Nine-Month Profit Nearly Quadruples Year-on-Year

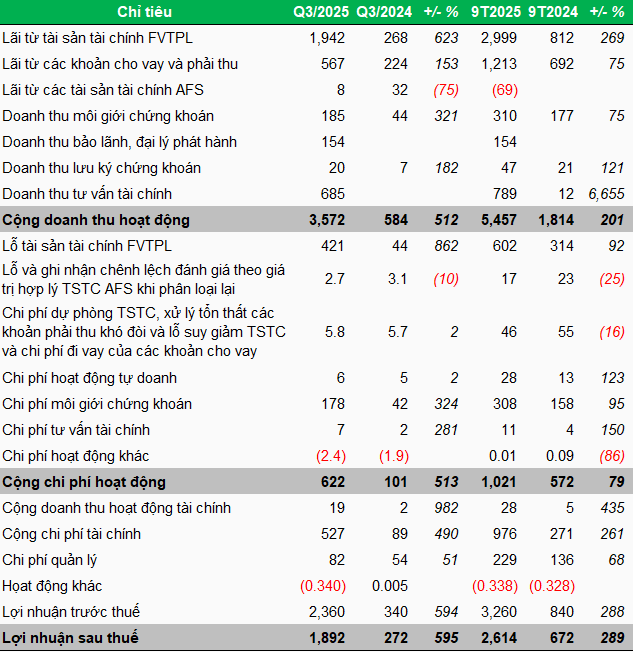

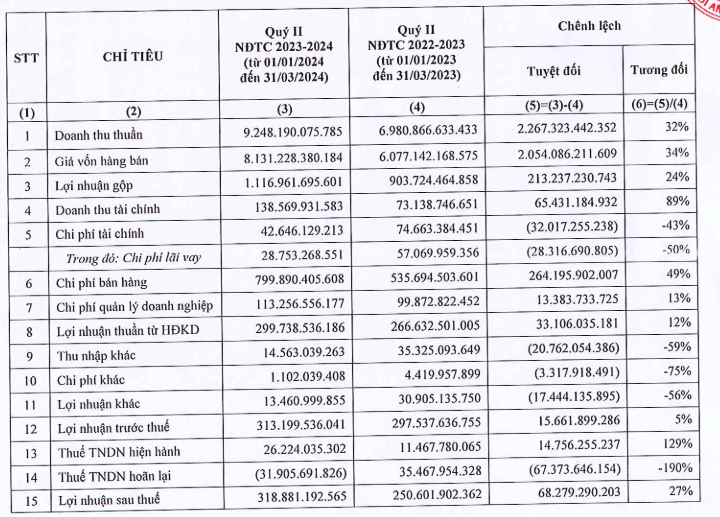

In its proprietary trading activities, VPBankS recorded a profit of over VND 1.5 trillion in Q3, nearly seven times higher than the same period last year. The primary drivers were significant gains from the sale of listed stocks and unlisted bonds, along with substantial new profits from the sale of unlisted stocks.

Source: VPBankS Q3/2025 Financial Report

|

Financial advisory services, which incurred a slight loss of nearly VND 2 billion in the same period last year, saw a remarkable turnaround with a profit of over VND 678 billion. The company attributed this to the expansion of investment advisory services in both debt capital markets (DCM) and equity capital markets (ECM).

Other key contributors included underwriting and securities distribution, which generated VND 154 billion in profit, and lending and receivables (primarily margin loans), which brought in nearly VND 567 billion in revenue—2.5 times higher than the same period last year. This growth was fueled by the launch of multiple products aimed at attracting customers, leading to a significant increase in margin debt and market share.

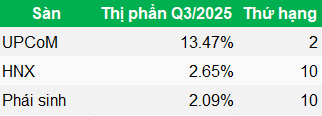

Q3/2025 market share data also highlights VPBankS’ progress, ranking it among the top 10 stock brokers on the HNX, UPCoM, and top 10 derivatives brokers.

|

VPBankS’ Market Share Growth in Q3/2025

Source: Author’s Compilation

|

However, the aggressive push in these programs led to higher costs, resulting in a slim brokerage profit of nearly VND 8 billion for VPBankS.

Another significant cost increase was in financial expenses, which reached over VND 527 billion—six times higher than the same period last year—due to a sharp rise in short-term borrowing costs.

