According to the latest strategic report by SSI Securities (SSI Research), Vietnam’s stock market in 2025 marks a clear shift in its trajectory—transitioning from a cautious post-crisis recovery to the initial stages of a new growth cycle.

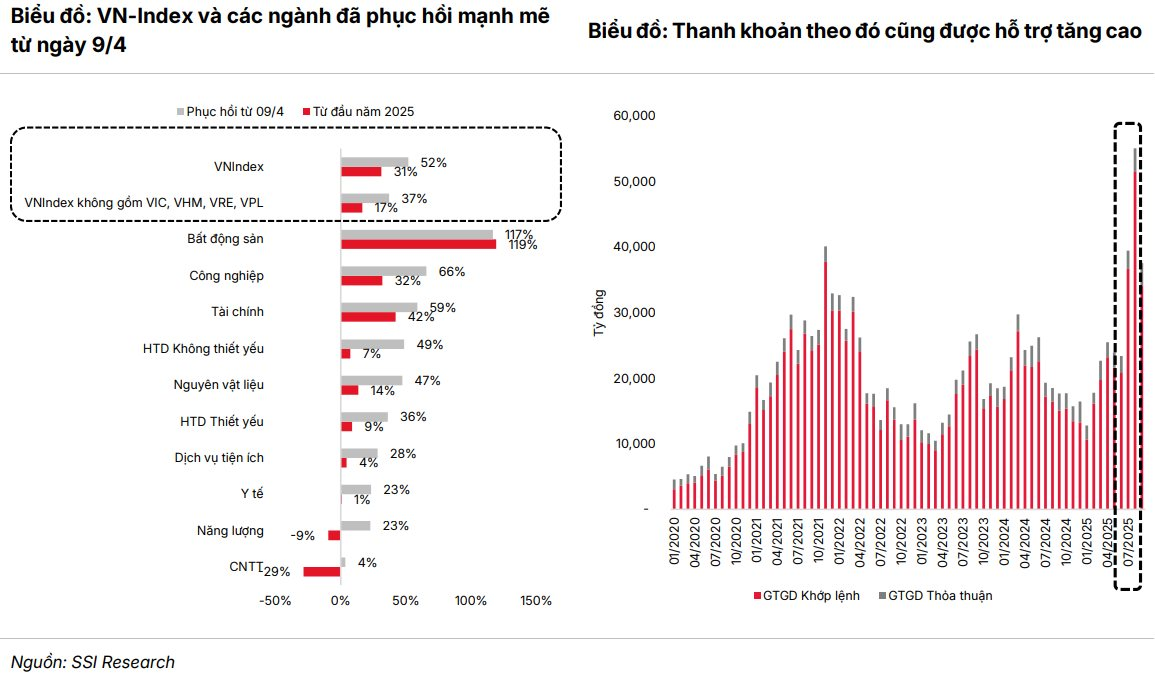

As of late September, the VN-Index surged by 31%, closing at a historic high of 1,661.7 points. This upward trend is not driven by short-term speculation but reflects a robust improvement in fundamental factors, a more transparent policy environment, and increasing participation from domestic investors.

SSI’s analysts report that market capitalization rose by 27% year-on-year, reaching VND 9,100 trillion, while average daily trading value increased by 36% to VND 28.7 trillion, peaking at VND 44 trillion in Q3. The strong liquidity recovery indicates improved risk appetite among investors, supported by accommodative monetary policies and solid corporate earnings. The State Bank of Vietnam (SBV) maintained a growth-supportive stance, keeping policy rates low, with credit growth projected at 19-20%.

Fiscal policy has also become more proactive. The government accelerated public investment disbursement in the final year of the 2021–2025 development cycle and extended the 2% VAT reduction until the end of 2026, bolstering domestic demand. These synchronized measures have established a stable macroeconomic foundation, fostering the expansion of the stock market.

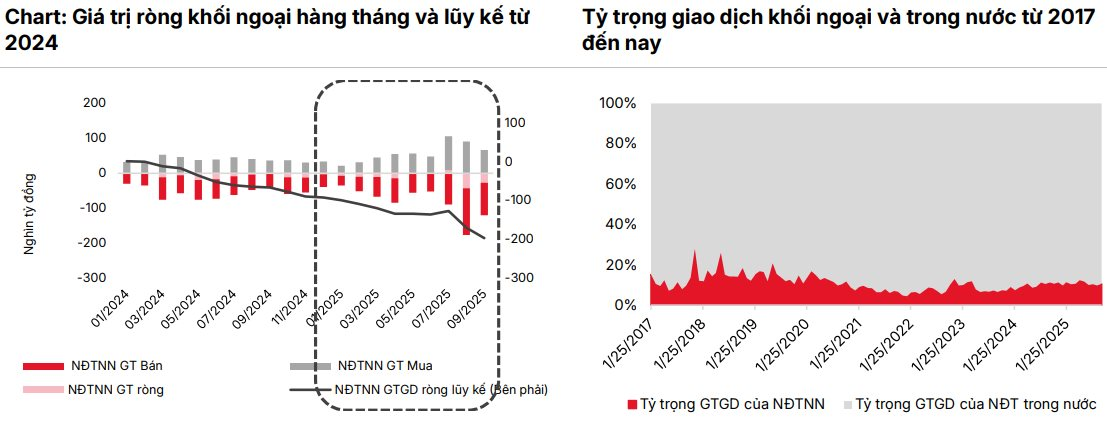

While domestic inflows drove the rally, foreign investors remained cautious due to short-term factors. Net selling was concentrated in March-April and August-September, primarily attributed to the VND’s 3.4% depreciation, profit-taking in high-performing stocks, and global capital shifts toward the U.S. and China.

