A New Phase in the Growth Cycle

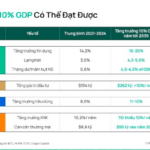

According to the 2026 Strategic Report titled The Dawn of Aspiration, published by SSI Securities Research and Investment Advisory Center (SSI Research), Vietnam’s economy is expected to remain among Asia’s fastest-growing. The government aims for an average annual GDP growth in the double digits by 2030, driven by three key factors: boosting public investment, leveraging the dynamism of the private sector, and maintaining stable FDI inflows.

Externally, the anticipated shift by the U.S. Federal Reserve toward a looser monetary policy is expected to stabilize the VND exchange rate and keep domestic capital costs low. This environment allows the State Bank of Vietnam to maintain supportive monetary policies, fostering credit growth and market liquidity.

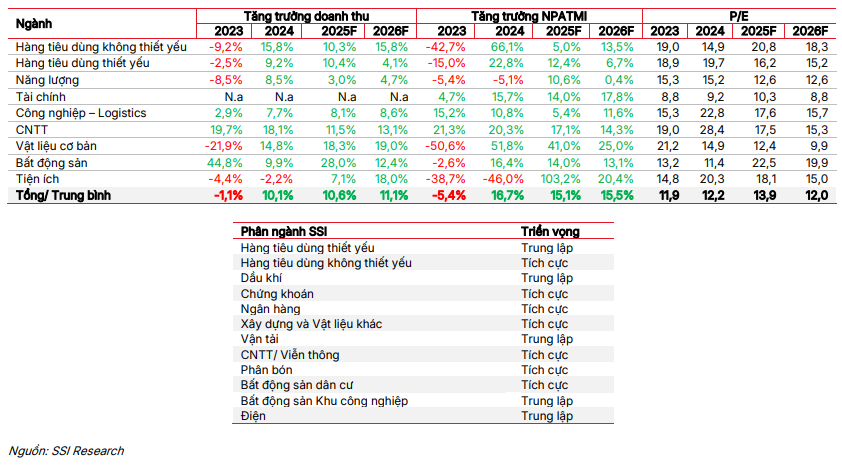

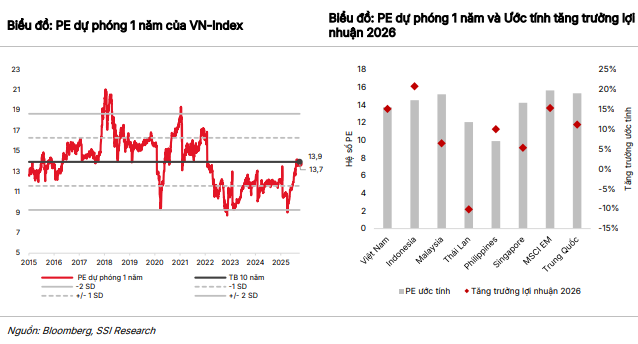

Despite a strong price rally in 2025, market valuations remain attractive. The VN-Index is trading at projected P/E ratios of 13.9 for 2025 and 12 for 2026, below the 10-year average of 14 and the 15-16 range seen during previous market peaks.

Compared to the region, Vietnam stands out with its combination of high growth and reasonable valuations. SSI Research maintains a VN-Index target of 1,800 points for 2026.

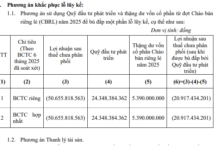

Vietnam’s upgrade to Emerging Market status by FTSE Russell, and the potential to meet MSCI Emerging Market standards, could attract approximately $1.6 billion in ETF inflows, along with significantly larger active capital.

|

Estimated Capital Inflows to Vietnam Post-FTSE Upgrade (Million USD)

|

Liquidity growth and a resurgence in IPOs are key themes for 2026. Domestic investors remain the market’s primary support, while large-scale listings like TCBS, VPS, and Gelex Infrastructure reflect renewed corporate confidence.

Historically, Vietnam’s strong market phases last about two years, delivering cumulative returns exceeding 130% before corrections. The current rally, starting in April 2025, is in its early stages. If history repeats, 2026 will mark the second phase of this uptrend, with leadership shifting from banks to consumer and technology sectors.

From Broad Recovery to Selective Leadership

In 2026, Vietnam’s market narrative shifts from broad recovery to selective leadership. The coming year will favor investors focused on profit sustainability, disciplined valuations, and comprehensive growth drivers, rather than short-term momentum.

Banking remains a market pillar, supported by robust credit growth and healthy profits. Consumer and retail sectors are expected to recover as disposable incomes rise. Real estate and infrastructure themes retain appeal due to public investment, with construction materials prioritized. Fertilizers and chemicals show steady growth, while IT rebounds post-correction. Brokerages continue to benefit from strong market liquidity.

SSI Research predicts 2026 will favor selective stock picking, prioritizing quality over momentum.

|

2026 Sector Outlook

|

Lingering Risks Remain

While 2026’s outlook is positive, short-term imbalances could impact market sentiment. High margin debt levels increase volatility risks tied to retail investor sentiment. The stable real estate cycle may see slowing demand, affecting bank credit needs.

Globally, trade tensions and capital shifts could pressure exports and the VND. Reform implementation warrants close monitoring.

These risks exist within a strengthening economic and market foundation, limiting short-term negative impacts. Corrections are natural in early bull markets, reinforcing growth foundations.

With expanding growth drivers, valuations below historical averages, and growing global recognition, Vietnam’s market is not just closing a chapter but opening a new one.

“The reins are steady, the path is clear, and the next growth wave has only just begun,” emphasizes SSI Research.

– 09:15 10/11/2025

Stock Market Update October 10: Selling Pressure on Shares Remains Mild

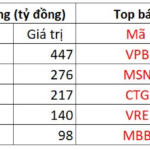

Liquidity in the 9-10 session saw a modest uptick, signaling that market support from capital inflows remains intact. Meanwhile, selling pressure on stocks has yet to exert a significant impact.

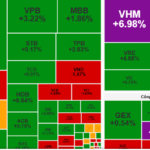

“Vin Group Stocks Surge, Propelling VN-Index to New Historic Highs”

The VinGroup family of stocks soared on October 10th, with VIC and VHM hitting their daily limit, while VRE and VPL surged close to their caps. This collective rally fueled a market-wide euphoria, propelling the benchmark VN-Index upwards by over 31 points.