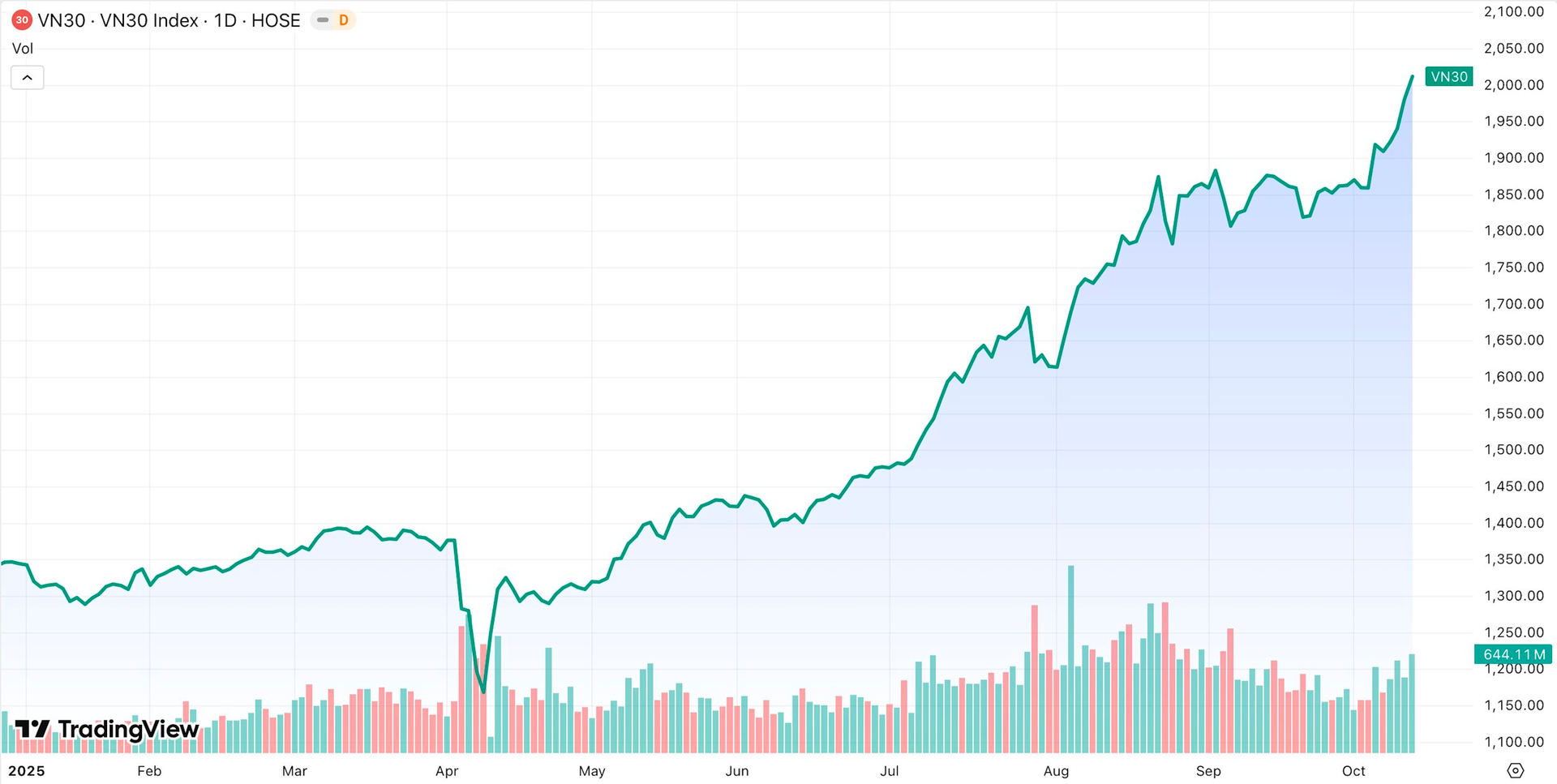

Despite the tumultuous global financial market over the past weekend, Vietnam’s stock market experienced a remarkable trading session, setting new records. From an initial decline, the VN-Index surged by nearly 18 points, closing at an all-time high above 1,765 points.

Large-cap stocks led the rally, with significant gains in key players such as VIC, TCB, VJC, HDB, and VRE. The VN30 Index closed with a nearly 32-point increase, surpassing 2,012 points for the first time in history.

Since FTSE Russell announced Vietnam’s upgrade to a Secondary Emerging Market on October 8th, the stock market has rallied for four consecutive sessions. This highlights investors’ optimism following this pivotal decision.

