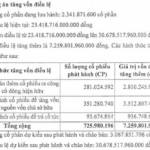

The rights issue ratio is set at 9:4, meaning existing shareholders holding 9 shares can purchase an additional 4 new shares. The subscription and payment period runs from October 24 to November 14, 2025. If successful, TPP’s chartered capital will increase from VND 450 billion to VND 650 billion, marking a 44% rise in outstanding shares.

TPP notes that the new capital raise may temporarily reduce projected EPS for 2025 by approximately 31%. However, the company believes this additional capital will alleviate financial pressure and create long-term growth opportunities in the years ahead.

| TPP’s chartered capital for 2025 is expected to reach VND 650 billion upon completion of this year’s share issuance. |

Founded in 1977, TPP began as a state-owned enterprise specializing in packaging and plastic components for the textile, healthcare, and household industries. Following its privatization in 2005 and listing on HNX in 2008, the company underwent multiple restructuring phases. A pivotal moment occurred in 2016-2017 when TPP became a subsidiary of DNP Holding (HNX: DNP), which now owns over 51% of its capital.

TPP is widely recognized for its premium household plastic brand, Inochi, and its industrial packaging solutions. The company ranks among the top 5 players in the industrial plastics market, supplying major brands such as Coca-Cola, Pepsi, Nestlé, P&G, Vedan, and Vietnam Airlines.

After 12 capital increases, most recently in 2022, TPP continues to expand its operations with three factories in Long An, Bac Ninh, and Dong Nai. Its distribution network spans nationwide, featuring 8 showrooms and a presence in leading retail chains like WinMart, Co.opmart, GO!, Emart, and Lotte.

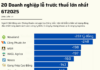

TPP’s revenue has consistently grown in recent years, surpassing VND 3.1 trillion in 2024—a threefold increase since 2020. In the same year, the company recorded a record after-tax profit of VND 42 billion, reflecting strong performance across most business segments. Notably, the Inochi segment grew by 36%, with online sales (eGT) surging 156% and exports rising 94%. These achievements position TPP to confidently expand its market share in 2025 and solidify its status as a leading domestic plastics brand.

In the first half of 2025, TPP reported revenue of over VND 1.6 trillion, a 6.2% year-on-year increase, while after-tax profit reached VND 31 billion, 2.6 times higher than the previous year, despite a 70% rise in interest expenses to VND 59 billion. This result fulfills 38% of the year’s profit target, which aims to double 2024’s figure.

Revenue growth coincided with a significant increase in accounts receivable to VND 659 billion. TPP attributes this primarily to strong order growth in rigid packaging, flexible packaging, and Inochi segments, driven by recovering domestic and export consumer markets. As of June 2025, the company’s short-term debt exceeds VND 1.4 trillion, with long-term debt at VND 419 billion, totaling over VND 2 trillion in liabilities.

| TPP’s interest expenses in the first half of 2025 nearly matched the full-year 2024 figure. |

TPP aims to establish Inochi as a leading brand in Southeast Asia – Image: TPP

|

– 4:00 PM, October 9, 2025

Nam Long Sets Date for Offering Over 100 Million Shares to Existing Shareholders

Nam Long is set to offer approximately 100.12 million shares to existing shareholders at a ratio of 100:12. The final registration date for exercising these rights is October 20, 2025.