Positive Signals Post-Upgrade Boost

Prior to the announcement, the market experienced unsettling fluctuations as the short-term breadth of HOSE—the percentage of stocks above the 20-day moving average (MA20)—plummeted below 25%, nearing the panic levels seen in April 2025 due to countervailing duty shocks.

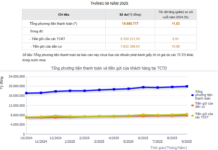

However, the last three trading sessions have seen a marked shift in sentiment: matched order values on HOSE have surpassed the 20-session average, signaling a return of capital and a resurgence in market activity.

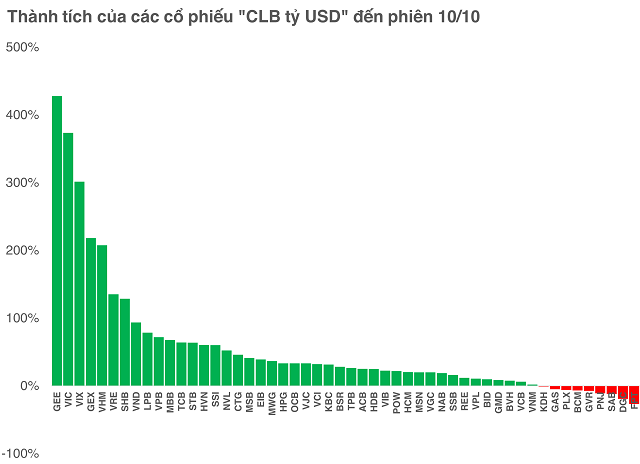

Leading the recovery are VinGroup stocks (VIC – VHM – VRE). Year-to-date, VIC has surged 4.7 times, VHM tripled, and VRE climbed 2.36 times, cementing their market leadership.

BSR shares are also drawing attention, nearing historic highs on expectations of joining the VN30 index in Q1/2026, having met most technical criteria per HoSE’s July 2025 assessment.

Simultaneously, the market is energized by high-profile IPOs in the securities sector. TCBS (TCX) completed its IPO and listed on HOSE on October 21, becoming Vietnam’s largest brokerage by equity. TCX openly aims for VN30 inclusion post-listing.

VPS Securities and VPBankS are also accelerating IPO preparations for imminent listings.

This capital cycle is vital for sustaining liquidity and mitigating post-rally cool-offs. However, challenges emerged with President Trump’s announcement of a 100% tariff on Chinese goods tied to rare earth export restrictions.

Active Foreign Capital Takes Early Position

Notably, active foreign funds are proactively positioning in Vietnam ahead of the upgrade. Even before the announcement, foreign investors piloted the Non-prefunding mechanism—allowing brokerages to settle trades on their behalf in case of delays.

On October 7, a foreign investor placed orders for MWG and MBB totaling over VND 15 billion without immediate payment, temporarily settled by VNDIRECT.

This mechanism, formalized in Circular 68/2024 (effective November 2023), marks a pivotal reform eliminating Vietnam’s “pre-funding” barrier—a key factor in FTSE Russell’s prolonged Frontier Market classification.

J.P. Morgan notes FTSE’s upgrade will take effect in September 2026, post-March 2026 review. During this interim, passive funds (ETFs) will await Vietnam’s inclusion in the FTSE Emerging Market All Cap Index before deploying capital.

The bank estimates passive inflows of $1.3 billion if Vietnam captures 0.34% index weight. Approximately 22 Vietnamese stocks currently meet FTSE EM All Cap criteria. J.P. Morgan raises its 12-month VN-Index target to 2,000–2,200 (+20–30%), citing stable macros and 20% annual corporate profit growth (2026–2027).

A successful MSCI upgrade could further boost valuations by 10%, enhancing Vietnam’s appeal to global investors.

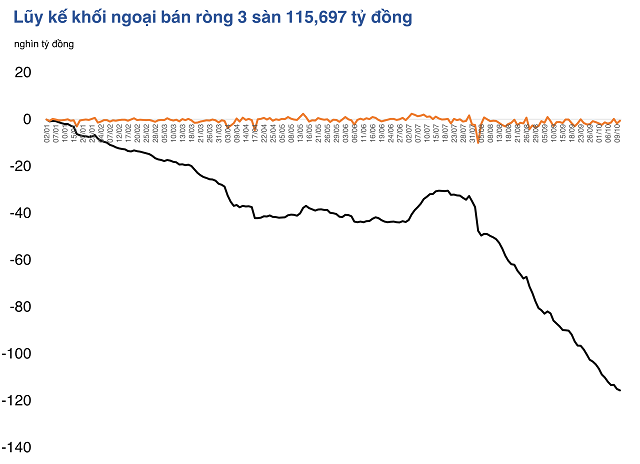

According to Nguyen The Minh, Director of Research & Retail Development at Yuanta Securities Vietnam, foreign capital remains net outflow due to VND-USD interest rate differentials. However, active funds are likely “front-running” the market.

On the tariff impact, Minh states: “Effects on Southeast Asia and Vietnam are balanced, with potential benefits. Stock market impacts are short-term and diminishing, likely concluding adjustments swiftly. Historical geopolitical/trade tensions show initial shocks fade rapidly.”

– 10:00 13/10/2025

Saigon Centre Secures Ho Chi Minh City’s Approval for Phase 3 Investment After Three Decades of Inactivity

Nestled in the heart of Ho Chi Minh City’s most vibrant intersection, Saigon Centre Phase 3 occupies a prime “diamond-grade” location. After over three decades of inactivity, this landmark project has recently been awarded an amended investment certificate, marking a significant milestone in its development.

Unlocking Opportunities: VPS Securities’ Vision with VCK Code – Three Pillars for Success

At the “VPS The Next Chapter” event, VPS Securities unveiled its anticipated stock code, VCK. During the event, Mr. Nguyễn Lâm Dũng, Chairman of the Board and CEO of VPS, shared insights into the leading brokerage firm’s future business strategies.

How Stock Market Upgrades Impact the Economy

Vietnam’s stock market has been upgraded from frontier to secondary emerging status, injecting renewed momentum into the country’s economy.