Earning $30 million per month as a single individual might feel comfortable, but for a family of four, the story is vastly different—especially when you’re still renting and don’t own a home. In such situations, many might resign themselves to thinking, “As long as we cover our expenses, that’s enough; how can we possibly save?”

However, the couple featured below takes a different approach: They don’t blame their low income, strive to minimize spending, maximize savings, and work to their fullest capacity. Their achievements have earned the admiration of many.

Two photos shared by the husband

“It’s almost 11 PM, but my wife is still working overtime… We’re currently renting and don’t have our own home yet. I work in IT with a monthly salary of $14 million, and my wife is an accountant earning $11 million per month. We both take on extra work in the evenings, bringing our total monthly income to about $30 million.

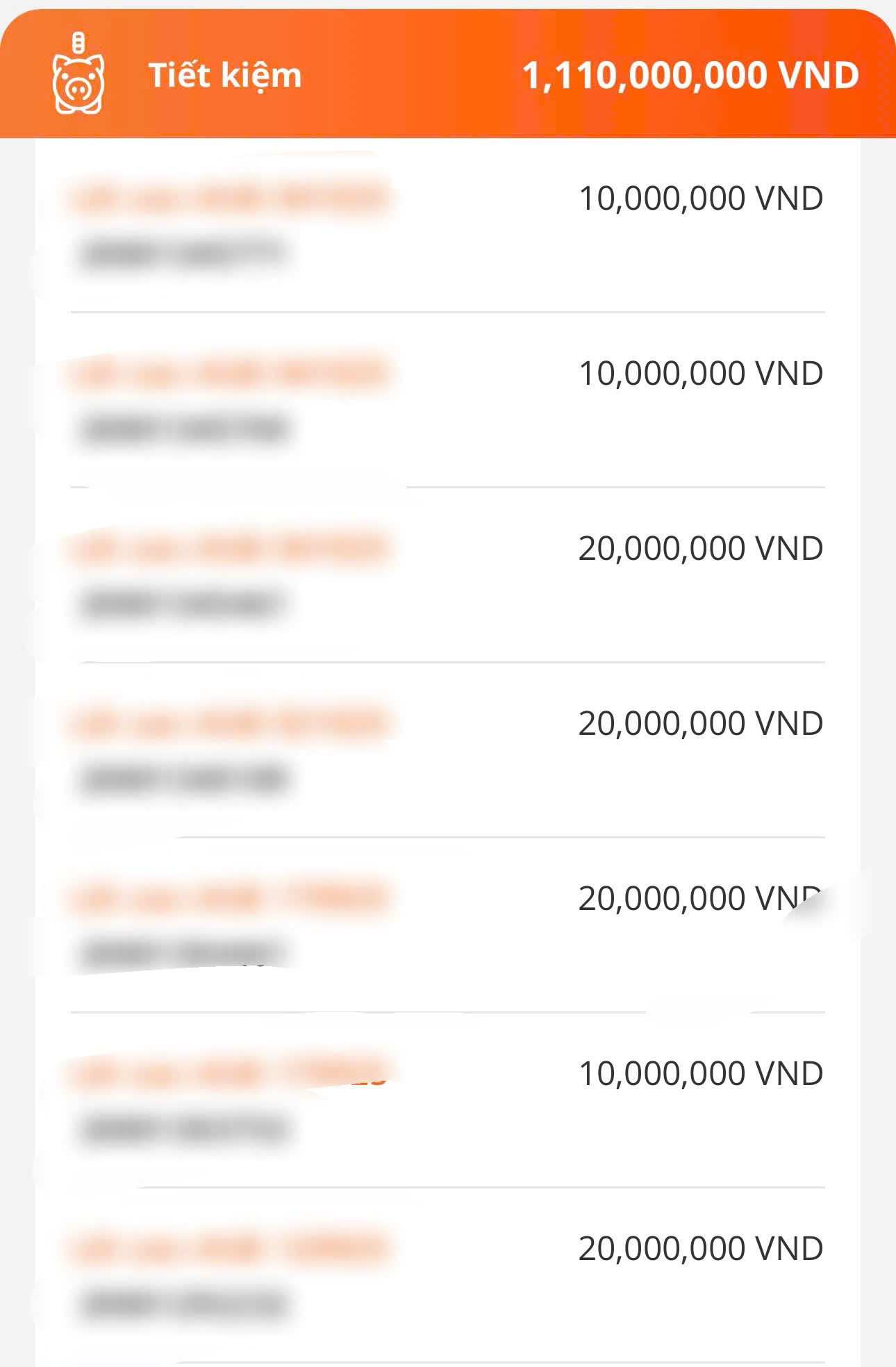

We’re raising two young children and paying $4 million in rent each month, but we still manage to save. Every month, as soon as we receive our salaries, we immediately save $10–20 million, and then we budget the remaining amount for expenses. With effort, we make it work. Looking back to when we first started our family, it took us a long time to save up to $100 million, then $200 million, and now we’ve reached $1.1 billion. This is the result of our persistent hard work to save money to build a house back in our hometown,” the husband shared.

In the comments section of the post, everyone expressed admiration for the family’s hard work, frugal spending, and disciplined saving. Some even admitted feeling ashamed, as they earn more, are single, but have savings that don’t even reach one-third of what this couple has achieved.

“I don’t know if you’re in Hanoi, Ho Chi Minh City, or another city, but if you’re living in a major city with that income, supporting two young children, and saving over $1 billion, you must be incredibly frugal. My household has two incomes, no children yet, no pressure from diapers or childcare, and no significant responsibilities toward our parents. We earn $40–50 million per month, but almost every month, we spend it all,” one person shared.

“That means your family spends only about $10 million per month on average… Of that, $4 million goes to rent, and the remaining $6 million covers food, education, diapers, and other essentials for the children. That’s truly remarkable,” another person commented in awe.

“Impressive, but if you allocated a portion of your monthly savings to buying gold or investing in stocks, given your knowledge, you’d likely have more than $1.1 billion by now,” someone suggested.

Saving or Investing: Consistency is Key!

Saving and investing may seem like two different paths, but they share a core principle: Both require consistency and discipline.

