Illustrative image

According to Reuters, the Philippines plans to extend its rice import ban until April 2026 to support local farmers in the world’s largest rice-buying nation. This move could further pressure global rice prices.

Specifically, the Southeast Asian country will only allow imports for about a month in January, when it needs to import at least 300,000 tons of grain from abroad. Agriculture Secretary Francisco Tiu Laurel Jr. stated this during a House of Representatives hearing. The restriction, initially set for 60 days, took effect on September 1.

Manila’s extended quota aims to protect local farmers, especially during peak harvest seasons. Globally, however, this could maintain high supply levels and further depress prices for a crop that sustains billions across Asia and Africa, providing up to half of daily caloric needs in some Southeast Asian regions.

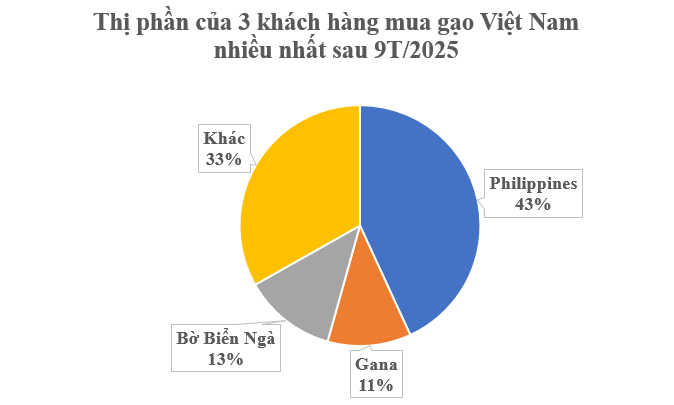

For Vietnam, in September 2025, rice exports reached 600,000 tons, valued at $288.4 million. Over nine months, total export volume and value hit 7 million tons and $3.55 billion, up 0.1% in volume but down 18.5% in value compared to 2024. The average export price for the first nine months of 2025 was $509 per ton, an 18.6% decrease from the same period in 2024.

The Philippines remains Vietnam’s largest rice buyer, with over 2.9 million tons valued at $1.4 billion, though this reflects a nearly 9% volume drop and a 27% value decline year-on-year. Export prices fell 20% to an average of $490 per ton.

Ghana ranks second, importing over 764,000 tons valued at $429 million, up 80% in volume and 47% in value year-on-year. Export prices averaged $561 per ton, an 18% decrease from 2024.

Côte d’Ivoire also saw triple-digit growth, with Vietnam exporting over 852,000 tons valued at $393 million in the first nine months, up 152% in volume and 94% in value. Export prices averaged $461 per ton, down 23% from the same period in 2024.

Vietnam has successfully diversified into markets like Ghana and Côte d’Ivoire, with Bangladesh showing a remarkable 164.7-fold growth. These figures highlight the adaptability and resilience of Vietnam’s rice export sector in exploring and expanding into new markets.

In the first week of October 2025, domestic rice markets remained stable, while Vietnamese export prices held steady. The Vietnam Food Association (VFA) reported on October 7 that 5% broken rice traded between $440 and $465 per ton; 100% broken rice at $315–$319 per ton; and Jasmine rice at $495–$499 per ton, unchanged from the previous week.

Regionally, Thai rice export prices continued to decline, reaching a nine-year low. Thai 5% broken rice was quoted at $345 per ton, down $5 from the previous week and the lowest since November 2016.

Vietnam Ranks Second Globally in Rice Imports

In the first nine months of 2025, Vietnamese businesses spent more on rice imports than on wheat and soybeans combined.

Filipinos’ Fancy for High-Quality Vietnamese Rice

The Philippine Department of Agriculture (DA) has revealed that consumers in the country are developing a taste for high-quality rice, with a particular preference for imports from Vietnam.