What is PC AI?

PC AI represents the perfect fusion of powerful hardware and artificial intelligence, transforming personal computers into smarter tools than ever before. PC AI is defined as a computer system equipped with specialized components to process AI data quickly and energy-efficiently.

To build a PC AI system, you need to integrate a CPU, GPU, and especially an NPU—a processor dedicated to AI algorithms. A practical example is Dell’s use of Intel Core processors combined with NVIDIA GPUs to handle 4K video processing with AI, reducing rendering time from hours to minutes. Additionally, at least 16GB of RAM and a high-speed SSD are crucial for ensuring smooth system performance.

Practical Applications of PC AI in Work and Life

PC AI is proving its value across various fields, from healthcare to entertainment, thanks to its intelligent processing and automation capabilities. With PC AI, you can tackle complex problems swiftly, such as analyzing big data or creating innovative content, delivering tangible benefits for both work and daily life.

PC AI in Industrial Manufacturing

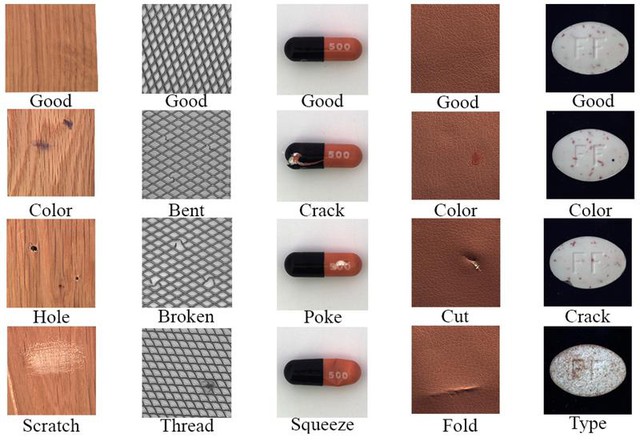

In industrial manufacturing, PC AI plays a pivotal role by monitoring processes and predicting failures before they occur. Factories using PC AI can boost productivity through automated defect detection. For instance, a German auto plant employs PC AI to analyze camera footage, swiftly identifying product flaws and reducing defect rates from 5% to 1%.

Furthermore, PC AI supports predictive maintenance, saving businesses millions. A Vietnamese electronics manufacturer uses PC AI to monitor machinery, predicting breakdowns up to two weeks in advance and significantly reducing downtime.

PC AI in Education

PC AI is revolutionizing education by personalizing lessons and automating learning support. PC AI systems enhance academic outcomes through individualized data analysis. For example, in an online classroom, PC AI adjusts content based on students’ learning habits, suggesting tailored exercises to match their knowledge levels.

To implement PC AI in education, start by selecting AI-integrated software like Google Classroom. Set up systems to track learning progress and use PC AI to create multimedia content, such as videos with auto-generated subtitles, making learning more accessible. Teachers should balance PC AI with direct instruction to ensure a holistic learning experience.

PC AI in Healthcare and Entertainment

PC AI enhances medical imaging diagnostics (X-rays, MRIs) with high accuracy (AUC ranging from 0.86 to 0.98), enabling earlier disease detection and reducing processing times from minutes to seconds.

In entertainment, PC AI enhances user experiences by recommending personalized content, as seen on platforms like Netflix and YouTube. To apply this, use PC AI for automated video editing—simply input data and let AI handle the rest, saving significant time and costs.

Challenges and Growth Potential

While PC AI offers numerous benefits, it also presents challenges, requiring continuous investment and innovation. Initial costs for PC AI can be double those of standard computers, but prices are expected to drop by 20% annually due to technological advancements.

In terms of potential, major manufacturers like HP and Lenovo are heavily investing, with Windows 12 anticipated to deliver groundbreaking AI improvements. According to IDC, by 2027, PC AI will account for 50% of the computer market, creating new job opportunities and driving innovation. This benefits not only businesses but also individual users, offering enhanced learning and working experiences.

Explore the PC range at FPT Shop—home to advanced computers from top brands like HP, Lenovo, ASUS, and Dell. With powerful configurations, Windows 11 support, and AI-ready upgrades, find the perfect PC for your needs today!

Q3 2025 CPI Surges 3.27% Year-Over-Year

According to the Statistics Bureau, the Consumer Price Index (CPI) for September rose by 0.42% compared to the previous month. The average CPI for Q3/2025 increased by 3.27% year-over-year from Q3/2024. Over the first nine months of 2025, the CPI climbed 3.27% versus the same period last year, while core inflation advanced 3.19%.

Vinamilk Saves $3 Million Annually with Self-Developed Order Management System

A seemingly simple process—verifying delivery photos—once cost Vinamilk over $3 million annually. Instead of scaling personnel or outsourcing, Vietnam’s leading FMCG company developed its own automated order coordination system. This innovation processes hundreds of thousands of images daily in mere minutes, marking a significant leap in the company’s digital transformation journey.