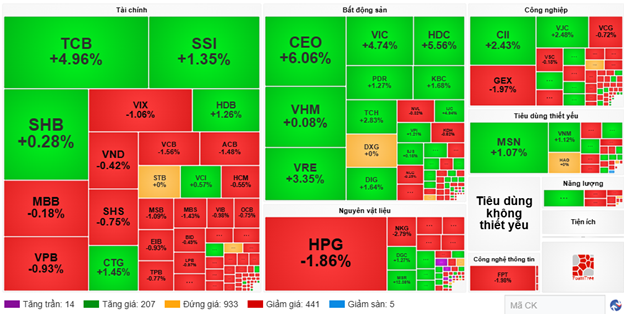

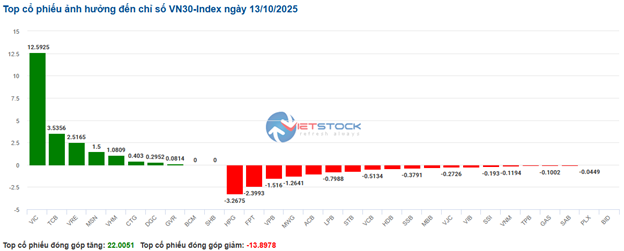

In terms of impact, VIC is the most positively influential stock, contributing 8.4 points to the VN-Index. Additionally, TCB added a total of 3.31 points to the index. Conversely, VCB had the most negative impact this morning, subtracting nearly 2 points from the index.

| Top 10 Stocks with the Strongest Impact on VN-Index in the Morning Session of October 13, 2025 (Measured in Points) |

Divergent trends dominated various sectors. On the upside, real estate led the market with a notable 2.27% increase, driven by standout performers such as VHM (+4.74%), VRE (+3.35%), KBC (+1.68%), KSF (+3.33%), PDR (+1.27%), TCH (+2.83%), and CEO (+6.06%).

Meanwhile, the materials and financial sectors also saw active trading, with strong buying interest in stocks like KSV (up to the ceiling), DGC (+1.27%), MSR (+12.36%), VIF (+4.52%), HGM (+4.37%), CSV (+2.25%); TCB (+4.96%), SSI (+1.35%), HDB (+1.26%), and CTG (+1.45%). However, several stocks experienced significant adjustments, including HPG (-1.86%), DCM (-1.37%), DPM (-1.64%), HSG (-2.11%), NKG (-2.79%); VIX (-1.06%), VCB (-1.56%), ACB (-1.48%), MSB (-1.09%), and MBS (-1.43%).

On the downside, the information technology sector recorded the most negative performance this morning, with leading stocks like FPT down 1.98% and CMG down 1.75%.

Source: VietstockFinance

|

Foreign investors continued to net sell over 934 billion VND across all three exchanges. Selling pressure was concentrated in HPG, VRE, and VPB, with values of 243.87 billion, 198.96 billion, and 173.28 billion, respectively. Meanwhile, the top net buyers were CEO (96.02 billion VND) and SHB (84.05 billion VND).

| Top 10 Stocks with the Strongest Foreign Net Buying and Selling in the Morning Session of October 13, 2025 |

10:30 AM: Real Estate Continues to Support the Index, VN-Index Remains in Flux

Buying interest resurfaced, helping major indices recover and surpass the reference level. As of 10:30 AM, the VN-Index reversed to gain over 4.2 points, trading around 1,751 points. The HNX-Index increased by 1.2 points, trading around 274 points.

Most stocks in the VN30 basket faced selling pressure, though the breadth of green gradually returned. On the negative side, HPG subtracted 3.26 points, FPT subtracted 2.39 points, VPB subtracted 1.51 points, and MWG subtracted 1.26 points. Conversely, stocks like VIC, TCB, VRE, and MSN maintained their green status, contributing over 20.1 points to the index.

Source: VietstockFinance

|

As of 10:30 AM, red dominated most sectors. Financial stocks continued to face selling pressure, with leading stocks like SSI down 0.74%, VPB down 1.87%, MBB down 0.73%, and ACB down 1.3%…

Additionally, sellers gained the upper hand in the industrial sector, with strong divergence. Selling pressure was concentrated in stocks like ACV down 1.08%, HVN down 1.38%, GMD down 0.88%, MVN down 0.19%…

The strongest recovery was in the real estate sector, with leading stocks like VIC up 4.32%, VHM up 0.41%, VRE up 4.21%, KBC up 2.8%, and newcomer CVR, which continued its second ceiling session, supporting the sector’s index.

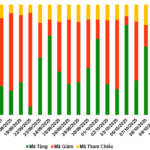

Compared to the opening, sellers maintained dominance. There were 443 declining stocks and 171 advancing stocks.

Source: VietstockFinance

|

Opening: Red Dominates Early Session, VIC, VHM & VRE Buck the Trend

The market opened on a negative note, with red dominating most sectors. The VN30 index was the most negatively impacted, as most stocks in this group declined.

Numerous VN30 stocks fell sharply, including HPG, FPT, VPB, ACB, HDB… Only VIC, VHM, VRE, TCB, and MSN maintained a green status.

The information technology sector saw a sharp decline of 1.7% in early trading, with stocks like FPT down 1.98%, CMG down 1.38%, and DLG down 2.5%.

The financial sector was equally pessimistic, primarily due to leading bank stocks such as VCB (-1.4%), VPB (-1.71%), MBB (-1.28%), LPB (-1.16%), ACB (-1.48%)…

In contrast, the real estate sector experienced divergence, with buyers gaining the upper hand. Buying interest focused on the sector’s three giants: VIC up 6.04%, VHM up 1.3%, and VRE up 2.73%. Meanwhile, most other stocks were predominantly red or unchanged.

– 12:00 PM, October 13, 2025

Nearly 1 Billion Bank Shares Set to Change Hands

Vietnam Thuong Tin Commercial Joint Stock Bank is advancing the transfer of over 821 million VBB shares from the Upcom market to HoSE, with completion expected no later than the first quarter of 2026.