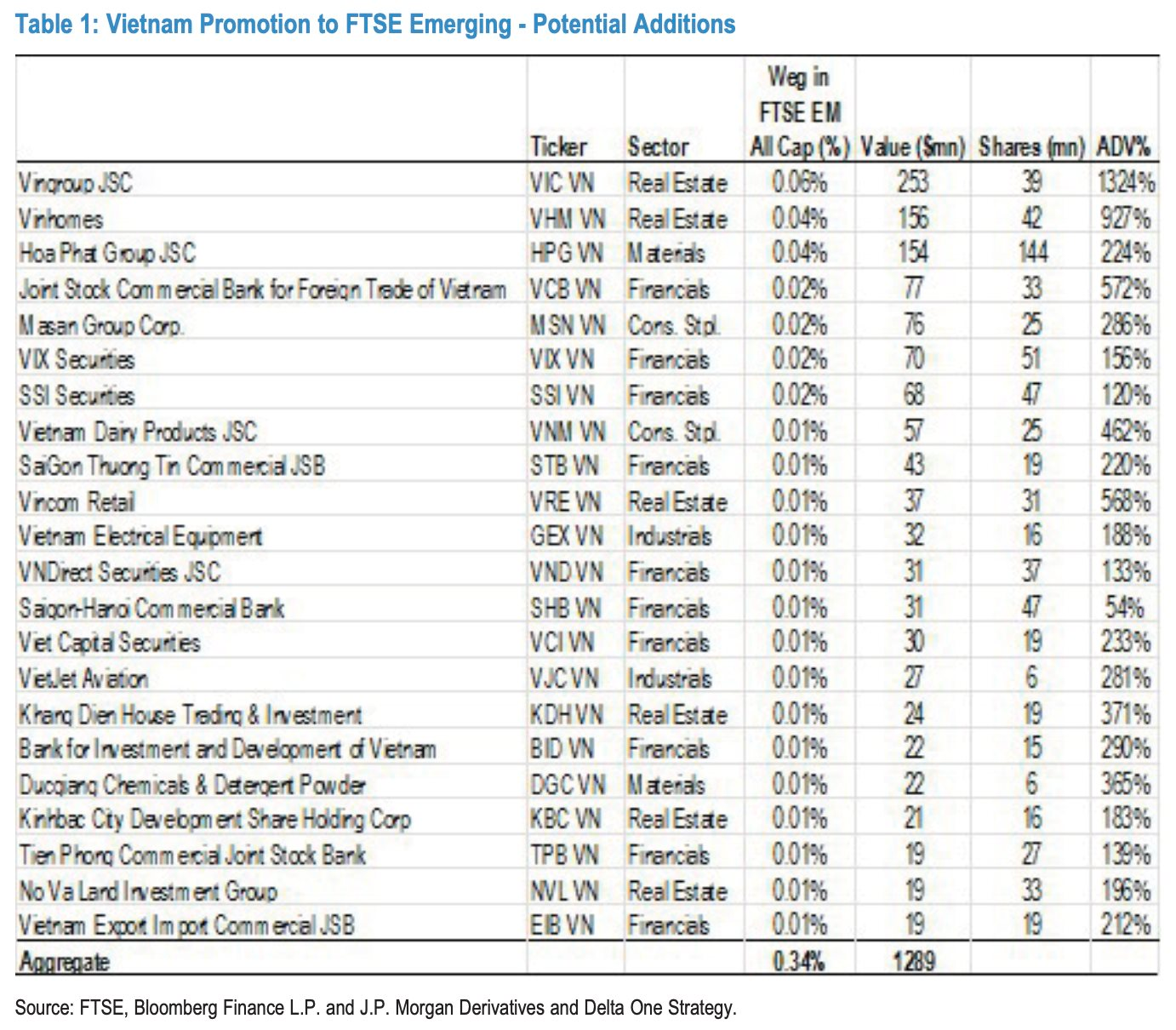

According to a recent J.P. Morgan report, FTSE Russell’s upgrade will attract significant passive capital inflows into Vietnam. J.P. Morgan estimates that global index funds could inject approximately $1.3 billion into the Vietnamese stock market, equivalent to a 0.34% weighting in the FTSE Emerging Market All Cap Index.

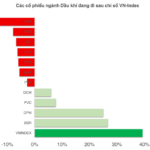

Based on current market capitalization, around 22 Vietnamese stocks are expected to be included in this index. Blue-chip stocks with remaining foreign ownership room, particularly the Vingroup family, are anticipated to attract substantial investment. Other stocks like MSN, VJC, GEX, and major securities firms are also expected to join the FTSE Emerging Index.

J.P. Morgan has raised its 12-month target for the VN-Index to 2,000 points under the base scenario and 2,200 points under the optimistic scenario, representing a 20–30% increase from current levels. A robust macroeconomic foundation and strong corporate earnings growth are key drivers of this positive outlook.

J.P. Morgan reports that Vietnam’s Q3 2025 GDP grew by 8.2% year-on-year, while listed companies’ profits are projected to grow by an average of 20% annually between 2026 and 2027. Additionally, a successful MSCI upgrade could further boost the market by approximately 10% through P/E re-rating.

