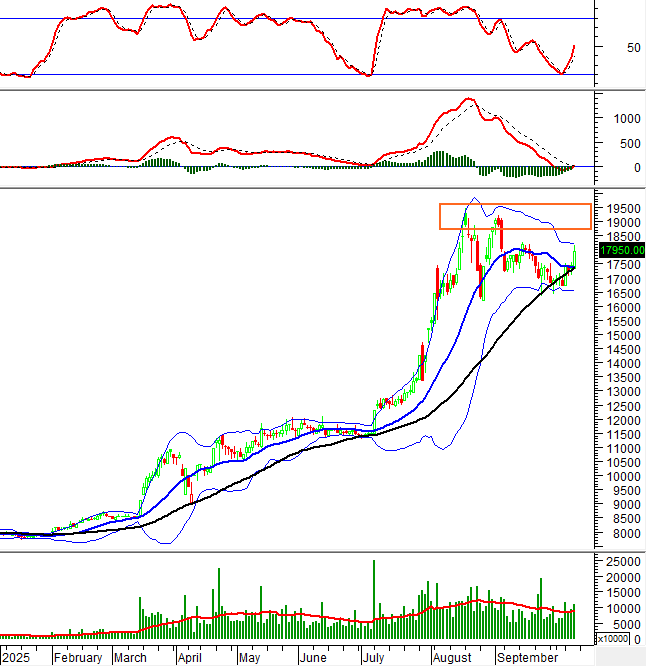

Technical Signals of VN-Index

During the morning trading session on October 9, 2025, the VN-Index continued its upward trend and is expected to surpass the previous peak from September 2025 (equivalent to the 1,700-1,711 point range).

Both the MACD and Stochastic Oscillator indicators have issued buy signals, enhancing the positive momentum and the likelihood of breaking through the previous high.

Technical Signals of HNX-Index

In the morning session on October 9, 2025, the HNX-Index is trading below the Middle line of the Bollinger Bands.

The appearance of a Long Upper Shadow candlestick pattern indicates significant selling pressure in the short term.

NKG – Nam Kim Steel JSC

In the morning session on October 9, 2025, NKG’s stock price saw a slight increase, accompanied by a small-bodied candlestick pattern and trading volume consistently below the 20-session average, reflecting investor caution.

However, NKG’s price has been recovering in recent sessions after retesting the 50-day SMA, as the Stochastic Oscillator emerged from the oversold region following an earlier buy signal.

If technical signals continue to improve, the short-term recovery prospects will be further strengthened.

SHB – Saigon-Hanoi Commercial Bank

In the morning session on October 9, 2025, SHB’s stock price rose, forming a Big White Candle pattern with trading volume surpassing the 20-session average, indicating investor optimism.

Additionally, SHB’s price has crossed above the Middle line of the Bollinger Bands and is well-supported by the 50-day SMA.

The MACD indicator continues to narrow its gap with the Signal line. If the MACD issues a buy signal and SHB successfully breaks through the August 2025 high (equivalent to the 18,700-19,600 range) in upcoming sessions, the medium-term outlook will be further supported.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:18 October 9, 2025

Technical Analysis Afternoon Session 10/10: Anticipating a Break Above Previous Highs

The VN-Index has continued its upward trajectory, surpassing its previous all-time high after decisively breaking through the September 2025 peak (equivalent to the 1,700–1,711 point range). Meanwhile, the HNX-Index remains in a state of consolidation, fluctuating around the Middle line of the Bollinger Bands.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.

SHB Brand Leaves a Lasting Impression on the Market and Captivates Public Hearts

According to the newly released report by Brand Finance Vietnam, SHB ranks 33rd among the Top 100 most valuable brands in Vietnam, solidifying the bank’s reputation, brand strength, and robust financial capabilities.