Being a pioneer has given Techcombank a significant market advantage, allowing ample time to refine product features, ensure optimal returns without barriers, and provide safety and flexibility. However, in a sea of options, what makes one product stand out from the rest?

From “Added Features” to a New Standard for Payment Accounts

Dr. Lê Xuân Nghĩa, an expert in economics, finance, and banking, once stated, “The future of credit lies in automatic profitability. In just a few years, people will only need to keep money in their wallets—and those wallets will generate returns automatically. This trend is creating a powerful effect, significantly contributing to the economy and bringing Vietnam’s financial market in line with global trends.”

His prediction has proven accurate. In just over a year, Automatic Profitability has evolved from a novel concept to a familiar feature for bank users in Vietnam. Customers now expect optimal interest rates on their idle balances, making it a necessity.

Dr. Lê Xuân Nghĩa believes Automatic Profitability is the trend propelling Vietnam’s financial market to global standards, significantly boosting the economy.

As Banks Enter the Fray: Numerous Options, but What Sets Them Apart?

The appeal of Techcombank’s Automatic Profitability has drawn other banks into the competition. However, their product implementations vary significantly, reflecting each financial institution’s unique strengths.

Some products require a minimum balance to ensure stable cash flow and optimal returns for high-balance customers, making them less accessible to those with smaller balances. Others mandate a minimum holding period to guarantee capital safety and high yields, which can hinder daily liquidity. Many banks offer tiered interest rates based on the duration of funds in the account, offering little differentiation from traditional weekly or monthly savings accounts. Certain products tie higher interest rates to additional services like cards, insurance, or investments.

Regardless of the mechanism, all products aim to maximize customer benefits, ensure capital safety, and strictly adhere to State Bank regulations. However, some products seem more focused on “following trends” than prioritizing customer experience, requiring users to carefully evaluate their choices.

Experts advise that, beyond interest rates, customers should consider three key factors before activating Automatic Profitability: the brand’s reputation and technological foundation, safety and flexibility, and transparency in mechanisms and balance/profit management.

Brand reputation and technological foundation are paramount, as the entire profit mechanism relies on automated allocation and digital management systems. Dr. Lê Xuân Nghĩa emphasized, “Automatic Profitability products depend heavily on a robust technological foundation. To grow into a significant deposit stream, banks must leverage strong databases and AI technology to analyze and select customers, creating an optimal ecosystem.”

