On October 9th, the Ho Chi Minh City Stock Exchange (HOSE) approved the listing of TCBS shares under the stock code TCX. The total number of listed shares exceeds 2.3 billion, corresponding to a charter capital of over VND 23,133 billion.

TCBS was recognized as a public company by the State Securities Commission on September 18, 2025, following the successful completion of its initial public offering (IPO).

IPO raises over VND 10,800 billion, 2.5 times the registered amount

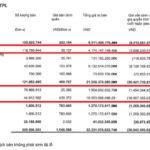

During the IPO, TCBS offered more than 231 million shares at a price of VND 46,800 per share, raising over VND 10,800 billion. The offering attracted significant market interest, with total subscriptions exceeding 575 million shares, 2.5 times the number of shares offered.

Post-IPO, TCBS has nearly 27,000 shareholders, meeting the listing requirements for shareholder structure. The two largest shareholders are Techcombank, holding 79.82%, and Mr. Nguyễn Xuân Minh, Chairman of the Board, owning 5.34%. Foreign investors account for 6.38% with 89 shareholders.

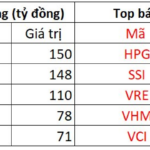

Based on the offering price, TCBS’s market capitalization is approximately VND 110,000 billion (equivalent to USD 4.2 billion). This positions TCBS as the leader in market capitalization within the securities industry, surpassing SSI and significantly outpacing peers such as VIX, VNDIRECT, HSC, and Vietcap.

Mr. Nguyễn Xuân Minh – Chairman of the Board, TCBS

|

Established in 2008, TCBS reached a charter capital of VND 1,000 billion by 2014. Since 2023, the company has accelerated its expansion, consistently increasing capital to become the largest chartered capital firm in Vietnam’s securities sector.

In terms of business performance, TCBS has maintained its leading position in recent quarters. In Q2/2025, the company reported an after-tax profit of VND 1,420 billion, the highest since its inception. All business segments showed positive growth, with margin lending and advance payment services generating VND 844 billion, up 15% quarter-on-quarter and 32% year-on-year.

– 10:02 10/10/2025

VPBankS Unveils Record-Breaking Profits Ahead of Highly Anticipated IPO

With robust results from proprietary trading, financial advisory services, and lending activities, VPBank Securities Joint Stock Company (VPBankS) reported pre-tax profits of nearly VND 2.4 trillion in Q3 and approximately VND 3.3 trillion for the first nine months of the year. This marks a significant year-over-year increase and achieves over 73% of the annual target. Another notable highlight is the margin loan balance reaching a new milestone.

Over 50 International Partners Explore Opportunities in VPBank’s IPO Venture

VPBankS has successfully conducted an international roadshow across Thailand, Singapore, Hong Kong (China), and the United Kingdom, engaging with numerous global partners. This initiative aimed to showcase investment opportunities, share growth strategies, and expand international collaborations, setting the stage for the largest IPO ever by a Vietnamese securities firm.

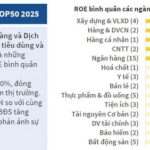

TOP50 2025: Private Sector Dominates, Banks Take the Lead

The 2025 “TOP50 Most Efficient Business Companies in Vietnam” list is headlined by the Banking sector, marking a significant milestone. Over its 14-year history, this ranking has mirrored the evolving Vietnamese economy, honoring resilient businesses that consistently lead through innovation and sustain their top positions.