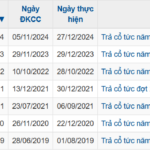

Ree Corporation (Ticker: REE, HoSE exchange) has just reported the results of its share issuance to pay dividends for 2024.

As of June 12, REE completed the issuance of nearly 70.64 million shares to pay 2024 dividends to 18,505 shareholders. The remaining 7,271 fractional shares will be canceled.

The entitlement ratio was 100:15, meaning that for every 100 shares owned, shareholders received 15 new shares. The newly issued shares are not restricted from transfer after listing.

The capital source for this issuance was the company’s undistributed post-tax profits. The share transfer is expected to take place in July 2025.

With this issuance, REE has increased its number of outstanding shares from 471.01 million to 541.6 million, equivalent to a charter capital of VND 5,416.5 billion.

Illustrative image

Previously, on April 4, 2025, REE paid 2024 dividends to shareholders in cash at a rate of 10%, meaning that for every share held, shareholders received VND 1,000.

With over 471 million REE shares currently trading in the market, the company is estimated to have paid out more than VND 471 billion for this cash dividend payment.

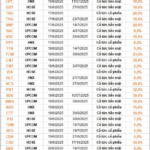

In terms of business results, the consolidated financial statements for Q1 2025 showed that REE achieved net revenue of VND 2,068 billion, up 13% compared to the same period last year. After deducting cost of goods sold, gross profit was VND 950 billion, an increase of 28%.

While the real estate and water infrastructure segments showed growth, the refrigeration segment decreased by 17.7% to VND 454 billion.

During the period, financial revenue increased by 57% to VND 110 billion, while financial expenses decreased by 15% to VND 191 billion. Profit from associates also increased by 16% to VND 140 billion.

As a result, REE reported a post-tax profit of VND 817 billion, up 49% compared to the same period last year.

For 2025, REE set a target of VND 10,248 billion in revenue and VND 2,427 billion in post-tax profit, an increase of over 22% and 21.7%, respectively, compared to 2024. Thus, the company has achieved 33.6% of its profit target in the first three months of the year.

REE’s total assets as of the end of Q1 2025 stood at VND 36,889 billion, slightly higher than the beginning of the year. Cash and cash equivalents were at VND 5,981 billion.

Inventories increased by 8% to VND 1,390 billion. Construction in progress remained unchanged at VND 1,470 billion.

In terms of capital structure, total liabilities decreased slightly to VND 13,662 billion, mostly comprised of long-term debt. Short-term bank loans amounted to VND 1,265 billion, long-term bonds were VND 2,304 billion, and long-term borrowings were VND 6,689 billion.

In the first quarter of 2025, REE paid VND 1.86 billion in remuneration to four members of its Board of Directors. Meanwhile, three members of the Executive Board received a total salary of VND 3.84 billion, including VND 2.25 billion for Ms. Nguyen Thi Mai Thanh.

“Cà Mau Protein Payout: Shareholders Reap Rewards with a Whopping 1.058 Trillion VND Dividend.”

“Đạm Cà Mau announces an impressive dividend payout of VND 1,058.8 billion for its shareholders. The company has declared a 20% dividend, to be paid out on July 15, 2025. Shareholders on the registry as of June 30, 2025, will be eligible to receive this substantial cash dividend, reflecting the company’s strong performance and commitment to returning value to its investors.”

BCM is About to Release Nearly 114 Million Shares as 2024 Dividend Payout

The Board of Directors of Becamex IDC, a leading industrial investment and development corporation listed on the Ho Chi Minh Stock Exchange (HOSE: BCM), has approved a plan to issue bonus shares as a dividend for the year 2024. The company intends to distribute a generous 11% dividend to its shareholders, with the issuance expected to take place in the second or third quarter of 2025.

The Nova Saigon Royal Fails to Redeem its 1,000 Billion VND Bond

“In a recent disclosure dated June 17, Nova Saigon Royal Investment Joint Stock Company (NSRC) announced that it was unable to fully repay the NSRCH2223001 bond tranche worth VND 1,000 billion, which was issued in 2022.”