From October 6th to 10th, the Ho Chi Minh City Stock Exchange (HoSE) issued a Decision on the Rules for Building and Managing the Vietnam Dividend Growth Index (VNDIVIDEND). This index tracks stocks with consistent dividend growth and payout capabilities.

The key selection criterion is the company’s ability to sustain profit distribution to shareholders.

According to the announcement, the VNDIVIDEND index is expected to include 10-20 stocks selected from the VNAllshare index constituents.

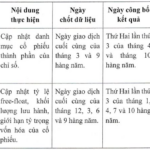

Eligibility criteria include a minimum listing period of 5 years, a market capitalization exceeding 2,000 billion VND, daily trading value between 8-10 billion VND, and positive after-tax profits in the last four quarters.

HoSE Launches VNDIVIDEND Index Tracking Dividend-Paying Stocks

From the eligible stocks, the system further selects those with a dividend payout ratio (DIVIDEND-RATIO) exceeding 80% of the 3-year average if already in the previous index, or above 100% if not previously included.

The DIVIDEND-RATIO is calculated as the dividend payout in year T-2 (two years prior to the review date) relative to the average of the preceding three years (T-3, T-4, T-5).

The final index will comprise up to 20 stocks with the highest DIVIDEND-RATIO and trading value, or a minimum of 10 stocks if fewer qualify.

Previously, in August 2025, HoSE introduced two new indices: VNMITECH, tracking modern industrial and technology firms, and the Vietnam Growth 50 Index (VN50 Growth), highlighting top-performing growth companies.

Unveiling HOSE’s VNDIVIDEND Index: Tracking Vietnam’s Dividend-Paying Stocks

On October 6th, the Ho Chi Minh City Stock Exchange (HOSE) introduced the Vietnam Dividend Growth Index (VNDIVIDEND), a benchmark designed to track the performance of growth stocks with a consistent record of dividend payouts. The index prioritizes companies demonstrating a strong commitment to shareholder value through regular profit distribution.

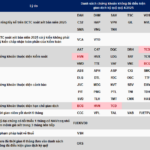

HoSE Brokerage Market Share Q3/2025: SSI Hits 5-Year High, MBS Surges to Push VNDirect Out of Top 6

In Q3 2025, the top 10 brokerage firms dominated the HoSE market, collectively commanding a staggering 69.05% share of trading volume in stocks, fund certificates, and covered warrants.