In a newly released report, SGI Capital assesses that Vietnam’s stock market is in a robust growth phase, supported by impressive economic expansion and the government’s flexible policy management.

However, alongside opportunities, the market faces challenges such as rapid credit growth, tightening bank liquidity, and speculative capital flows that pose risks of asset bubbles.

Bank Liquidity Under Pressure, Interest Rates May Rise Again

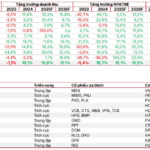

According to SGI Capital, Q3/2025 GDP grew by 8.25%, the highest in years, reflecting the effectiveness of policies aimed at mitigating tariff risks from the U.S. The government has boosted public investment, resolved legal bottlenecks, maintained low interest rates, and promoted credit growth of 13.3% over nine months. As a result, asset markets like real estate and stocks have been among the earliest beneficiaries.

However, increased money supply and lower interest rates have heightened exchange rate pressures, while speculative capital flows may lead to future asset bubbles.

SGI Capital notes that capital mobilization has lagged behind credit growth due to low interest rates, forcing many banks to rely on the interbank market for liquidity. Despite the State Bank’s money injections via OMO, interbank interest rates have remained high for the past three months.

Government bond yields are also rising, reflecting the economy’s substantial capital demand. As sensitive interest rates climb, market liquidity and trading volumes typically decline. If credit continues to grow at 18–20% annually, deposit interest rates may need to rise soon to restore liquidity.

The report also highlights regulatory efforts to curb real estate speculation. Policies such as limiting loan ratios for second and third homes and taxing idle land are deemed necessary to prevent speculation and ensure long-term macroeconomic balance. However, these measures may exert short-term pressure on both the real estate sector and banks, as real estate credit remains a significant growth driver.

Product Quality and Corporate Appeal Are “Sufficient Conditions”

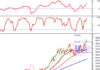

SGI Capital reports that despite foreign investors net-selling over 110 trillion VND since the year’s start, the VN-Index has remained stable, showcasing the strength of domestic capital. If Vietnam is upgraded by FTSE in September 2026, passive funds could allocate approximately $1.5 billion from March 2027, while active fund inflows could be larger depending on market attractiveness.

However, given the current market capitalization and liquidity, a few billion dollars flowing in over 6–12 months “no longer determines market trends.”

Market vibrancy has enabled companies to raise nearly 40 trillion VND through IPOs and issuances in Q3. Nonetheless, new domestic capital inflows are slowing, while foreign divestment pressures, internal shareholder exits, and increased issuance needs have significantly reduced market liquidity.

SGI Capital notes that with margin levels reaching record highs at many securities firms, the market requires fresh capital to sustain growth in the final months of the year.

In summary, the analysts emphasize: “An upgrade is great news, but we shouldn’t expect a flood of foreign capital. The key driver of market growth remains macroeconomic stability—an environment enabling businesses to expand and deliver sustainable profits to shareholders. An upgrade is necessary, but product quality and corporate appeal are sufficient conditions for Vietnam to attract long-term foreign investment.”

“Enhancing Product Quality and Administrative Reforms: A Catalyst for Attracting Foreign Investment, Says Deputy Chairman of SSC”

On October 10th, the State Securities Commission (SSC) hosted a conference to disseminate amendments and supplements to the Securities Law and its implementing regulations.