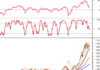

Vietnam’s stock market witnessed a historic trading week from October 6th to 10th, as FTSE Russell upgraded the country from Frontier to Secondary Emerging market status. Coupled with the economy’s robust growth momentum, the benchmark VN-Index surged 6.18%, surpassing the September 2025 peak and setting a new all-time high at 1,747.55 points. Liquidity improved by 19% compared to the previous week, with large-cap stocks leading the impressive rally.

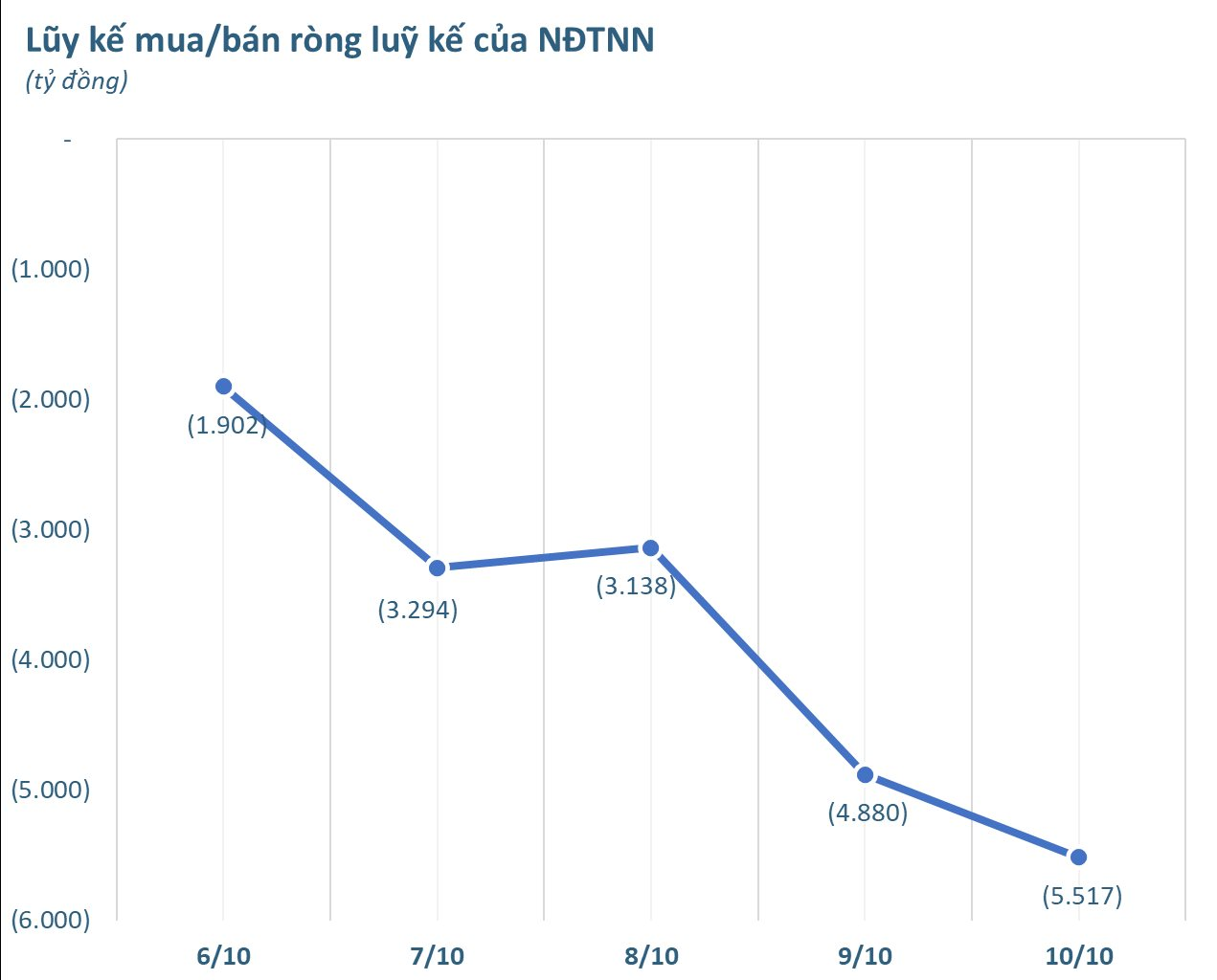

Foreign investors continued their net selling pressure, though at a reduced intensity compared to prior weeks. Notably, on Wednesday, October 8th, foreign investors turned net buyers on the Ho Chi Minh City Stock Exchange (HOSE). Over the five sessions, foreign investors were net sellers of VND 5,517 billion across the market.

On individual exchanges, foreign investors were net sellers of VND 5,030 billion on HoSE, VND 430 billion on HNX, and VND 57 billion on UPCoM.

