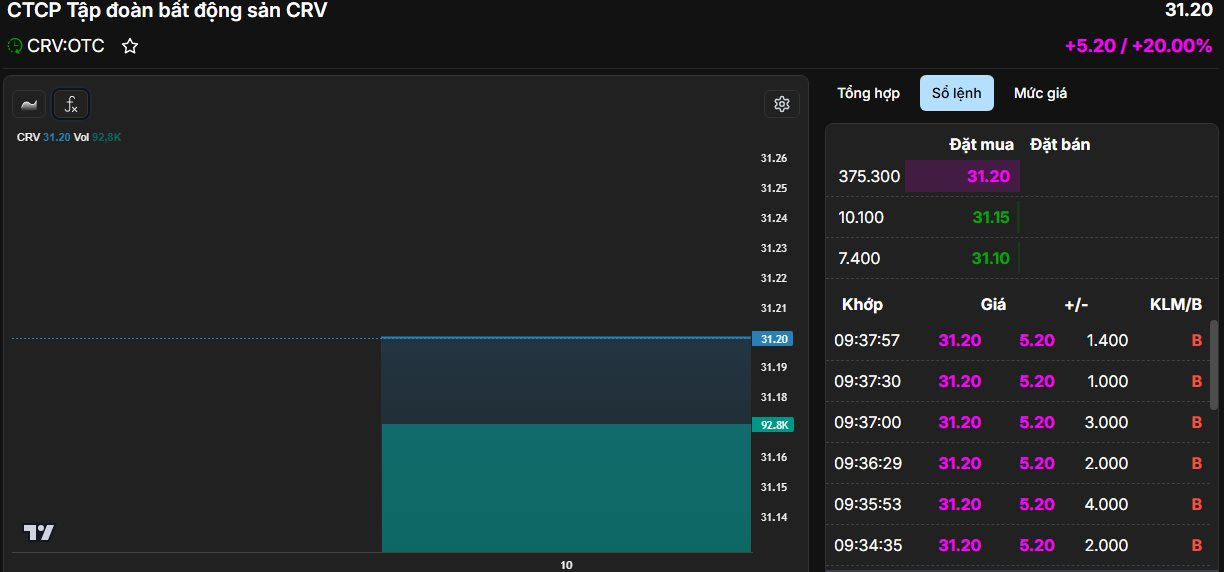

On October 10th, over 672 million shares of CRV Corporation (CRV Group) officially began trading on the Ho Chi Minh City Stock Exchange (HOSE). From the opening bell, the stock surged from its reference price of VND 26,000 per share to hit the ceiling price of VND 31,200 per share, marking a maximum increase of 20%. Trading volume exceeded 92,000 units.

