The global economy and political landscape faced numerous fluctuations and uncertainties in the first half of the year. Among these, the most prominent trend has been “de-dollarization,” with central banks reducing their dollar reserves and gold becoming the second most-held “currency” after surpassing the Euro.

However, in June, another precious metal surpassed gold as the top-held asset by ETFs: silver. What led to this new trend in hoarding? Are international investors seeing a bright future for this precious metal?

De-dollarization: A Game-changer

One of the strongest motivators behind the shift in the precious metals market in 2024 and early 2025 has been the global trend of de-dollarization. Central banks are actively diversifying their foreign exchange reserves and reducing their reliance on the US dollar.

According to analysts from Bank of America (BofA): “Central banks globally are actively reducing their holdings of US assets (treasury bonds and dollars) in their reserves and holding more gold.”

This is not mere speculation; a study by the European Central Bank (ECB) revealed that “gold bars have risen in the ranking of official reserve assets, surpassing the Euro and only trailing the dollar.” By the end of 2024, the ECB estimates that gold accounted for 20% of global reserves, while the “dollar, though still leading at 46%, is continuing to decline.”

The World Gold Council’s (WGC) annual survey of central banks reinforces this view. Out of 73 responding central banks, a record 95% expected their gold holdings to increase over the next year. And a significant 73% expected to reduce the proportion of dollars in their reserves. Interestingly, 62% of the surveyed banks expected the proportion of Renminbi (RMB) to increase over the next five years, second only to the expected increase in gold reserves (76%).

These data paint a clear picture: faith in the dollar is eroding. This drives a search for alternative assets to store value and diversify risk. Inevitably, gold is the top choice, but in June, retail investors turned to another metal that has played an incredibly prominent role in the industry over the past five years: Silver.

Gold’s Weakness in the Face of Conflict

According to Kitco News data, “Gold prices ended the week lower than they were before the war (conflict between Israel and Iran) began.” BofA commented that “war and geopolitical conflict are usually ‘not a long-term growth driver’ for gold prices.” Instead, BofA predicts gold could reach $4,000 per ounce within a year, mainly due to “a massive US fiscal debt.”

Gold’s lack of positive reaction to severe geopolitical events indicates that the market is cautiously pricing in risks, and long-term macroeconomic factors (such as public debt and monetary policy) may have a more significant impact than immediate shocks.

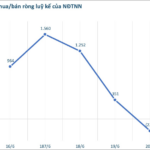

While gold remained weak despite the conflict, silver emerged as a bright spot. Data from Heraeus, a leading German precious metals company, shows that investment demand for silver is outpacing gold: “In the first five months, the growth in silver holdings in ETFs lagged behind gold. However, since June, silver has taken the lead.”

In June, “silver holdings in ETFs surged… with holdings increasing by 18.2 million ounces to 759 million ounces in the first two weeks.” Total inflows into silver since the beginning of the year reached “nearly 41 million ounces, a growth rate significantly higher than gold,” according to Heraeus’ report. Notably, 49% of the net increase in silver ETFs this year came from June alone.

Silver prices surged more than 13% in June to a 13-year high

Several factors contributed to silver’s breakout performance:

- More Attractive Pricing: Gold’s persistently high prices continue to deter jewelry purchases. In contrast, silver remains relatively affordable.

- Diversification: With gold fully priced for risk and struggling to break through resistance levels, investors seek more effective diversification options. Heraeus suggests that investors and speculators have turned to white metals like silver and platinum for better value and higher growth potential.

- Strong Industrial Demand: Although industrial silver demand is predicted to soften this year due to a slowdown in the solar PV market, Heraeus emphasizes that “on a historical basis, total demand is still 19% higher than the ten-year average.” This solid fundamental demand provides a supportive foundation for silver prices, setting it apart from gold, which is primarily an investment and reserve asset. Moreover, according to Metals Focus, the silver market is expected to experience a fifth consecutive year of supply deficit, further underpinning silver prices.

- Fed Policy: While the Fed maintained interest rates at 4.5%, their recent meeting presented a scenario of two rate cuts in 2025 if inflation remains stable and on target at 2%. Heraeus analyzed that “this would be the most favorable outcome for precious metal prices, as two more rate cuts could lead to a weaker dollar.” A weaker dollar would indirectly support silver prices, given their inverse relationship.

The precious metals market is at a turning point, with de-dollarization and shifting investor sentiment creating new opportunities. Silver, with its strong investment inflows in June, is proving its growing importance.

In Vietnam, investors can stay ahead of global trends by accumulating silver bullion. With a 31.5% increase in the last year, silver offers a cost-effective investment opportunity compared to gold.

The latest updates from the Phu Quy Gold, Silver, and Gemstone Group show that silver bullion is trading around VND 1,392,000/tael, equivalent to over VND 37.1 million/kg for buying, and VND 1,435,000/tael, equivalent to VND 38.2 million/kg for selling.

“Vingroup Shares Soar Following Turbulent ETF Restructuring”

Since the beginning of the year, Vingroup and Vinhomes stocks have been among the top performers on the stock market, with impressive gains of 130% and 85%, respectively.

Unlocking the Safe: The Golden Heist.

A master of their craft, an elusive gold bullion dealer, has been apprehended. This cunning individual had managed to sell a staggering 96 gold bars, amounting to over VND 11 billion. With their ill-gotten gains, they deposited the funds into a personal bank account, dreaming of a future of lavish spending. However, their plans were swiftly thwarted, and justice prevailed.

The Energy Markets on June 18: Oil Prices Surge Over 4%, Sugar Falls 3%

The global oil market witnessed a significant surge on June 17th, with prices soaring by over 4% as tensions between Iran and Israel showed no signs of abating. This escalation has had a ripple effect on commodities, with gold prices experiencing a slight uptick, while sugar prices took a hit, dropping by approximately 3%.