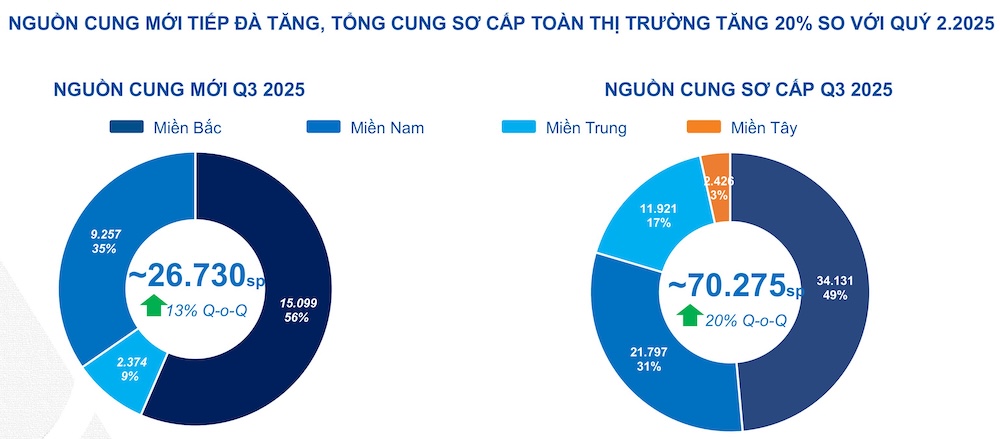

Northern Region Sees Highest New Supply in Two Years

Supply continues to rise by 13% compared to the previous quarter, though regional trends vary significantly.

In Q3/2025, the Northern Region witnessed a notable increase in both new and total primary supply compared to the previous quarter. The total primary supply is estimated at 34,131 units, marking an 11% quarterly rise. New supply alone reached 15,099 units, a 32% quarterly increase, marking the highest new supply in two years.

In Hanoi’s high-rise segment, projects in Hung Yen and Bac Ninh intensified competition with attractive products and sales policies. Phase 1 launches garnered significant interest due to strategic locations and flexible payment plans (e.g., 15% down payment upon signing the sales contract), driving sales momentum.

In the Central Region, Q3/2025 primary residential supply surged by 52% year-on-year, totaling 11,921 units. New supply reached 2,374 units, tripling from the previous quarter, primarily driven by new apartment projects in Da Nang.

In the Southern Region, following a strong Q2, new supply in Q3 dropped by 20% quarter-on-quarter to 9,257 units, mainly due to seasonal factors as developers avoided launches during the Ghost Month. Total primary supply decreased by 18% to 21,797 units. New supply concentrated in Ho Chi Minh City, Binh Duong, and Long An, with continued growth expected. New apartment supply accounted for nearly 80% of new inventory, mostly in former HCMC areas or along key routes like National Highway 13 and 1K.

Source: DXS-FERI

|

Absorption Rates Improve as Buyers Become More Selective

The Northern Region maintained a 30-35% absorption rate, consistent with the previous quarter. The Central Region saw a 20-25% rate, concentrated in Da Nang, while other areas struggled. The Southern Region’s absorption rate fell by 5 percentage points to 40-45%.

Total transactions from primary supply decreased compared to Q2/2025, as buyers became more cautious, thoroughly researching and comparing projects amid increased supply. Buyers also favored reputable brokers for better service and accurate market insights.

However, compared to Q1/2025, the market rebounded strongly. New supply grew by 234%, total primary supply by 59%, and successful transactions (absorption) surged by 114%.

