On the morning of October 8th, FTSE Russell announced the upgrade of Vietnam’s stock market from frontier to secondary emerging market status, effective September 2026.

This recognition by FTSE Russell not only unlocks opportunities for billions in international investment but also marks a pivotal step in aligning Vietnam’s financial markets more closely with global financial flows.

Billions in Capital Inflow Expected

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities, stated that the upgrade from frontier to emerging market is a critical milestone, deepening Vietnam’s integration into the global financial system.

According to Mr. Son, countries like Saudi Arabia and Kuwait, which have undergone similar upgrades, experienced significant positive impacts, notably a surge in foreign investment. This upgrade opens the door for substantial capital inflows, potentially attracting billions from both passive and active investment funds.

FTSE Russell announces Vietnam’s stock market upgrade to secondary emerging market status by September 2026. (Illustrative image)

“Assuming all stocks in the FTSE Vietnam Index are included in FTSE’s emerging markets indices, we estimate passive and active capital inflows could reach $3–7 billion post-upgrade,” Mr. Son noted.

He added that market liquidity is expected to improve post-upgrade. Removing pre-funding requirements will encourage institutional investors, potentially boosting daily trading volumes to $2–3 billion. This enhances liquidity, stability, and reduces volatility.

Additionally, the upgrade enhances Vietnam’s economic image and regional standing.

“As one of ASEAN’s fastest-growing economies, this upgrade increases Vietnam’s appeal to major investors like pension funds and ETFs. It also strengthens Vietnam’s position in international trade negotiations and attracts higher-quality FDI,” Mr. Son shared.

The upgrade also fosters economic growth and corporate development. Increased capital will support IPO activities, expand market capitalization, and enhance corporate governance.

The stock market will become a more effective capital-raising channel, contributing to the GDP growth target of over 8% in 2025 and double-digit growth from 2026–2030. This upgrade also encourages corporate reforms and governance improvements.

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities. (Photo: D.V)

“Overall, this upgrade not only brings financial benefits but also drives structural reforms, moving Vietnam closer to high-income status by 2045,” Mr. Son analyzed.

Upgrade Beyond Symbolic

Mr. Gary Harron, Head of Securities Services at HSBC Vietnam, noted that Vietnam’s economy has thrived despite skepticism. With an 8.23% GDP growth in Q3, the highest since 2011, Vietnam has proven its economic prowess among frontier and emerging markets.

This upgrade places Vietnam just two steps away from “Developed Market” status, reflecting collective efforts by the government, regulators, and market participants.

“In the six months since FTSE Russell’s last report, we’ve seen strong collaboration among stakeholders to address final barriers, leading to this secondary emerging market upgrade,” Mr. Gary Harron said.

Mr. Gary Harron, Head of Securities Services at HSBC Vietnam. (Photo: D.V)

According to Mr. Harron, this upgrade is more than symbolic. It influences analyst perceptions, media coverage, and global asset allocation decisions. For Vietnam, shedding the “frontier” label signifies recognition and assurance.

Mr. Harron believes this reclassification can shift investor behavior and confidence, alter long-term economic trajectories, and reduce reliance on any single trading partner.

HSBC experts highlight Vietnam’s capital market progress, with market capitalization and trading accounts increasing sevenfold over a decade. This year alone, the VN-Index rose by one-third, surpassing COVID-19-era peaks driven by optimism about Vietnam’s role in global supply chains.

This upgrade will further accelerate reforms. Global investors confident in Vietnam’s future will demand greater alignment with international standards.

However, Mr. Harron noted that despite recent IPO improvements, Vietnam’s stock market still lags regional peers in capital mobilization for businesses.

According to the World Bank, Vietnam’s capital market trails similarly sized economies, making the economy heavily reliant on bank credit.

HSBC Global Research highlights that private sector bank credit in Vietnam is double the stock market capitalization, a disparity uncommon in ASEAN, increasing vulnerability to inflation and rising interest rates.

“It’s encouraging to see Vietnam’s new September regulations simplifying IPO and listing processes, enhancing capital efficiency and investor protection,” Mr. Harron concluded.

SSI Research Maintains 1,800-Point Target for VN-Index in 2026

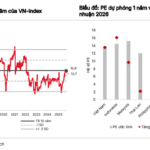

Despite the significant price surge in 2025, the VN-Index is currently trading at a forward P/E of 13.9x for 2025 and 12.0x for 2026, below its 10-year average of 14.0x and the 15-16x thresholds seen during previous market exuberance phases. SSI Research maintains its 2026 target for the VN-Index at 1,800 points.

Vietnamese Prime Minister Calls on Businesses and Entrepreneurs to Embrace the ‘Three Pioneers’ Spirit

In a historic milestone where the number of active businesses in Vietnam has surpassed one million for the first time, Prime Minister Phạm Minh Chính outlined five key aspirations. He urged Vietnamese enterprises and entrepreneurs to embrace the “three pioneering spirits,” explore new frontiers of growth, and boldly venture “into the vast ocean, deep into the earth, and high into space.” These efforts aim to propel the nation toward rapid and sustainable development, firmly advancing toward socialism, entering a new era of prosperity, wealth, civilization, and flourishing progress.

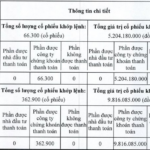

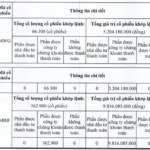

VNDIRECT Processes Payments for Two Non-Prefunding Transactions

On October 8th, VNDIRECT Securities Corporation reported a case of a foreign institutional investor (FII) failing to settle payment within the stipulated timeframe.