Illustrative image

Saving without consistency makes it difficult to accumulate a substantial amount for capital. Investing impulsively or chasing trends can lead to greater losses than gains, or even total loss. Consistency is the decisive factor in turning small amounts into significant sums, while discipline acts as the brake that prevents overspending and reckless decisions driven by fleeting emotions.

In reality, families that maintain the habit of setting aside a fixed portion of their income for savings over decades achieve financial stability. However, relying solely on saving without exploring investment opportunities means missing out on optimal returns. Thus, considering investment as the next step after saving isn’t entirely incorrect.

It’s important to emphasize that investing is like planting a tree—you can’t expect fruit the day after sowing the seed. Only those who are patient and disciplined enough to nurture the tree through harsh seasons will eventually reap the rewards. Conversely, those seeking quick riches and lacking consistency are more likely to give up midway or suffer significant losses. In other words, financial success doesn’t stem from a few momentary wise decisions but from hundreds, even thousands, of small, repeated choices over many years, made with clarity and discipline. Whether saving or investing, it’s this consistency that truly grows assets and provides long-term financial security for families.

The Vinh Phuc Provincial Party Committee Secretary: Inspect and Address Projects Exhibiting Wasteful Tendencies

According to Mr. Duong Van An, Secretary of the Vinh Phuc Provincial Party Committee, the Executive Board of the Provincial Party Committee has unanimously decided to assign the responsibility of leading and directing the inspection and supervision of projects and works with signs of wastefulness in the province to the Provincial Standing Committee. This decision aligns with the direction provided by General Secretary To Lam.

A Creative and Compelling Title: “The 2025 National Budget: Unlocking Opportunities and Empowering Vietnam’s Future.”

Chairman of the National Assembly Tran Thanh Man has issued Resolution No. 160/2024/QH15 on the allocation of the central budget for the year 2025.

Urgent Implementation of New Decree on Petrol Business; Proposals for Tax Extension, Reduction of Automobile Registration Fees, etc.

The Prime Minister has directed the urgent implementation of necessary measures to upgrade the stock market; submit to the Government a new Decree on gasoline business in May 2024; study and propose in May 2024 the extension of the tax payment deadline, reduction of registration fees for domestically manufactured and assembled automobiles, and reduction of land and water rental fees;…