Vietnam is poised for a breakthrough growth phase, aiming for double-digit GDP growth between 2026 and 2030, heralding a new era of economic development. The question arises: Is a 10% growth rate feasible, and how would achieving it impact the stock market?

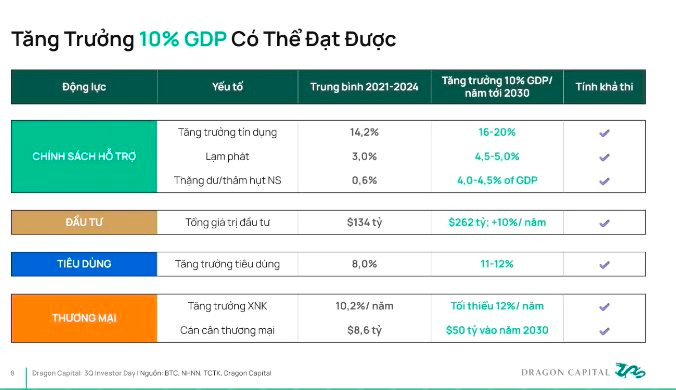

At the recent Investor Day, Mr. Le Anh Tuan, CEO of Dragon Capital, affirmed that the double-digit growth target is entirely achievable, contingent on sustaining four key drivers: supportive policies, investment, consumption, and trade.

Regarding supportive policies, to achieve a 10% annual GDP growth, credit growth must be maintained at 16–20%/year, inflation controlled within 4–5.5%, and a trade surplus of 4–4.5%.

In terms of investment, total investment across the economy is projected to rise to approximately $262 billion/year by 2030, equivalent to over 10% annual growth. This capital will stem from expanded public investment, stable FDI inflows, and a robust private sector resurgence.

For consumption, Dragon Capital forecasts that if asset channels maintain their upward trajectory and consumer confidence continues to improve, consumption growth could reach 11–12%/year, becoming a critical pillar of long-term growth.

In trade, while export-import turnover is not expected to surge as in previous periods, to achieve a 10% GDP growth, trade activity must increase by at least 12%/year, with a trade surplus of around $50 billion by 2030.

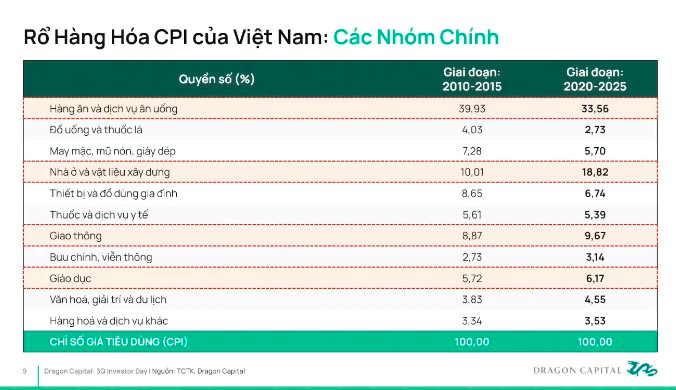

Addressing the question, “Could 10–12% growth trigger inflationary pressures?”, Mr. Tuan suggests examining Vietnam’s CPI structure, which comprises four main groups: food, construction materials, transportation, and education.

According to him, current inflation risks are not concerning. Education costs, which surged over the past 10–15 years, are slowing; fuel and construction material prices are well-controlled due to China’s slower economic growth, and Vietnam enjoys a food production surplus.

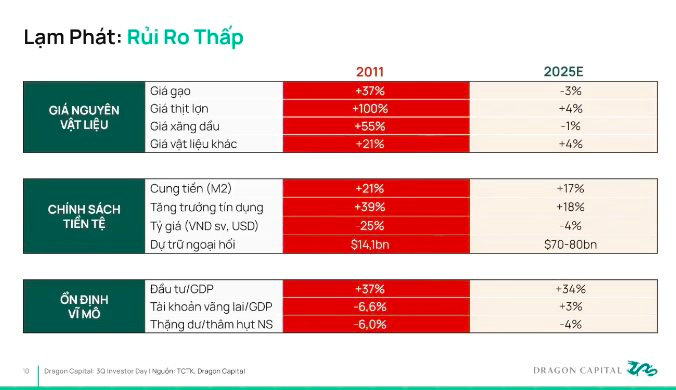

Compared to 2011–2012, when price-controlled sectors saw fuel prices rise 55%, rice by 37%, and pork double, the situation has changed as Vietnam no longer employs price controls.

On monetary policy, during 2005–2008, credit grew by 50%/year, and in 2011 by nearly 40%, causing the exchange rate to drop 25%. “We no longer face such risks,” Mr. Tuan emphasized.

Regarding macroeconomic stability, he noted that previously, investment accounted for 37% of GDP with a 6% budget deficit. Today, Vietnam’s fiscal and monetary foundations are far more stable, so double-digit growth does not imply uncontrolled inflation.

According to Mr. Tuan, double-digit GDP growth will positively impact the stock market. Historically, Asian economies like South Korea, Taiwan (China), Thailand, and China experienced stock market booms during their double-digit growth phases, often growing exponentially.

“With double-digit GDP growth, stock market growth shifts from percentage to multiple. At VN-Index 1,700, the P/E ratio is around 12.5–13, while 2026 profits are expected to rise 18–20%. I believe Vietnam’s stock market is on the cusp of a new opportunity, despite recent strong gains,” Mr. Tuan stressed.

J.P. Morgan predicts the VN-Index could reach 2,200 within 12 months—a scenario increasingly plausible if the economy enters a double-digit growth cycle.

With a strengthening macroeconomic foundation and lessons from preceding markets, Mr. Tuan is confident that sustained double-digit growth will propel Vietnam’s stock market into a new growth cycle, expanding not only in scale but also in quality, depth, and global competitiveness.

European Scooter Brand Enters Vietnam, Starting at Just VND 95 Million

On October 10, 2025, the iconic Italian scooter brand Lambretta officially launched in Vietnam through its distributor, Lamscooter, marking the arrival of a new player in the premium scooter segment.

The Pearl: Unveiling the Legacy Beneath the Heritage Roof

The Pearl stands as a testament to Nam Long’s bold venture into the luxury segment, while also embodying a timeless architectural masterpiece. More than a residence, it is a heritage-inspired sanctuary, meticulously crafted to preserve enduring values for generations to come.

Optimizing Social Housing Policies: Enabling Cash Contributions in Lieu of Land Funds and Adjusting Income Caps for Buyers

The draft decree amending the Social Housing Law introduces a new mechanism allowing developers to pay a fee in lieu of allocating 20% of land in their projects for social housing. Additionally, it raises the income ceiling for eligible buyers and renters. These adjustments aim to address existing challenges and inject fresh momentum into the social housing development program.