By the close of the 10/10 session, the USD Index (DXY), which gauges the greenback’s strength against a basket of six major currencies, stood at 98.85 points, marking a 1.14-point increase from the previous week’s end.

The Japanese yen traded at 0.66 USD, lingering near its weakest level since mid-February. The currency is on track for a nearly 2.5% weekly decline, following Sanae Takaichi’s victory in the LDP leadership race on October 4th. Takaichi, expected to become Japan’s next Prime Minister, has pledged to boost the economy through increased public spending and continued loose monetary policy, putting downward pressure on the yen.

Meanwhile, the euro traded at 1.16 USD, hovering near a two-month low and down 1.1% for the week, as political instability in France continued to erode confidence in the shared European currency.

Notably, on October 10th, U.S. President Donald Trump announced a 100% tariff on Chinese imports, effective November 1st, along with export controls on critical software. Most Chinese goods exported to the U.S. already face high tariffs, ranging from 50% on steel and aluminum to 7.5% on consumer goods.

The weakening yen and euro, coupled with the new U.S. tariff policy, have caused significant volatility in global financial markets, driving up U.S. Treasury yields and bolstering the U.S. dollar’s strength.

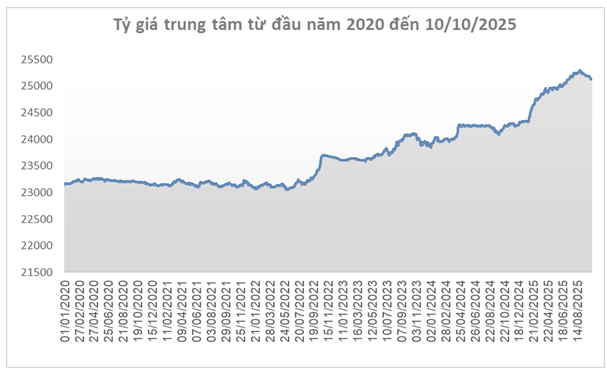

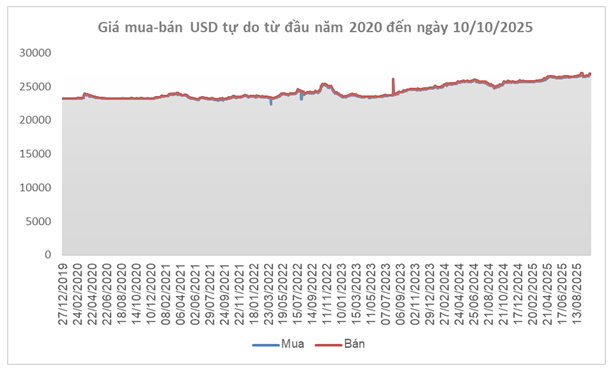

Domestic Exchange Rates Decline for the Second Consecutive Week

Source: SBV

|

In Vietnam, the State Bank set the central exchange rate on October 10th at 25,128 VND/USD, a 34-dong decrease from the previous week, marking the second consecutive week of decline. With a ±5% band, commercial banks’ exchange rates are allowed to fluctuate between 23,872 and 26,384 VND/USD.

At the Foreign Exchange Reserve Management Department, the reference exchange rate was listed at 23,922 – 26,334 VND/USD (buy – sell), down 32 dong and 36 dong respectively from the previous week.

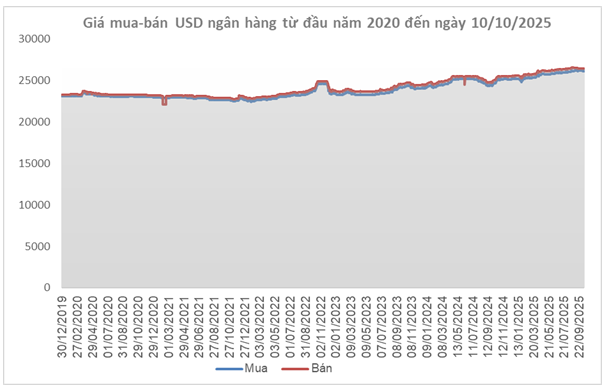

Source: VCB

|

Within the banking system, Vietcombank ended the week with a USD/VND rate of 26,114 – 26,384 VND/USD, a 56-dong decrease on the buying side and a 36-dong decrease on the selling side.

Source: VietstockFinance

|

Conversely, in the free market, the USD/VND rate traded around 26,830 – 26,930 VND/USD, up 315 dong on both sides compared to the previous week’s end.

– 19:15 12/10/2025

USD Price Retreats

During the week of September 29 – October 3, 2025, the US dollar weakened as the nation entered a new period of uncertainty. This followed the failure of President Donald Trump and Congress to reach a budget agreement by the October 1 deadline, resulting in a government shutdown and the suspension of numerous programs and services.

American Timber Executives: ‘Manufacturing Furniture in the U.S. Is Nearly Impossible—We’re Staying in Vietnam’

Instead of relocating production to another country to avoid tariffs, many of Vietnam’s leading furniture exporters are making a bold move: staying put and betting that American consumers themselves will absorb the additional costs. They believe that strong demand will help Vietnam’s timber industry weather the tariff storm.

The Ambiguous 40% Transfer Tax Status Leaves Businesses in Uncertainty

Amidst the uncertainty surrounding the U.S. 40% tax on transshipment goods, businesses must proactively adapt by accelerating localization efforts, diversifying supply chains, and rigorously adhering to rules of origin. This presents both a challenge and a unique opportunity for sustainable growth.