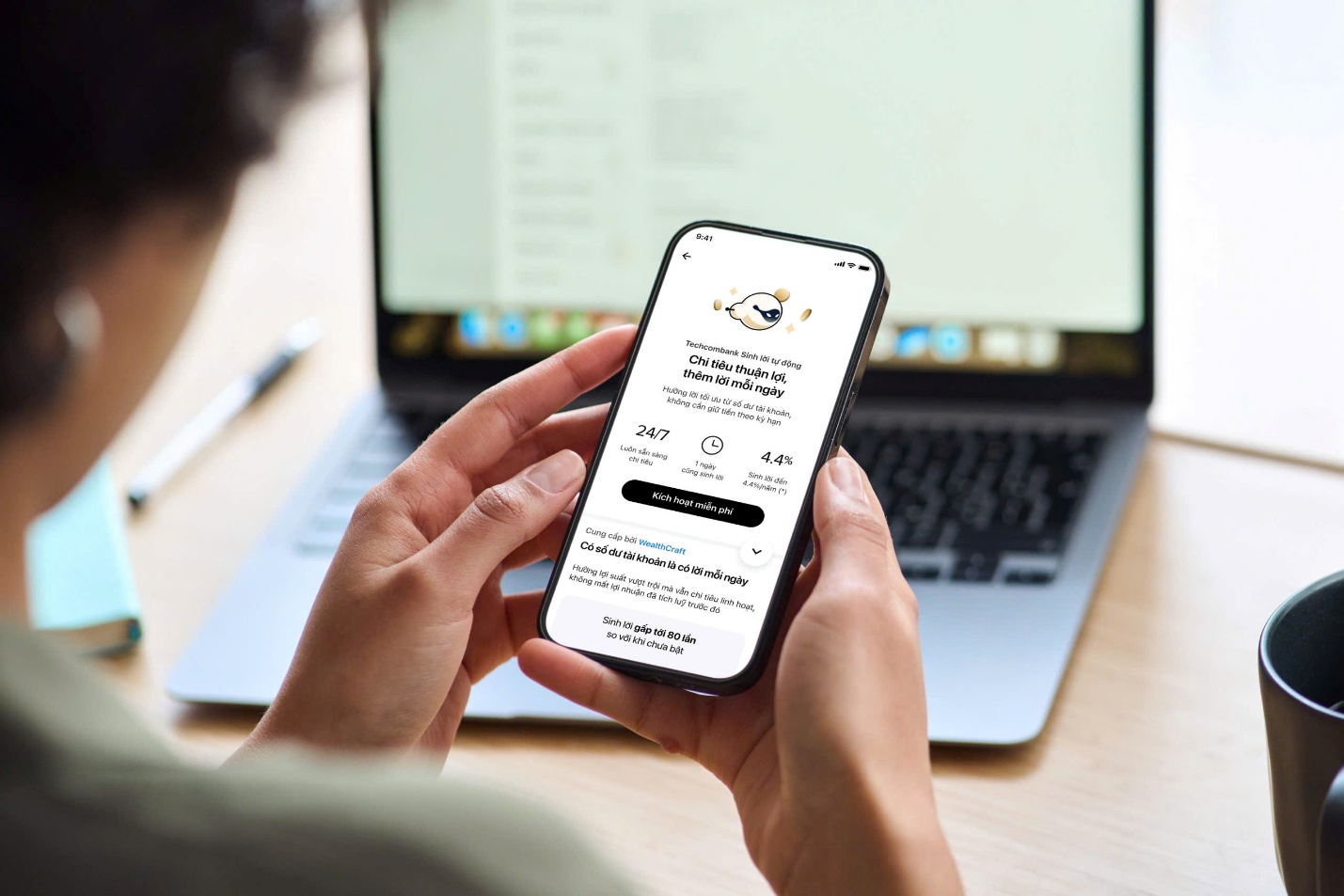

Techcombank’s Automatic Profitability currently offers one of the highest returns for payment accounts, with interest rates up to 4.4% per annum.

Flexibility is the second critical factor, meaning 24/7 accessibility without barriers or thresholds. As the product generates returns on payment account balances, ideally, it should not require a minimum balance, holding period, or threshold—allowing customers to withdraw or spend anytime without affecting accrued interest. Without flexibility, users might prefer traditional savings products with higher yields.

Thirdly, before activation, customers should easily access information on the mechanism, profit payment schedules, and balance/interest tracking—ideally through digital banking. Reputable banks typically transparently disclose fund usage, investment partners (if any), and strict compliance with State Bank regulations.

For instance, Techcombank’s website clearly explains the product’s operation: “After activating Automatic Profitability, the system automatically allocates idle funds in the customer’s payment account to safe profit-generating products like Non-Term Deposits, Bao Loc Deposit Certificates, and other profitable assets…” and “Profits from Automatic Profitability are accumulated daily and paid periodically into the account the following month.”

Challenges and Advantages of Being a “Pioneer”

Pioneering new products offers significant benefits but also exposes Techcombank to intense competition from later entrants. However, Jens Lottner, Techcombank’s CEO, shared, “Developing Automatic Profitability requires extensive technology, artificial intelligence, and integration across various products. This is our irreplaceable differentiator.”

The bank’s confidence is well-founded. Techcombank’s Automatic Profitability platform has passed the most stringent international standards, evidenced by three prestigious IBA Stevie Awards 2025: a Gold Award for Customer-Centric Product Design, and two Bronze Awards for Outstanding AI Application and Outstanding Financial Services. The Stevie Awards, likened to the “Oscars of international business,” are among the most esteemed global business accolades. These awards not only showcase the product’s competitiveness and Vietnam’s financial sector’s technological advancement but also affirm Techcombank’s commitment to optimizing customer experience.

Techcombank’s Automatic Profitability will soon receive enhanced security features.

By leading the way, Techcombank has gathered feedback from millions of customers, refining new versions to offer superior liquidity, spending, and profitability without barriers or thresholds. Even the smallest balances generate returns daily.

With benefits 88 times higher than traditional accounts, Techcombank’s Automatic Profitability allows customers to withdraw funds anytime without affecting accrued interest. Profits are easily tracked through the digital banking app. For many Techcombank customers, Automatic Profitability is the new-generation account, completely replacing previous forms and becoming the preferred transaction bank.

Leveraging its technological edge and pioneer status in Automatic Profitability, Techcombank continuously enhances its offerings. Nguyễn Vân Linh, Deputy Director of Techcombank’s Retail Banking Division, stated that the bank is investing in upgrades to deliver the best value and experience. Upcoming features will include additional security layers to further safeguard accounts, providing customers with greater peace of mind.

By optimizing benefits at the most frequent touchpoint between banks and users, Automatic Profitability not only transforms personal financial management but also creates an effective capital mobilization channel. Idle funds are reactivated, reintegrating into the financial system to support credit, production, and consumption. This groundbreaking product from Techcombank has the potential to set new standards for modern banking, showcasing its appeal and influence.

Quảng Ngãi – Hoài Nhơn Expressway: Over 20 Trillion VND Project Faces Potential Delays

Land acquisition challenges threaten to derail the progress of the Quang Ngai – Hoai Nhon expressway project. “Failure to complete land clearance by October 15th will severely jeopardize our timeline, as the upcoming rainy season will prevent large-scale asphalt paving, putting the entire project at risk,” stated Le Thang, Director of Project Management Unit 2.

Techcombank Honored as “Best Bank in Vietnam” by Euromoney for the Sixth Consecutive Year

October 1, 2025 – Surpassing over 600 contenders from 100 countries worldwide, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) has been crowned “Best Bank in Vietnam” by Euromoney magazine at the prestigious 2025 Euromoney Awards for Excellence. Techcombank stands as the only Vietnamese bank to achieve this esteemed recognition for six consecutive years.

Revolutionizing Delivery Standards: J&T Express Leverages Technology to Ensure “On-Time Delivery, Complete Satisfaction”

Vietnam’s logistics market is brimming with opportunity, yet faces significant challenges amidst the booming e-commerce landscape. In this dynamic environment, J&T Express, leveraging cutting-edge technology in its operations, has carved out a path to success, earning a nomination at the prestigious Better Choice Awards 2025.