In Q3/2025, the primary land supply in Ho Chi Minh City and its surrounding areas (Tay Ninh, Dong Nai) saw a slight 2% increase compared to the same period in 2024. Notably, approximately 96% of this supply originated from previously launched projects.

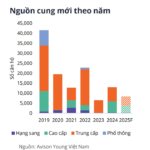

New supply in the quarter rose by about 12% compared to Q3/2024. Long An (former) dominated with 90% of the new product launches, reflecting a market shift toward “satellite cities.” This trend favors regions with ample land reserves, lower price points, and favorable connectivity.

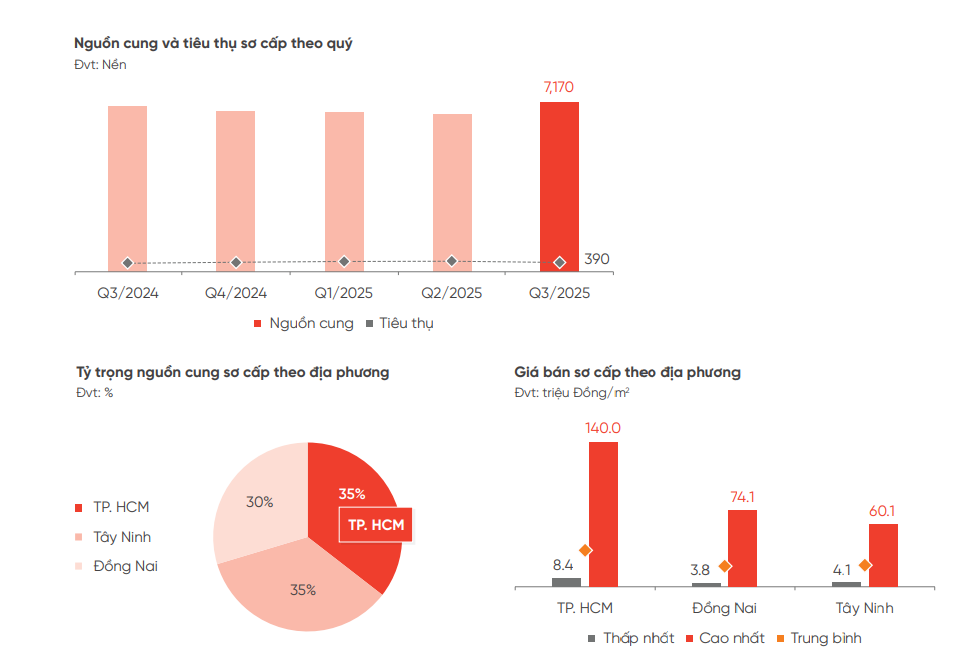

Despite 7,170 primary land products entering the market in Q3, only 390 plots were sold.

Compared to the previous year, overall demand in the Southern land market increased by approximately 8%. However, absorption rates remained low. With 7,170 primary products launched in Q3, only 390 plots were sold, representing a mere 5% absorption rate. Demand concentrated on projects with complete legal frameworks, synchronized infrastructure, and convenient connectivity.

Primary land prices remained stable compared to the previous quarter, staying high due to input cost pressures and supply-demand imbalances. Post-provincial mergers, price gaps between regions narrowed significantly.

DKRA data highlights growing price disparities. In Ho Chi Minh City, project land prices peaked at 140 million VND/m². Nearby provinces recorded lower peaks: Tay Ninh at 74 million VND/m² and Dong Nai at 60 million VND/m². In contrast, the lowest prices in these provinces ranged from 3.8 to 4.1 million VND/m², underscoring stark differences.

In the secondary market, prices rose by an average of 5% compared to Q2/2025. Liquidity remained positive, supported by factors like eased real estate credit, limited new supply, and strong genuine demand, driving both price growth and market liquidity.

For Q4/2025, DKRA Consulting forecasts continued new supply scarcity, with approximately 450–550 new products expected. Primary supply will slightly increase from Q3/2025, primarily from previously launched projects.

Key “satellite city” areas like Can Giuoc (former), Ben Luc (former), Duc Hoa (former), and Binh Duong (former) will remain supply leaders, leveraging large land reserves, price growth potential, and robust infrastructure connectivity.

Overall market demand is expected to grow steadily, with Tay Ninh and Ho Chi Minh City leading consumption. Primary prices will stay elevated due to input costs and supply-demand gaps. Projects with completed infrastructure, favorable connectivity, and transparent legal frameworks will see notable price increases.

Secondary market prices are projected to rise as investor confidence improves, real estate credit eases, and new supply remains scarce. Growth will concentrate in satellite areas with strong infrastructure and genuine demand.

A&T Saigon Riverside: Embracing the Urban “Resort-Style Living” Trend

Nestled along the picturesque Saigon River waterfront, A&T Saigon Riverside redefines modern living with four core values: “Live Ahead,” seamlessly aligned with the vibrant growth of Ho Chi Minh City’s Northeast hub; “Live Resort-Style,” surrounded by over 50 premium resort-inspired amenities; “Live with Flair,” through exquisite high-end finishing standards; and “Live Elite,” within a sophisticated and cultured resident community.

Unveiling the Flaws in Vietnam’s Social Housing Development: Insights from a Former National Assembly Delegate

Affordable housing plays a pivotal role in addressing the settlement needs of low-income individuals. However, its development is currently fraught with significant challenges.