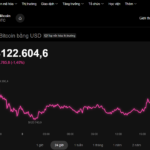

On the morning of October 12, the cryptocurrency market continued its downward trend. Data from the OKX exchange reveals that over the past 24 hours, Bitcoin (BTC) dropped by more than 2%, trading at $110,210.

Bitcoin Plunges Significantly

Altcoins also experienced a widespread decline, with Ethereum (ETH) falling over 2% to $3,750; BNB decreasing by 0.8% to $1,118; XRP dropping more than 2% to $2.30; and Solana (SOL) losing over 5%, now at $176.

According to Cointelegraph, the cryptocurrency market has yet to recover from the historic crash that led to over $20 billion in liquidations across exchanges. This downturn stems from U.S. President Donald Trump’s announcement of a 100% tax on Chinese imports, triggering a massive sell-off by investors.

Bitcoin is currently trading around $110,210. Source: OKX

Ray Salmond, Cointelegraph’s market analyst, notes that Bitcoin is trading below its average value of $120,000.

“The $115,000 – $110,000 range is considered a low-price zone, attracting many pending buy orders,” he stated.

However, he warns that market sentiment remains fragile, with trading volume plummeting by nearly 45%. If liquidity does not improve, Bitcoin could continue to weaken by the end of the week. Conversely, if capital returns, prices may swiftly rebound.

Potential for Short-Term Recovery

Domestically, Phạm Duy Đông, founder of the Saigontradecoin community, observes that after sharp crashes, the cryptocurrency market often experiences short-term recoveries, though long-term trends remain uncertain.

According to Đông, after deep declines, prices typically rebound and approach pre-crash levels. At that point, investors can better assess whether the market will continue rising or reverse course.

Strategically, he advises against selling at this juncture, as most investors are currently in the red.

“Instead of panic selling, cryptocurrency holders should monitor market developments further. Consider rebalancing portfolios by shifting from weaker coins to those with stronger potential,” he suggests.

As the cryptocurrency market continues to plummet, many domestic investors express concern over significant asset value losses.

“The market is highly unpredictable now; my account has lost half its value. If prices keep falling like this, the risk of account liquidation is substantial,” shared Nguyễn Hoàng Thạch from Ho Chi Minh City.

Crypto Investors Devastated as Trump’s Statement Wipes Out Month’s Worth of Gains

Bitcoin’s price plummeted below $106,000 shortly after U.S. President Donald Trump announced a 100% tariff on Chinese goods.

Bitcoin Skyrockets, Experts Warn of ‘Worthless Cryptocurrency’ Risks

As Bitcoin reaches new heights and enters “Uptober,” a month historically celebrated as a golden period for cryptocurrencies, the global investment community finds itself divided. On one side, enthusiasts anticipate a sustainable growth phase, while others caution against potential risks, asserting that “Bitcoin is not a viable asset.” This dynamic reflects the ongoing tension between faith in technological innovation and fears of a financial bubble.

UK’s Largest Investment Platform Declares: “Bitcoin Is Not an Asset”

A leading UK trading platform has issued a stark warning to investors anticipating profits from relaxed cryptocurrency regulations: digital assets should not be part of any investment portfolio.