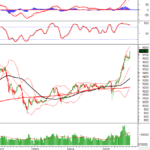

Last week, the VN-Index surged by 108.44 points to reach 1,747.55. Total trading value hit VND 159.418 trillion. Similarly, the HNX-Index closed the week at 273.62, up 7.87 points from the previous week. Liquidity on the HNX also saw a significant boost, with total trading value reaching VND 11.47 trillion.

On the HoSE, foreign investors net sold 178.1 million units, with a net value of over VND 5.049 trillion. On the HNX, foreign investors net sold for five consecutive sessions, totaling 14 million units with a net value of over VND 433 billion.

On the Upcom market, foreign investors net sold 2.36 million units, with a net value of nearly VND 64 billion. Overall, during the trading week from October 6th to 10th, foreign investors net sold 194.5 million units across the market, with a corresponding net value of over VND 5.546 trillion.

VBB to Change Listing Venue

Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank – stock code: VBB) has received approval from the State Securities Commission for its plan to issue shares to existing shareholders.

Vietbank is advancing the transfer of over 821 million VBB shares from Upcom to HoSE.

Accordingly, Vietbank will offer over 270.9 million common shares at a par value of VND 10,000 per share, with a total issuance value of over VND 2.709 trillion. Following the issuance, Vietbank’s charter capital will increase from VND 8.21 trillion to nearly VND 10.92 trillion.

In addition to the capital increase plan, Vietbank is also progressing the transfer of over 821 million VBB shares from Upcom to HoSE, expected to be completed by Q1/2026 at the latest. As of June 30th, Vietbank’s total assets reached VND 178.671 trillion, up nearly 10% from the beginning of the year.

BaF Vietnam Agriculture Corporation (stock code: BAF) has finalized the registration dossier for the public issuance of bonds in 2025. These are non-convertible, unsecured bonds without warrants, with a maximum total face value of VND 1.000 trillion. The bond interest rate is fixed at 10% per annum, with a 6-month interest calculation period.

The raised funds will be used by BaF Vietnam, with VND 670 billion allocated to supplement capital for business operations and pig farming production, and the remaining VND 330 billion to repay part of the principal debt from loan agreements. As of June 30th, BaF Vietnam’s total short-term and long-term debt, including convertible bonds, amounted to over VND 3.07 trillion, nearly 72% of total equity.

On October 31st, Binh Son Refining and Petrochemical Joint Stock Company (stock code: BSR) will finalize the shareholder list for dividend distribution and capital increase from equity.

Specifically, Binh Son Refining plans to issue over 1.9 billion shares to execute these rights. BSR will issue over 930 million shares for dividend distribution at a ratio of 100:30, meaning shareholders holding 100 shares will receive 30 newly issued shares.

BSR’s charter capital will increase from VND 31.005 trillion to approximately VND 50.073 trillion.

Simultaneously, BSR plans to issue over 976.6 million bonus shares at a ratio of 100:31.5, meaning shareholders holding 100 shares will receive an additional 31.5 new shares. After these issuances, BSR’s charter capital will increase from VND 31.005 trillion to approximately VND 50.073 trillion.

Nearly 2.3 Million SJE Shares Remain Unsold

Song Da 11 Joint Stock Company (stock code: SJE) offered over 15.8 million shares to raise VND 205.8 billion. However, by the end of the offering on October 3rd, Song Da 11 distributed 15,831,289 shares, achieving approximately 87% of the total offered shares.

Song Da 11 stated that the shares not purchased by existing shareholders were further offered to 18 company employees. However, one investor declined to purchase, and another did not fully subscribe to the allocated shares, leaving 2,295,244 shares undistributed. With the issuance of 15.83 million shares, the charter capital increased from VND 241.7 billion to VND 400 billion.

SJE has 2,295,244 shares remaining undistributed.

Mr. Phan Duy Binh, a member of the Board of Directors of Tien Thinh Group Joint Stock Company (stock code: TT6), registered to sell 1 million shares before the company finalizes the shareholder list for the 2024 dividend payment.

Specifically, Mr. Binh registered to sell TT6 shares from October 10th to November 7th to meet personal financial needs. After the transaction, Mr. Binh will no longer hold any TT6 shares. It is estimated that Mr. Binh could earn VND 6.6 billion from selling these shares. Notably, Mr. Binh registered to divest during the same period TT6 finalizes the shareholder list for issuing 2.26 million shares as a 2024 stock dividend at an 11% ratio. The final registration date is October 23rd.

Conversely, from October 2nd to 31st, Mr. Pham Tien Hoai, Chairman of TT6’s Board of Directors, registered to purchase nearly 2.6 million additional shares, increasing his ownership to 65.76%, equivalent to over 13.5 million shares.

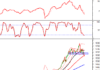

Positive Outlook Persists in the Warrant Market for the Week of October 13-17, 2025

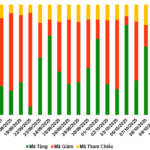

As the trading session closed on October 10, 2025, the market witnessed 164 stocks advancing, 67 declining, and 47 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 448,600 CW.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented National Record, Securing Top 3 Global Position

Billionaire Pham Nhat Vuong is the first Vietnamese individual to achieve this remarkable milestone.