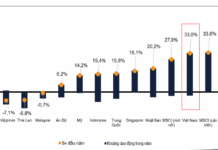

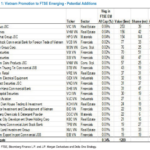

Vietnam’s stock market experienced significant volatility last week, marked by several notable developments. A key highlight was FTSE Russell’s official upgrade of Vietnam’s stock market from Frontier to Secondary Emerging status, effective from the early hours of October 8th.

Stock Market Reaches Historic Highs

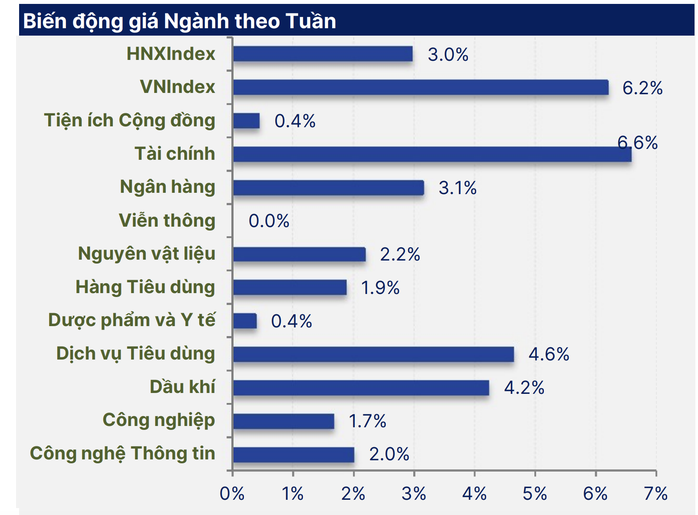

This positive news, coupled with favorable economic data, propelled the VN-Index up by over 100 points, a 6.18% increase, closing the week at a record high of 1,747 points. Meanwhile, the VN30 index surged by 6.51%, reaching 1,980 points, surpassing its September peak and inching closer to the 2,000-point milestone.

Liquidity improved after three consecutive weeks of decline, with trading volume on HoSE rising by 17.4% compared to the previous week, averaging around VND 35 trillion per session. Market sentiment remained optimistic despite foreign investors’ net selling for the 12th consecutive week, totaling over VND 5 trillion.

Despite the VN-Index’s 100-point surge, many investors’ portfolios saw minimal gains or even losses.

Interestingly, while the overall market soared, many investors’ portfolios remained stagnant or even declined. “Encouraged by the positive market sentiment and the upgrade news, I invested further in securities and banking stocks. However, my portfolio value has dropped compared to the beginning of the week,” lamented Khanh Thy, an investor from Ho Chi Minh City.

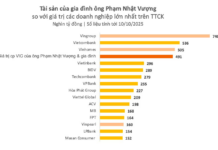

Explaining this phenomenon, Dinh Viet Bach, an analyst at Pinetree Securities, noted that the VN-Index’s 100-point gain was largely driven by Vingroup’s stocks (VIC, VHM, VRE, and VPL), contributing over 45 points. This concentration of capital in blue-chip stocks left many investors’ portfolios unaffected or negatively impacted despite the market’s overall rally.

Latest Stock Market Forecast

Looking ahead, Dinh Viet Bach predicts that the VN-Index could continue its upward trajectory, setting new all-time highs. The market’s focus may expand beyond Vingroup stocks to other sectors.

“Next week, the release of Q3 financial reports from various companies could serve as a catalyst for the market’s ascent to new peaks. Capital may rotate into sectors like securities, real estate, steel, and public investment, fostering a more sustainable rally,” Bach added.

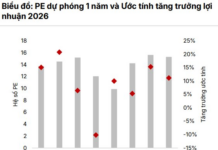

Other securities firms, such as SHS and Mirae Asset, share a positive outlook. They cite the market upgrade, strong Q3 GDP growth, and improved liquidity as factors driving investor interest in new opportunities. Investors are advised to consider increasing their exposure based on Q3 and year-end earnings growth prospects. The short-term outlook remains optimistic.

Source: SHS

Concerns from Global Markets

However, escalating U.S.-China trade tensions have rattled global financial markets, potentially impacting Vietnam’s market at the start of the week. Phan Dung Khanh, Investment Advisory Director at Maybank Securities, believes that while Vietnam’s market may experience short-term volatility due to international developments, a swift recovery is likely. He notes that repeated tariff-related news has somewhat desensitized the local market, and the medium to long-term outlook remains positive.

Echoing this sentiment, Dinh Minh Tri, Director of Individual Customer Analysis at Mirae Asset Securities, suggests that any market correction would likely be brief, occurring in the initial sessions of the week. He emphasizes that global markets generally maintain an upward trend. “Significant adjustments, if any, would probably follow investors’ full absorption of Q3 earnings reports from listed companies,” Tri concluded.

J.P. Morgan Forecasts VN-Index to Hit 2,200 Points, Highlights 22 Top Money-Magnet Stocks Amid Upgrade

J.P. Morgan has revised its 12-month target for the VN-Index upward, setting a base-case scenario at 2,000 points and an optimistic scenario at 2,200 points. This adjustment reflects a potential 20–30% increase from current levels, signaling confidence in the market’s growth trajectory.

Market Pulse 13/10: Real Estate Sector Attracts Inflows, VN-Index Extends Winning Streak to 4 Consecutive Sessions

At the close of trading, the VN-Index surged by 17.57 points (+1.01%), reaching 1,765.12 points, while the HNX-Index climbed 1.73 points (+0.63%) to 275.35 points. Despite this, the overall market breadth tilted toward the red, with 409 decliners outpacing 273 advancers. In contrast, the VN30 basket was dominated by green, boasting 17 gainers, 10 losers, and 3 unchanged stocks.

Vietstock Daily October 14, 2025: Will the Uptrend Continue?

The VN-Index has formed a Three White Soldiers candlestick pattern, accompanied by trading volume consistently above the 20-session average, signaling prevailing market optimism. The index is closely tracking the Upper Band of the Bollinger Bands, while the MACD indicator continues its upward trajectory following a buy signal. This confluence of factors underscores a positive short-term growth outlook.

Afternoon Technical Analysis, October 13: Soaring to New Heights

The VN-Index has continued its upward trajectory, reaching an all-time high. With the previous peak from September 2025 (around 1,700–1,711 points) now decisively broken, this level shifts from resistance to a robust support zone. Meanwhile, the HNX-Index has rebounded, testing the Middle line of the Bollinger Bands.

VN-Index Surges in Q3/2025, Boosting Open-Ended Funds

Q3/2025 marked a remarkable milestone for Vietnam’s stock market as the VN-Index surged over 20% in just three months, recording one of the most robust recoveries since the COVID-19 pandemic. This growth not only reflects an improved market sentiment but also delivers exceptional returns for many open-ended funds, particularly equity-focused portfolios.