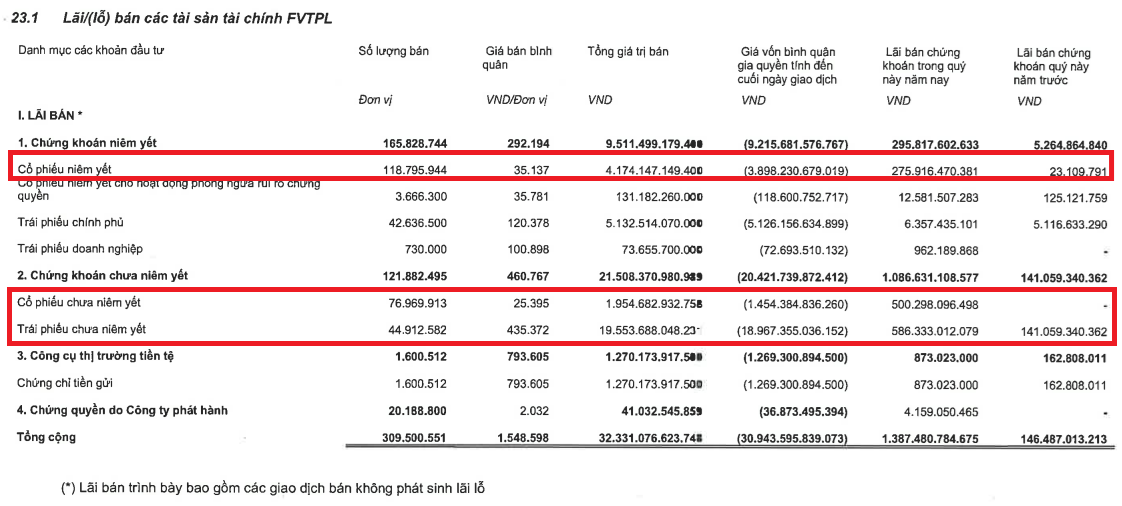

With these results, the company’s pre-tax profit in Q3 was nearly VND 1.9 trillion, seven times higher than the same period last year. This brought the nine-month cumulative profit to over VND 2.6 trillion, four times higher than the same period last year and achieving over 73% of the adjusted annual plan.

After deducting all expenses, the company’s net profit was nearly VND 1.9 trillion in Q3 and over VND 2.6 trillion in the first nine months, setting a new record in its operating history.

|

VPBankS’ Q3 and Nine-Month Business Results

Unit: Billion VND

Source: VietstockFinance

|

| VPBankS Sets New Nine-Month Profit Record |

Margin Debt Reaches New Milestone

As of Q3/2025, VPBankS’ total assets exceeded VND 62.1 trillion, more than double the beginning of the year. Margin debt continued to set new records, reaching nearly VND 26.7 trillion—1.5 times higher than the previous quarter and nearly three times higher than the beginning of the year. This achievement resulted from a series of competitive margin loan packages tailored to various customer segments, aggressively rolled out since the start of the year.

| VPBankS’ Lending Scale on a Strong Growth Trajectory |

According to VPBankS, the ample and low-cost funding supporting margin and bond trading activities stems from its strategic position within the ecosystem of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB).

Additionally, with equity of nearly VND 20.3 trillion, the company still has a lending limit of over VND 13.5 trillion. This is expected to unlock significant growth opportunities as the market anticipates foreign capital inflows due to upgrades and many institutions reaching their lending limits.

In another notable development, VPBankS announced plans to offer up to 375 million shares (25% of its capital) at VND 33,900 per share. The company aims to raise over VND 12.7 trillion, valuing it at nearly VND 64 trillion (approximately USD 2.5 billion) post-IPO.

The subscription and deposit period for the shares is scheduled from October 10 to October 31, 2025, with allocation results announced from November 1 to November 2. Payment for the shares will be accepted from November 3 to November 7. Following the IPO, the company plans to list on the HOSE in December 2025.

– 13:35 09/10/2025

Over 50 International Partners Explore Opportunities in VPBank’s IPO Venture

VPBankS has successfully conducted an international roadshow across Thailand, Singapore, Hong Kong (China), and the United Kingdom, engaging with numerous global partners. This initiative aimed to showcase investment opportunities, share growth strategies, and expand international collaborations, setting the stage for the largest IPO ever by a Vietnamese securities firm.

Vietnam’s Largest Stock Market Deal in History Set to Launch in Days

VPBankS is set to redefine the financial landscape with its groundbreaking IPO, marking a historic milestone in the securities industry. This unprecedented offering promises to be a game-changer, setting new benchmarks for scale, innovation, and investor opportunity.