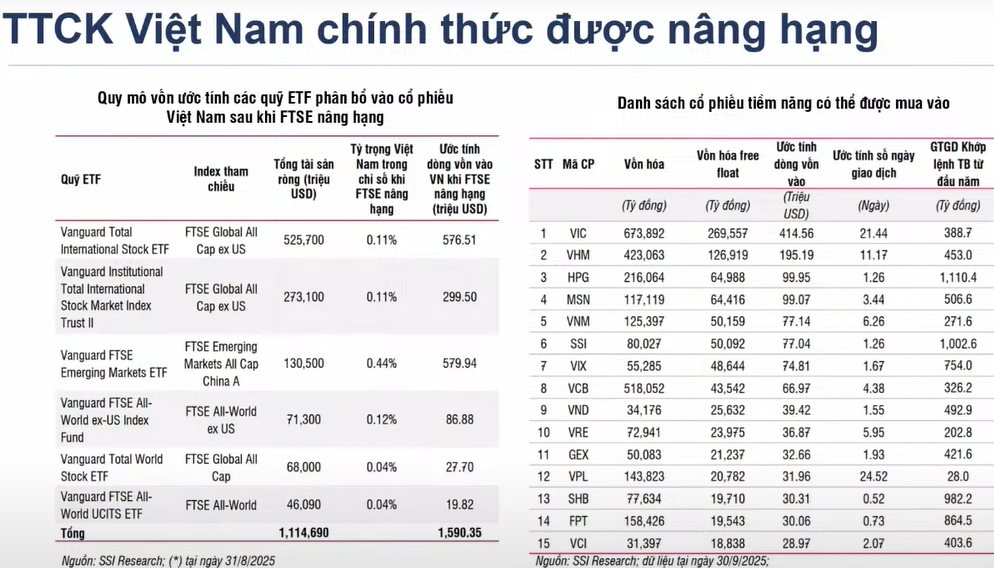

SSI estimates $1.6 billion inflow from passive funds post-upgrade

Mr. Hung noted that foreign investors have net sold $4 billion year-to-date, far exceeding the estimated $1.6 billion passive fund inflow post-upgrade. “If Vietnam can reclaim withdrawn capital through reforms and market expansion, it would be a much bigger story than passive fund inflows at upgrade,” he emphasized.

The FTSE Russell upgrade is just the beginning for Vietnam’s stock market. The ultimate goal is MSCI emerging market recognition, which could significantly boost foreign capital. On a “10-point scale,” MSCI standards represent the pinnacle. Vietnam is implementing a central counterparty clearing model (CCP), a key MSCI requirement not covered by FTSE.

“Phạm Nhật Vượng’s Empire: Only 37.3% Female Staff, Yet Women Leaders Dominate at 59%—Banks Emerge as Female Strongholds, Except Sacombank”

The “women empowerment” narrative at Vingroup transcends mere statistics; it’s deeply embedded in the founder’s philosophy of talent utilization. Surrounding Chairman Phạm Nhật Vượng, the most senior leadership roles—spanning finance, business, and legal—are predominantly held by formidable women leaders.

What Scenarios Await the Stock Market Before and After the Upgrade Announcement?

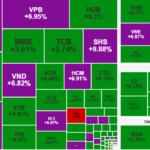

The VN-Index briefly touched the 1,700-point milestone before retreating, as trading liquidity dwindled amid investor caution ahead of the highly anticipated market upgrade announcement.

October Stock Market: Coiled and Ready for a Breakout?

According to experts, Vietnam’s stock market is currently in a healthy accumulation phase, setting the stage for an imminent breakout. The most probable scenario points to the market entering a new upward trajectory.