According to the consultation document, PTM plans to allocate approximately VND 69 billion to acquire up to 100% of the charter capital of VND 15 billion from the five existing shareholders of Dat Viet Trading, at a price of VND 460,000 per share.

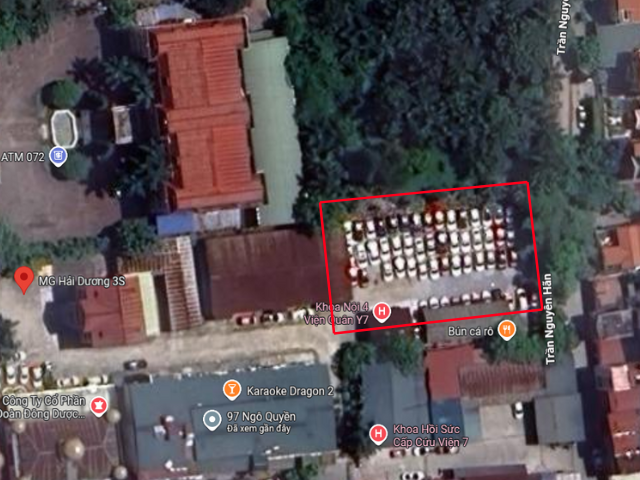

The land leased by Dat Viet Trading from the state spans over 3,770m², located on the frontage of Ngo Quyen Street—a central axis of Hai Duong City (now part of Le Thanh Nghi Ward, Hai Phong City). The lease term extends until 2061. This is the site where PTM currently operates an MG dealership.

Currently, PTM pays around VND 400 million per month (equivalent to VND 4.8 billion annually) to lease the entire premises and facilities from Dat Viet Trading, including a three-story showroom, a pre-engineered steel service workshop, and an outdoor parking area.

Upon completing the acquisition, PTM will become the full legal owner of this entity, thereby securing the long-term land lease and all existing assets. This move eliminates annual rental expenses and ensures long-term business stability.

The three-story building at 97 Ngo Quyen, former Hai Duong City (now Hai Phong City), now displays a “Coming Soon” sign for the MG Hai Duong Showroom – Image: Google Maps

|

The front area of 97 Ngo Quyen is set to become the MG Hai Duong Premium Standard Showroom – Image: Google Maps

|

PTM confirms the land has been efficiently utilized. Google Maps images show the rear area serving as a car parking lot – Image: Google Maps

|

According to PTM CEO Tran Van My, acquiring Dat Viet Trading allows the company to immediately leverage existing infrastructure, shorten investment timelines, reduce new construction costs, and ensure stable operating costs until 2061. Additionally, the current land rental fee for Dat Viet Trading is only about VND 295 million per year, significantly lower than commercial rates in the area.

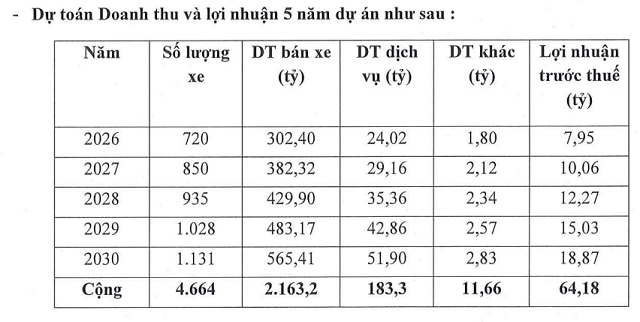

Financially, if PTM acquires all shares of Dat Viet Trading, it is projected to achieve pre-tax profits of over VND 64 billion in the first five years of operation, with total revenue during this period reaching approximately VND 2.16 trillion. In contrast, continuing to lease the premises is expected to yield only about VND 40 billion in pre-tax profits, as high rental costs significantly impact profit margins.

Specifically, the company’s calculations indicate both scenarios project similar revenue, with approximately VND 302 billion in 2026, increasing to VND 565 billion by 2030. This growth is driven by rising car sales from 720 to over 1,130 units annually, along with revenue from repair services, parts, and vehicle care. However, the nearly VND 24 billion profit difference between the two scenarios highlights the superior financial efficiency of the acquisition, while also establishing fixed assets for PTM instead of recurring rental payments.

PTM identifies Hai Duong as a strategic location along the Hanoi – Hai Phong – Quang Ninh transportation corridor, ideal for developing an integrated sales, service, and after-sales model adhering to MG Premium standards. Owning this facility will also help the company complete its northern region network and expand into Hung Yen in the next phase.

PTM forecasts pre-tax profits of over VND 64 billion from 2026 to 2030 following the acquisition of Dat Viet Trading. Source: PTM

|

PTM is a subsidiary of Hang Xanh Automobile Services JSC (Haxaco, HOSE: HAX), holding 51.6% of its capital. The company pioneered the first MG dealership in Vietnam and currently operates 15 dealerships nationwide, with 9 meeting global Premium 3S standards. PTM aims to increase this number to 20 dealerships and capture 40% of the MG market share by 2025.

In the first half of this year, PTM reported revenue of VND 687 billion, a 50% increase year-on-year, primarily from MG vehicle sales. However, net profit after tax decreased to VND 33 billion due to higher selling expenses. The company targets pre-tax profits of VND 180 billion in 2025 and has achieved 23% of this goal after six months.

From October 22 to November 5, PTM will seek shareholder approval via written consent for the acquisition of Dat Viet Trading. If approved, this strategic move will stabilize long-term business operations, enhance financial efficiency, and increase asset value within the MG distribution network in Vietnam.

PTM issues additional 3.2 million shares at VND 10,000 per share

PTM relists on UPCoM from August 22, valued at VND 640 billion thanks to MG brand

– 13:15 10/10/2025

Sông Đà 11 Falls Short, Selling Only 2.3 Million Shares in Latest Offering to Shareholders

Following the conclusion of the offering, Song Da 11 successfully sold over 15.8 million shares. The remaining nearly 2.3 million unsold shares will be canceled.

“Acquiring More: Tân Thành Đô’s Ambitious Plans for CTF Shares”

New City Group, a prominent Vietnamese company, has recently announced its intention to acquire an additional 3 million shares of City Auto Joint Stock Company (HOSE: CTF) between August 28 and September 26, 2025. This move underscores New City Group’s strategic expansion plans and its confidence in the potential of City Auto, a well-known name in the automotive industry.