MARKET ANALYSIS FOR THE WEEK OF OCTOBER 6-10, 2025

During the week of October 6-10, 2025, the VN-Index reached a new all-time high, forming a Big White Candle pattern, reflecting investor optimism. However, trading volume needs to consistently surpass the 20-week average to support a more sustainable upward trend in the future.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Establishing a New All-Time High

On October 10, 2025, the VN-Index surged for the third consecutive session, with trading volume exceeding the 20-session average, indicating strong investor confidence.

Currently, the index has set a new all-time high and remains close to the upper band of the Bollinger Bands. Meanwhile, the MACD indicator continues its upward trajectory after generating a buy signal, suggesting positive short-term prospects.

HNX-Index – Re-testing the 50-Day SMA

On October 10, 2025, the HNX-Index experienced a slight decline, accompanied by a small-bodied candlestick pattern, and is currently re-testing the 50-day SMA, reflecting investor hesitation.

Additionally, the Bollinger Bands are narrowing (Bollinger Band Squeeze), while the ADX indicator continues to decline, remaining below the gray zone (20 < ADX < 25).

Capital Flow Analysis

Smart Money Flow Dynamics: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow Dynamics: Foreign investors continued net selling on October 10, 2025. If this trend persists in upcoming sessions, the outlook will become increasingly pessimistic.

Technical Analysis Department, Vietstock Advisory Division

– 16:58 October 12, 2025

Dragon Capital Expert: “Don’t Be Surprised, Confused, or Fearful When Stocks Experience a 5-10% Dip”

Mr. Le Anh Tuan, CEO of Dragon Capital, asserts that short-term market fluctuations, whether upward or downward, are entirely normal—akin to “potholes and bumps” along the market’s long-term journey.

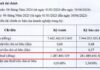

Maybank Securities: VN-Index to Stabilize Between 1,600 – 1,700 Points in October, Targeting 1,800 Post-Accumulation Phase

According to Maybank Securities’ October strategy report, the VN-Index is likely to continue fluctuating within the 1,600-1,700 range in October 2025, before targeting the 1,800 mark. This optimism is driven by expectations of an expansionary monetary and fiscal policy, accelerating corporate earnings, and the potential return of foreign capital inflows.

SSI Research Maintains 1,800-Point Target for VN-Index in 2026

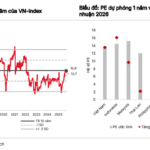

Despite the significant price surge in 2025, the VN-Index is currently trading at a forward P/E of 13.9x for 2025 and 12.0x for 2026, below its 10-year average of 14.0x and the 15-16x thresholds seen during previous market exuberance phases. SSI Research maintains its 2026 target for the VN-Index at 1,800 points.