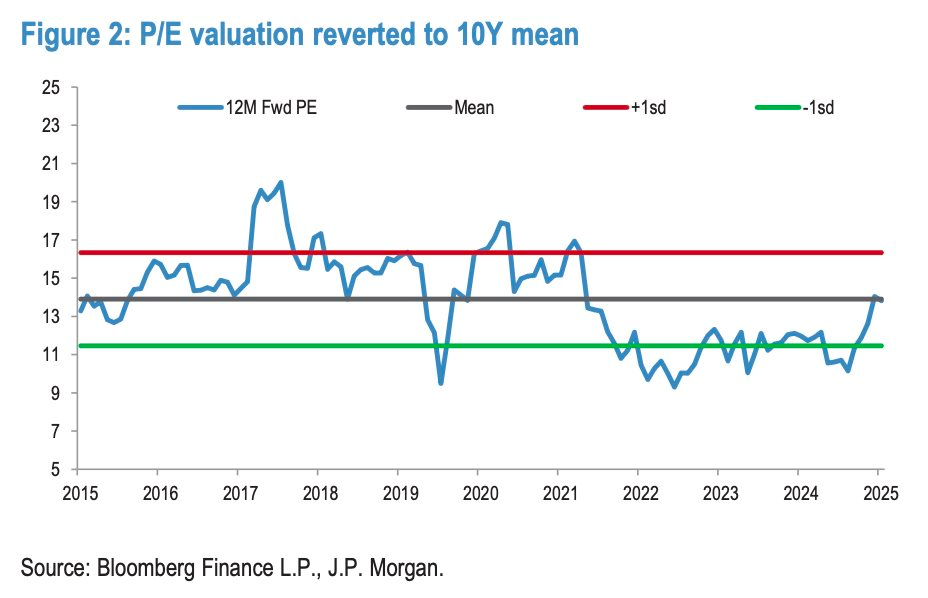

J.P. Morgan considers the VN-Index’s current valuation reasonable, with a projected P/E of 15–16.5 times over the next 12 months. While higher than the ASEAN average, it remains below the historical peaks of 2018 and 2021, reflecting long-term growth expectations and improving corporate profitability.

Echoing this sentiment, Mr. Le Anh Tuan, CEO of Dragon Capital, emphasized at a recent Investor Day event that double-digit GDP growth will positively impact the stock market.

“When GDP grows by double digits, stock market growth is measured not in percentages but in multiples. At a VN-Index of 1,700 points, the P/E ratio is around 12.5–13 times, while 2026 earnings are expected to grow by 18–20%. I believe Vietnam’s stock market is on the cusp of a new era, despite recent strong gains,” Mr. Tuan stated.

With a strengthening macroeconomic foundation and lessons from mature markets, Dragon Capital’s CEO is confident that sustained double-digit growth will propel Vietnam’s stock market into a new growth cycle, expanding not only in scale but also in quality, depth, and global competitiveness.

Similarly, a recent NH Securities (NHSV) report highlights the FTSE Russell upgrade as a major milestone, unlocking growth opportunities for Vietnam’s stock market. This upgrade serves as a springboard for global integration, with expected ETF inflows of approximately $1.4 billion and active capital inflows potentially reaching $4–5 billion.

NHSV also highlights the IPO wave as a key focus for 2025–2026. Domestic investors are expected to remain the market’s primary support, while large-scale listings such as TCBS, VPS, and Gelex Infrastructure reflect renewed corporate confidence.

The VN30 Index represents the 30 largest and most liquid stocks on the Ho Chi Minh City Stock Exchange (HoSE). It serves as a benchmark for leading market stocks, commonly referred to as “Blue-chips.”

VIC Stock Hits Record High of Over 200,000 VND/Share, VN-Index Extends Winning Streak

Vingroup’s VIC stock has shattered records, soaring to an all-time high of over 205,000 VND per share. This unprecedented surge not only marks a historic milestone for the conglomerate but also propels the market forward, adding more than 17 points to its cumulative gains.

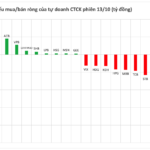

Proprietary Trading Firms Unleash Nearly $35 Million in Net Selling on First Trading Day: Which Stocks Are in the Crosshairs?

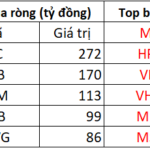

Proprietary trading firms net sold a staggering VND 774 billion on the Ho Chi Minh Stock Exchange (HOSE), marking a significant shift in market dynamics.

Where Are Oil & Gas Stocks Amid a Soaring Market?

Following the Vietnamese stock market’s ascent to new heights and its official upgrade to secondary emerging market status, investor focus is shifting towards stocks with unique narratives, particularly within the energy sector. However, several energy stocks are currently lagging significantly behind the broader market’s momentum.