Russian Crude Oil Dominates Turkey’s Refineries in Q3 2025

In the third quarter of 2025, Russian crude oil continued to dominate Turkey’s refinery inputs, despite geopolitical pressures and assertive diplomacy from the Trump administration.

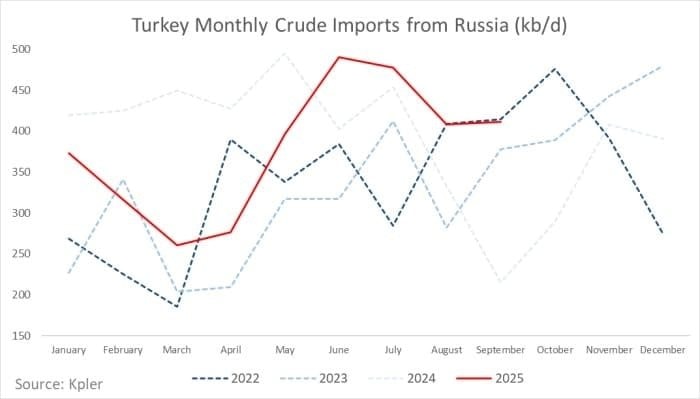

September import data revealed that Russian crude inflows to Turkey surpassed monthly averages, reaching 410,000 barrels per day—a trend that began in early summer with no signs of reversal.

On September 25, during President Donald Trump’s first meeting with Turkish President Recep Tayyip Erdoğan at the White House in six years, Trump addressed energy concerns. He urged Ankara to curb Russian oil imports—a politically charged message delivered as Turkey’s reliance on Moscow’s crude hit a four-year high.

However, Turkey’s government swiftly deflected responsibility. The Energy Minister reminded the press that crude oil purchases are “commercial decisions made by private refineries,” not state policy. Turkey’s refineries—state-controlled Tüpraş (Türkiye Petrol Rafineleri A.Ş.) and SOCAR-owned Star Rafineri A.Ş.—are the primary buyers of Russian Ural crude, forming the backbone of Turkey’s energy system.

Turkey’s Crude Oil Imports from Russia (2022-2025)

Since early summer 2025, Turkey’s Russian crude imports averaged 410,000 barrels per day, a 20% increase year-over-year. This surge stems from both refinery design and economic factors.

Turkish refineries are optimized for heavier, sour crudes like Russia’s Ural oil, which has an API gravity of 29-30 degrees and higher sulfur content compared to lighter Middle Eastern or U.S. grades.

While Ural isn’t the only sour crude in the Mediterranean market, finding a viable, cost-effective alternative has proven challenging. Russian seaborne exports surged to 3.4 million barrels per day—the highest since spring 2024—with Turkey eagerly participating. In the first week of October alone, five Russian tankers from Primorsk unloaded at Turkish oil ports.

One theoretically promising alternative is Iraq’s Kirkuk crude, a heavy oil returning to market after a two-year hiatus. Iraq recently resumed exports to Turkey, offering refineries a potential Russian substitute.

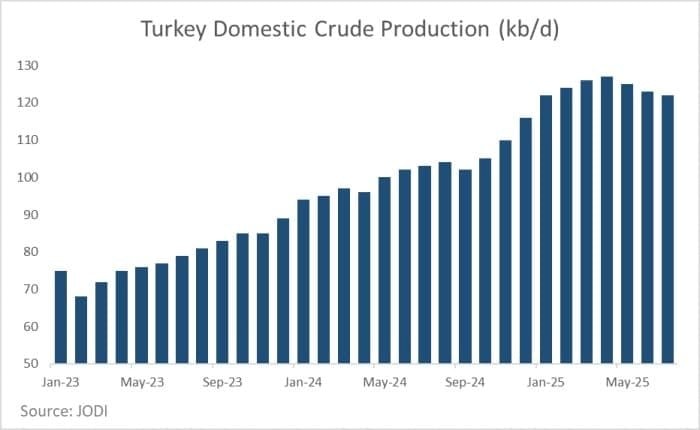

Turkey’s Domestic Oil Production

However, Kirkuk’s return faces hurdles. SOMO priced Kirkuk $1.25 above Brent in October. Even with increased output, refineries note Kirkuk’s inconsistent quality, making it a supplement rather than a Ural replacement.

Another potential source, Kazakhstan’s Kebco crude (similar to Ural), remains unsanctioned by the EU, driving strong Mediterranean demand. However, its popularity comes at a cost: Kebco trades just $2.75 below Brent, compared to Ural’s $7 discount as of early October.

Annually, Turkey could save approximately $1.04 billion by importing Russian crude. For refineries facing slim margins, Russian oil remains the most economically attractive option, even amid political risks.

Turkey’s energy landscape is further complicated by rising domestic crude production. New discoveries in 2022-2023 boosted output from 70,000–75,000 barrels per day in early 2023 to 120,000–125,000 barrels per day in 2025.

Unlike Turkey’s traditional 12-degree API super-heavy crude, new fields produce lighter Gabar oil (40-degree API), significantly improving domestic supply quality. However, Turkish law prohibits exporting domestically produced crude, mandating full local refining.

Since Turkish refineries are designed for heavier blends, lighter domestic oil must be mixed with heavier grades—most conveniently, Ural crude. Thus, increased Turkish production reinforces, rather than reduces, reliance on Russian feedstock.

Washington’s calls to limit Russian oil imports may be diplomatically acceptable, but they contradict Turkey’s refining infrastructure and cost structure. Alternatives—whether from Iraq, Kazakhstan, or domestic sources—remain too costly, limited, or light to fully replace Ural crude.

As of early autumn, with imports above average and Russian crude offering the best value per barrel, Ankara shows no urgency to shift course. Despite political pressures, Turkey’s energy calculus remains ruthlessly pragmatic: Russian oil fits best.