However, SSI Research notes that the divergence between foreign and domestic capital flows is not unprecedented—similar phases in 2016 and 2021 saw foreign capital return as macroeconomic stability and market valuations became clearer.

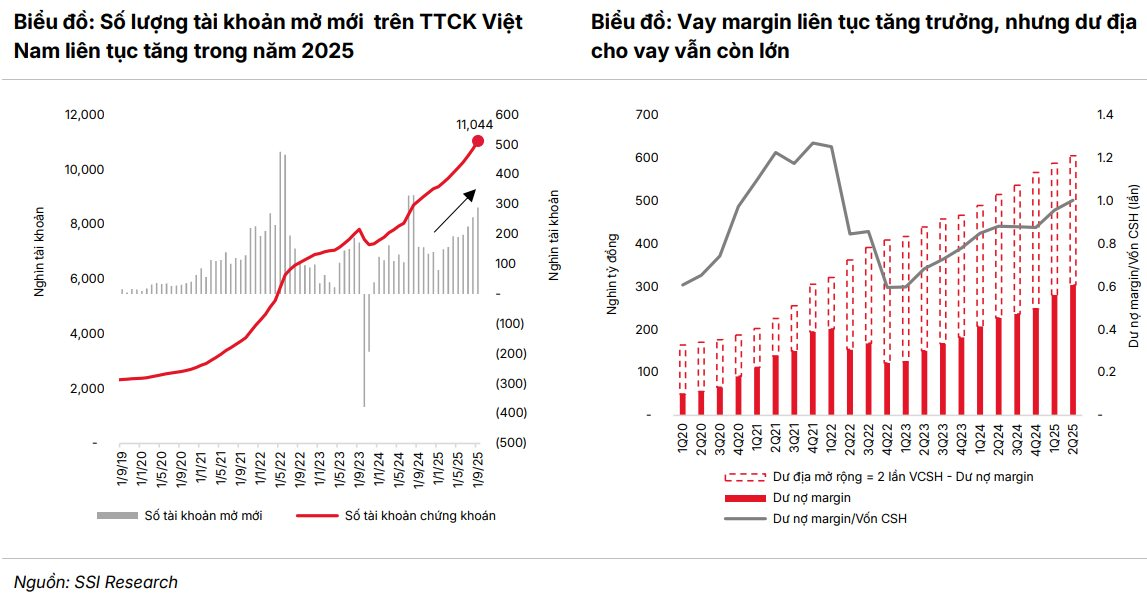

Despite foreign investors’ continued net selling, totaling VND 96.5 trillion by September, domestic capital played a pivotal role in absorbing selling pressure and sustaining market liquidity. The number of individual trading accounts reached 11.0 million, equivalent to 10.6% of the population, up 17.2% year-to-date.

“This shift reflects a structural change in Vietnam’s investor base: the rise of a domestic investor class—a cohort driving liquidity depth and sustainable trading behavior, mirroring trends observed in South Korea and Taiwan during earlier stages,” the report highlights.

Additionally, margin lending surged as securities firms expanded leverage limits amid low funding costs and favorable profitability. This amplified gains during the uptrend, contributing to the VN-Index’s outperformance in the region for the second consecutive year.

SSI concludes that Vietnam’s current market dynamics resemble the early stages of previous growth cycles (2016–2018 and 2020–2022), when the VN-Index recorded cumulative gains exceeding 130%. The combination of stable macroeconomic fundamentals, improved liquidity, and strengthened investor confidence suggests that 2025 is not the cycle’s peak but the foundation for a multi-year growth phase.

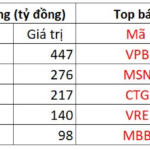

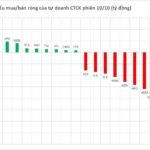

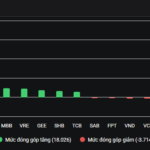

Foreign Investors Reverse Course, Pouring Nearly 450 Billion VND into a Blue-Chip Stock Amid Reduced Selling Pressure in Session 10/10

Foreign block transactions remain a drawback, yet there’s a silver lining as net selling totaled 637 billion VND across the entire market.

Vietnamese Billionaire Pham Nhat Vuong Makes Unprecedented Move in Vietnam’s Stock Market History

The stock codes VIC and VHM both surged to their upper limit of 7%, setting new record highs. Notably, this marks the second consecutive session of Vinhomes hitting the ceiling price.