Baf Vietnam Agriculture Joint Stock Company (Stock Code: BAF, HoSE) has announced a resolution by its Board of Directors approving a public bond issuance plan.

Accordingly, Baf Vietnam plans to issue 10,000 BAF12502 bonds with a face value of VND 100 million per bond, totaling VND 1,000 billion. These are non-convertible, unsecured, and non-subordinated bonds.

The bonds have a 36-month term from the issuance date, with a fixed interest rate of 10% per annum, paid semi-annually.

The issuance is scheduled for Q4/2025 or Q1/2026, pending approval from the State Securities Commission (SSC) with a Public Offering Registration Certificate.

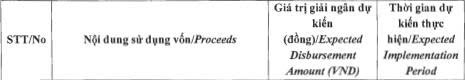

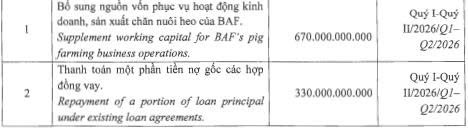

The proceeds will be used to supplement capital for business operations, pig farming production, and partial repayment of principal on existing loans, as detailed below:

Source: Baf Vietnam

In other developments, Baf Vietnam recently announced a resolution to acquire a 49.99% stake in Khoi Duong Livestock Company Limited.

Following the acquisition, Baf Vietnam’s total capital contribution will exceed VND 29.99 billion, representing a 99.99% ownership in Khoi Duong Livestock.

Ms. Bui Huong Giang, CEO, has been appointed to manage the company’s entire capital contribution.

Khoi Duong Livestock, established on May 14, 2021, is a limited liability company with two members and a charter capital of VND 30 billion.

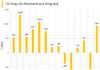

Financially, Baf Vietnam’s Q2 2025 consolidated financial report shows net revenue of VND 2,510.4 billion, a 3.9% decrease from Q2 2024, with after-tax profit reaching nearly VND 342.9 billion, 2.2 times higher year-over-year.

As of June 30, 2025, total assets increased by 14.1% to nearly VND 8,501.8 billion. Inventory stands at VND 2,235 billion (26.3% of total assets), with long-term work in progress at VND 731.6 billion.

Liabilities total VND 4,222.2 billion, down 6.4% from the beginning of the year. Loans and finance leases account for VND 2,583.4 billion (61.2% of total liabilities).

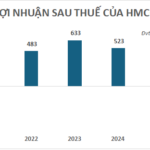

Hoan My Medical Corporation Reports Nearly VND 248 Billion in Profit for First Half of 2025

Hoàn Mỹ Medical Corporation (HMCC) announced a remarkable post-tax profit of nearly VND 248 billion in the first half of 2025, marking a staggering 94% increase compared to the same period last year.

Gemadept Successfully Completes Issuance of Over 6.3 Million Shares to 101 Employees

By the end of the issuance period on October 2, 2025, Gemadept successfully allocated over 6.3 million shares to 101 outstanding employees and staff members for their exceptional performance in 2024, at a price of 10,000 VND per share.