The Ministry of Home Affairs has issued Decision No. 863/QĐ-BNV, announcing new administrative procedures and abolishing several procedures in the social insurance (SI) sector under its management. Notably, it outlines specific steps and procedures for temporarily suspending contributions to the pension and survivorship fund for businesses facing difficulties.

Businesses affected by natural disasters, fires, or epidemics will have their damages assessed by authorities to determine eligibility for suspending SI contributions.

Applicable entities include employers affected by changes in structure, technology, economic crises, recessions, or those implementing economic restructuring policies or international commitments.

Additionally, businesses suffering losses due to natural disasters, fires, epidemics, or crop failures are also eligible for consideration.

The process consists of four steps:

Step 1: Affected businesses must submit a written request for suspension, along with a list of employees before and after the impact, and a list of employees on mandatory SI leave.

If damages exceed 50% of total assets due to natural disasters, fires, epidemics, or crop failures, the application must include the latest asset inventory report and damage assessment minutes. If over 50% of employees are on leave, the corresponding list must be submitted to prove the extent of the impact.

Step 2: Within 15 working days of receiving the application, the competent authority will review and respond in writing.

For locally managed businesses, local home affairs agencies determine the number of employees on leave, while local finance agencies assess asset damage. For centrally managed businesses, specialized agencies under the respective ministries handle the assessment.

This policy is a practical support measure, helping businesses overcome challenges, reduce financial pressure, and maintain employment for workers.

Step 3: Once eligible, businesses submit a request to suspend pension and survivorship fund contributions to the SI agency, along with documents confirming employee leave or asset damage.

Step 4: Within 10 working days of receiving a complete application, the SI agency must process the suspension request. If rejected, a written response with reasons must be provided.

In special cases such as structural changes, economic crises, recessions, or natural disasters, employers may request the Social Insurance (SI) agency to suspend contributions to the pension and survivorship fund.

Required documents include:

– Written request from the employer.

– List of employees before and after the difficulties.

– List of employees on mandatory SI leave.

– Asset inventory report and damage assessment minutes (if applicable).

Eligible businesses submit a request for suspension, including the written request and documents confirming employee leave or asset damage.

This policy is a practical support measure, helping businesses overcome challenges, reduce financial pressure, and maintain employment for workers, while ensuring flexibility in fulfilling SI obligations.

Q3 GDP Estimated to Surge by 8.22%

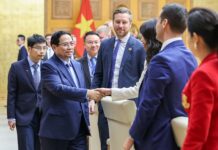

On the morning of October 5th, during the regular September 2025 government meeting, Minister of Finance Nguyễn Văn Thắng announced that the estimated GDP growth for the third quarter was 8.22% compared to the same period last year. Excluding 2022, when the economy rebounded strongly post-COVID-19, this marks the highest third-quarter growth since 2011.

Navigating Multiple Jobs: How to Optimize Social Insurance Contributions Without Losing Out

When employees sign fixed-term labor contracts of one month or more, they are required to contribute a portion of their salary to social insurance (BHXH) through their employer. But what happens if an individual works simultaneously for multiple companies? How should their BHXH contributions be managed in such cases?

“A Proposal to Support Voluntary Social Insurance Contributions for Workers Aged 45 to 60 to Ensure Retirement Benefits”

We propose an additional 20% support for voluntary social insurance participants, on top of the existing 20% central support. This means that participants who have contributed to the social insurance fund for a total of 15 years will be eligible for a pension.