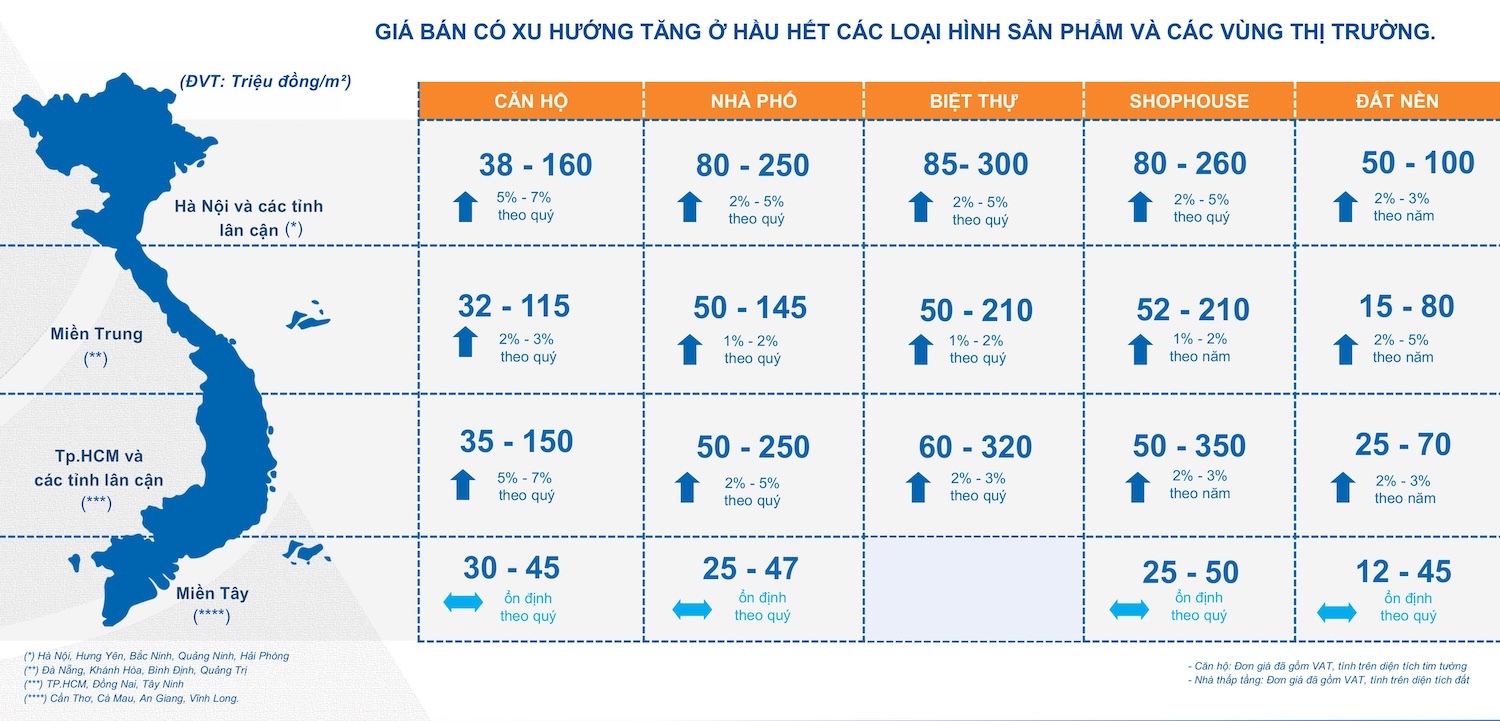

In the North, low-rise prices rose 2-5% year-on-year, driven by large urban projects. High-rise prices increased 5-7% quarter-on-quarter.

In the Central Region, low-rise prices rose 1-2% quarterly, apartments by 2-3%, and land plots regained interest in some localities.

In the South, apartment prices increased 5-7% quarter-on-quarter, while low-rise prices rose 2-5% year-on-year.

Source: DXS-FERI

|

Real Estate Firms Make a Strong Comeback

DXS-FERI experts note that buyers are open but cautious, with some investors leveraging low interest rates and attractive developer policies. Some projects allow purchases with just a 10% down payment.

The market saw a recovery in both quantity and quality, with real estate firms resuming investments and operations. By September 2025, active real estate businesses increased by 96% year-on-year, with 1,699 new or reactivated firms compared to 373 dissolutions or suspensions. Registered capital rose 61% to VND 335 trillion.

Q4/2025 is expected to see abundant new supply across key provinces, including apartments and low-rise units.

Liquidity is projected to polarize. Projects with clear legal frameworks, timelines, and connectivity will attract buyers, while others must compete with incentives and transparency. Investment capital continues to shift from North to South, with joint ventures between domestic and international firms gaining traction.

Prices are expected to rise in central areas and well-developed infrastructure zones. Peripheral areas with incomplete legal frameworks or infrastructure may stagnate or lose liquidity.

“Vietnam’s real estate market has laid the groundwork and is now reaping initial rewards. The new cycle will be a controlled revival, focusing on real value, capabilities, and sustainability,” said DXS-FERI experts.

DXS-FERI outlines three Q4/2025 scenarios:

Optimistic: 40-50% new supply growth, 8-9% floating interest rates, 10-15% price increases, and 40-45% absorption.

Expected: 25-35% new supply growth, 9-11% floating interest rates, 5-10% price increases, and 35-40% absorption.

Challenging: 5-15% new supply growth, 10-12% floating interest rates, 2-5% price increases, and 20-30% absorption.

– 07:00 09/10/2025

Unusual Trends Emerging in the Land Plot Market

While land plots in areas like Da Nang, Hai Phong, and Hanoi are experiencing a boom, the markets in Ho Chi Minh City and Binh Duong are only beginning to show signs of recovery. Meanwhile, Ba Ria – Vung Tau remains relatively quiet, with prices dropping by 10% and interest levels decreasing by 13%.

National Average Real Estate Price Surpasses 100 Million VND per Square Meter

According to Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, the average property price nationwide has surged from VND 74 million/m² in Q1 2023 to VND 101 million/m² in Q3 2025, marking a 36% increase. Meanwhile, rental prices have remained stagnant during this period.