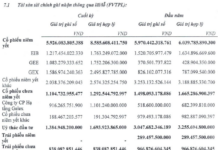

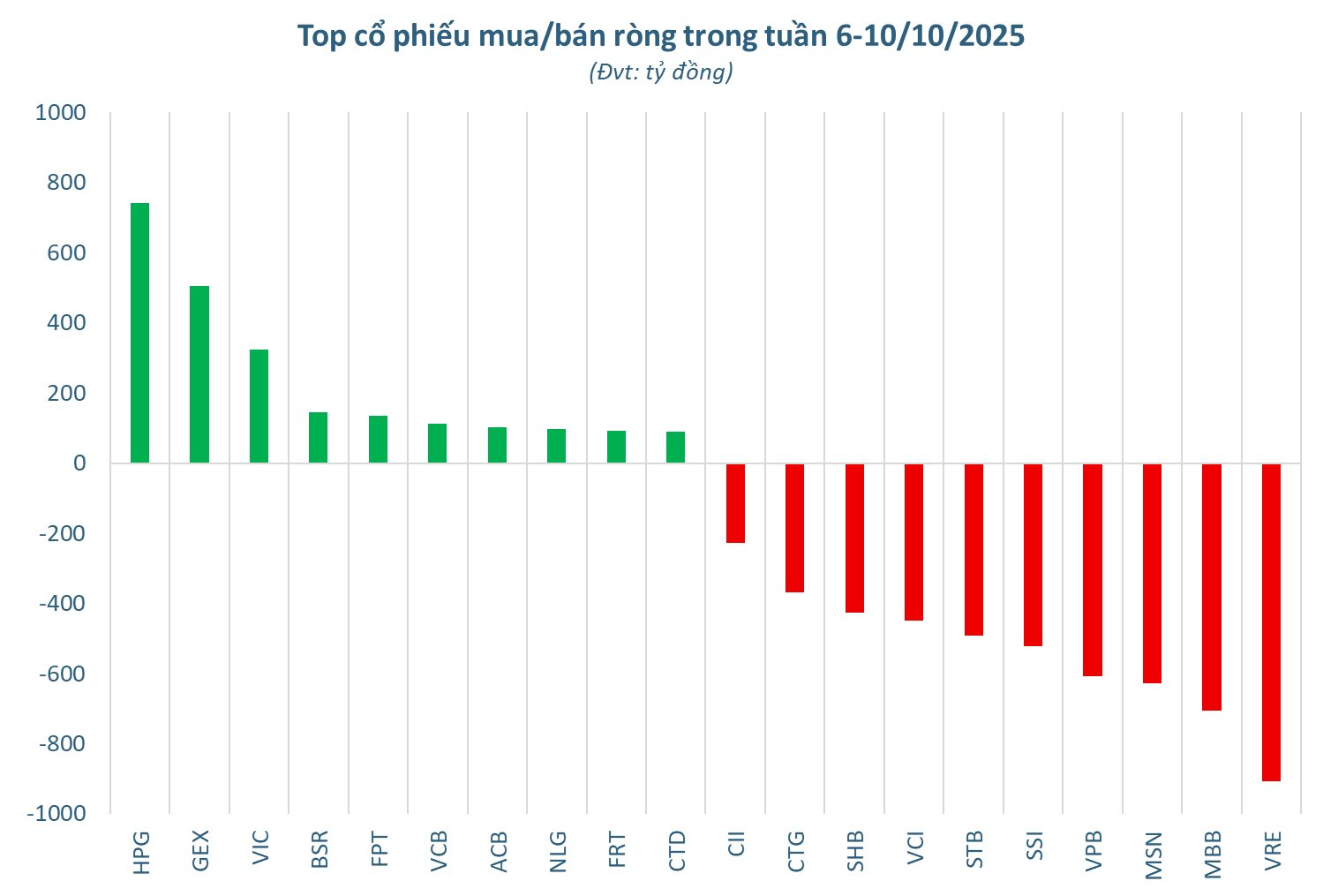

Analyzing individual stocks, VRE was the most heavily sold, with a net outflow of VND 906.8 billion, significantly outpacing other stocks. MBB followed with VND 705.6 billion, trailed by MSN (VND 628.6 billion), VPB (VND 608.6 billion), and SSI (VND 521 billion). Other large-cap stocks facing capital outflows included STB (VND 492.4 billion), VCI (VND 449.8 billion), SHB (VND 425.5 billion), and CTG (VND 367.6 billion). CII, IDC, and SHS also saw significant net selling, ranging from VND 190 billion to VND 220 billion each.

On the buying side, HPG led with a net inflow of VND 741.4 billion, followed by GEX (VND 506.1 billion) and VIC (VND 324.9 billion). BSR (VND 145.4 billion), FPT (VND 134.8 billion), VCB (VND 112.3 billion), and ACB (VND 101.6 billion) also attracted significant foreign interest. Additionally, NLG, FRT, CTD, TCH, and LPB recorded net buying values ranging from VND 70 billion to nearly VND 100 billion.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented National Record, Securing Top 3 Global Position

Billionaire Pham Nhat Vuong is the first Vietnamese individual to achieve this remarkable milestone.

Maybank Securities: VN-Index to Stabilize Between 1,600 – 1,700 Points in October, Targeting 1,800 Post-Accumulation Phase

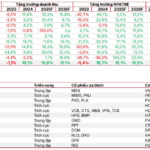

According to Maybank Securities’ October strategy report, the VN-Index is likely to continue fluctuating within the 1,600-1,700 range in October 2025, before targeting the 1,800 mark. This optimism is driven by expectations of an expansionary monetary and fiscal policy, accelerating corporate earnings, and the potential return of foreign capital inflows.

SSI Research Maintains 1,800-Point Target for VN-Index in 2026

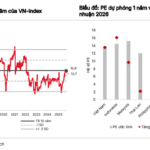

Despite the significant price surge in 2025, the VN-Index is currently trading at a forward P/E of 13.9x for 2025 and 12.0x for 2026, below its 10-year average of 14.0x and the 15-16x thresholds seen during previous market exuberance phases. SSI Research maintains its 2026 target for the VN-Index at 1,800 points.

Over 672 Million CRV Shares Officially Listed on HOSE

On the morning of October 10, 2025, the Ho Chi Minh City Stock Exchange (HOSE) hosted the Listing Decision Award Ceremony for CRV Real Estate Group Joint Stock Company (HOSE: CRV). This marked the official debut of over 672 million CRV shares on HOSE, with a reference price of VND 26,000 per share.