Specifically, 3 million shares of UTT will officially trade on UPCoM from October 17th, with a reference price of 9,200 VND per share.

Following that, on October 22nd, over 5.8 million shares of HPO will list on UPCoM with a reference price of 23,300 VND per share.

According to the disclosure, UTT was established in 1996. After equitization, the company changed its name to Thanh Trì Urban Environment Joint Stock Company in 2016. Currently, UTT does not meet the criteria for a public company, as it has only 54 shareholders (compared to the minimum requirement of 100), with 51 non-major shareholders representing 12.59% of the charter capital.

The parent company and largest shareholder of UTT is Hanoi Urban Environment One Member LLC, holding a 60% stake. The other two major shareholders are Mr. Nguyễn Quốc Tuấn, a board member (16.95%), and Mr. Đậu Minh Lâm (10.46%).

In terms of business operations, the company specializes in collecting domestic waste in Thanh Trì district (now comprising Thanh Trì, Ngọc Hồi, Nam Phù, Đại Thanh communes, and Thanh Liệt ward), then transporting it to the Nam Sơn – Sóc Sơn waste treatment site for disposal.

In 2024, UTT reported net revenue of nearly 76 billion VND from waste treatment activities, an 18% decrease compared to the previous year, due to competition from private enterprises in the same sector. Financial revenue solely comes from bank deposit interest, amounting to 364 million VND in 2023 and 121 million VND in 2024.

With declining revenues, UTT‘s after-tax profit in 2024 was nearly 23% lower than the previous year, at approximately 2.3 billion VND.

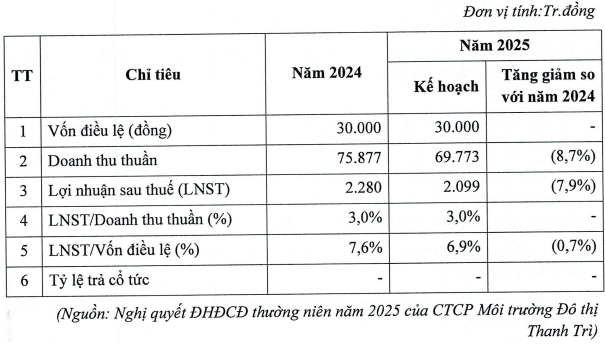

For 2025, UTT sets a target of 70 billion VND in net revenue and 2.1 billion VND in after-tax profit, representing a 9% and 8% decrease, respectively, due to anticipated rising labor costs and the company having only one contract to execute. However, revenue for the first six months has already reached over 41 billion VND, equivalent to 59.3% of the annual plan.

|

2025 Business Plan for UTT

|

HPO was also established in 1996, originally as Electricity – Lighting Joint Stock Company. The company became public in 2007 and conducted an IPO in 2013, increasing its charter capital to over 58 billion VND, which remains unchanged.

As of March 31, 2025, HPO has 185 shareholders, with 5 major shareholders representing 55.2% of the capital, and the remaining 180 shareholders holding the other 44.8%. The five major shareholders are Ms. Nguyễn Thị Hương (24.41%), Chairwoman Trần Hậu Phượng (11.97%), Vice Chairman and CEO La Quý Hưng (5.17%), Board Member and Deputy CEO Phạm Đức Quang (6.68%), and Board Member Phạm Thị Hồng Hạnh (6.97%).

HPO has no subsidiaries or affiliates, only one production plant in Hưng Yên and a representative office in Hanoi.

The Hưng Yên plant covers 50,791m², including an internal transportation system, outdoor storage, workshops, and auxiliary areas. It features over 25,000m² of industrial workshops equipped with modern machinery for manufacturing urban lighting products, street lighting, garden lighting, and outdoor lighting.

The company’s products are primarily supplied to major partners such as Vietel Construction Corporation, An Việt Investment Construction Production and Trading JSC, Hồng Đại Phát Investment Construction and Trading LLC, and Vietnam Urban Development and Trading JSC. HPO also exports to international partners like Bonnel Supply Ply Limited in Australia and IBEX International Limited in Venezuela.

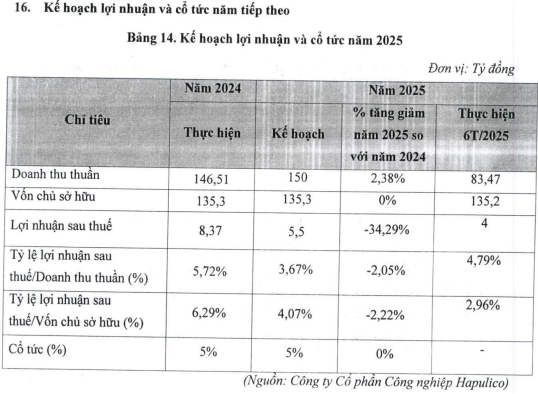

In 2024, HPO reported net revenue of nearly 147 billion VND and after-tax profit of over 8 billion VND. While revenue remained stable, profit increased by more than 45% year-on-year, indicating successful cost optimization.

For 2025, the company forecasts a 2% revenue increase to 150 billion VND, but a 34% profit decline to 5.5 billion VND. This is due to provisions for rising raw material costs (e.g., steel prices), maintaining high wages to retain and attract labor, and increased depreciation from new machinery investments.

In the first six months of 2025, the company achieved over 83 billion VND in revenue, meeting 56% of the annual target, and 4 billion VND in after-tax profit, reaching nearly 73% of the profit plan.

– 11:43 13/10/2025

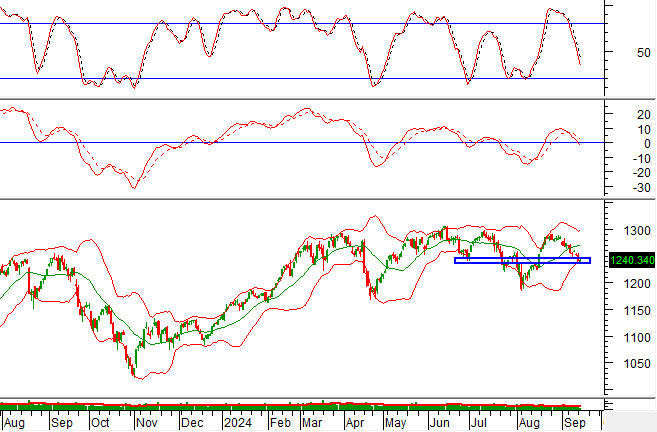

Foreign Investors Reverse Course, Pouring Nearly 450 Billion VND into a Blue-Chip Stock Amid Reduced Selling Pressure in Session 10/10

Foreign block transactions remain a drawback, yet there’s a silver lining as net selling totaled 637 billion VND across the entire market.

Habeco Set to Launch Another Publicly Traded Beer Company

The Hanoi Stock Exchange (HNX) has officially approved the listing of 10 million shares of Hanoi Beer – Hong Ha Joint Stock Company (HHB), a subsidiary of Habeco, under the stock code HHB.