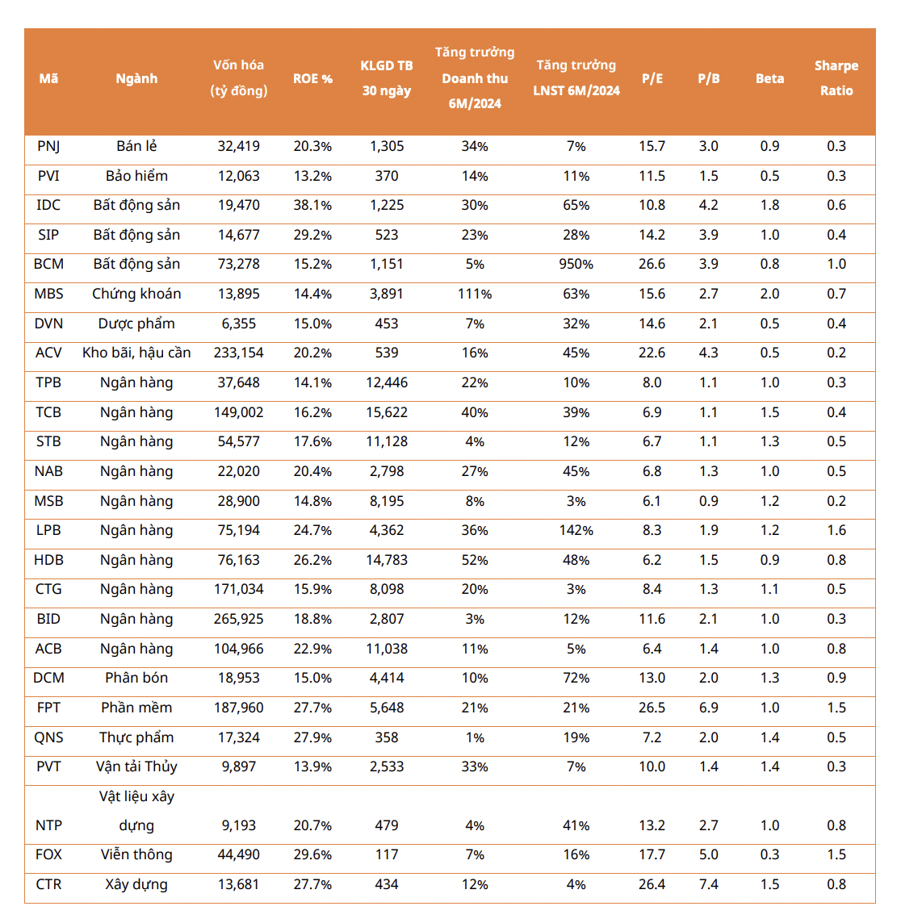

With a market capitalization of approximately VND 21 trillion, CRV surpassed several major real estate players on the exchange, including Phat Dat (VND 15.6 trillion), DIC Corp (VND 13 trillion), and Dat Xanh (VND 13 trillion).

Established in 2006 with an initial charter capital of only VND 5 billion, CRV’s capital had grown to VND 6,724 billion by early 2022, making it a key component of the Hoang Huy Financial Ecosystem (stock code: TCH). CRV is renowned for its large-scale projects in Hai Phong, including Hoang Huy New City – II in Thuy Nguyen, spanning 49.4 hectares with a total investment of over VND 15 trillion; Hoang Huy Commerce in Kenh Duong – Vinh Niem with an investment of VND 3,706 billion; and Hoang Huy Grand Tower in So Dau with an investment of VND 1,486.5 billion, delivering thousands of residential units.

As of June 18th, Hoang Huy Investment and Service Corporation (stock code: HHS), a member of the Hoang Huy Ecosystem, holds 51% of CRV’s shares. Additionally, Mr. Do Huu Ha serves as the Chairman of CRV’s Board of Directors. Mr. Ha also holds the highest leadership positions at TCH and HHS.

In terms of business performance, CRV aims to achieve revenue of VND 4 trillion and after-tax profit of VND 1.6 trillion in 2025, representing increases of 82% and 250%, respectively, compared to the previous year. For 2026, targets are set at VND 5 trillion in revenue and VND 2 trillion in after-tax profit. If realized, this would mark the strongest growth period in CRV’s history.

Prior to listing, in July 2025, CRV’s Shareholders’ Meeting approved a plan to issue an additional 16.81 million shares to existing shareholders at a ratio of 40:1, with an offering price of VND 26,000 per share. If successful, the company expects to raise VND 437 billion, which will be allocated entirely to the Hoang Huy New City – II project in Thuy Nguyen District, Hai Phong.

“A Step Towards Home with Fenica: The Ultimate Residential Solution in Ho Chi-Minh City’s Northeast Infrastructure”

On October 10th, Fenica, a high-rise project located on Tran Quang Dieu Street in Tan Dong Hiep Ward, unveiled its concept “One Step Home,” emphasizing its vision to create a convenient and well-connected living space tailored for young individuals.

Proposed Credit Tightening for Real Estate: Capital Gridlock, Market Freeze

Experts argue that while the policy of market stabilization and real estate price control is sound, the proposed credit tightening by the Ministry of Construction requires careful consideration. Such unilateral measures and abrupt regulatory actions could disrupt the market, leading to widespread panic and severe consequences. Instead, the focus should be on increasing supply and reducing input costs, which are more sustainable solutions for long-term market health.

What Policy Solutions Can Cool Down the Real Estate Market?

In response to the Prime Minister’s directive to curb and reduce housing prices, the Ministry of Construction is actively developing a Government Resolution outlining specific policies aimed at controlling unreasonable price increases.