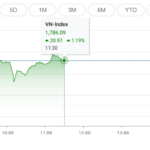

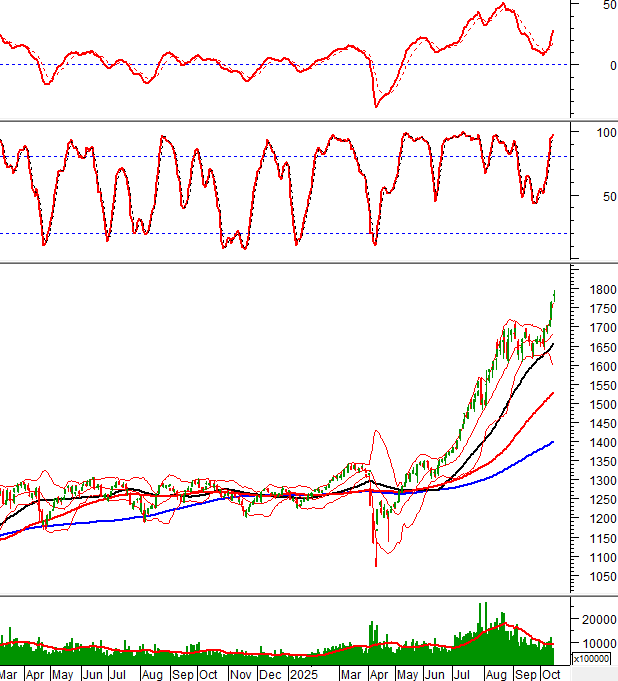

Technical Signals of VN-Index

During the morning trading session on October 14, 2025, the VN-Index continued its upward trajectory, reaching a new record high with no significant resistance levels above.

The index is currently adhering to the Upper Band of the Bollinger Bands, indicating that growth prospects remain positive as the band continues to expand.

Technical Signals of HNX-Index

In the morning session on October 14, 2025, the HNX-Index saw modest growth, with the MACD indicator issuing a buy signal once again.

Trading volume is expected to remain above the 20-day average by the end of the session.

CII – Ho Chi Minh City Infrastructure Investment Joint Stock Company

During the morning session on October 14, 2025, CII shares rose for the fifth consecutive session, accompanied by a Rising Window candlestick pattern, reflecting continued investor optimism.

Currently, CII has surpassed and is retesting the 50% Fibonacci Projection level (equivalent to the 29,000-29,800 range).

Additionally, the stock price has breached the Upper Band of the Bollinger Bands, while the MACD indicator continues to rise after issuing a buy signal. This suggests that the medium-term upward trend remains favorable.

PET – PetroVietnam Technical Services Corporation

In the morning session on October 14, 2025, PET shares rebounded after retesting the 50-day SMA, with trading volume exceeding the 20-session average, indicating bullish investor sentiment.

The stock price remains close to the Upper Band of the Bollinger Bands, while the MACD indicator continues to rise and stays above zero after issuing a buy signal, further supporting the current recovery.

Furthermore, PET is retesting the neckline (equivalent to the 33,800-34,800 range) of a Rounding Bottom pattern currently forming. If the stock price sustains its recovery and successfully breaks through this range in subsequent sessions, the potential price target would be the August 2025 high (equivalent to the 40,500-42,000 range).

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:20 October 14, 2025

Vietnam’s Key Stock Index Surpasses 2,000 Points for the First Time

Large-cap stocks surged, spearheading Vietnam’s stock market rally and propelling the VN30 index past the 2,000-point milestone for the first time.

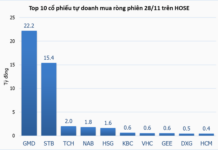

Foreign Block Continues Net Selling Spree, Offloading Over a Trillion Dong as VN-Index Hits New Peak, Heavily Dumping Bluechip Stocks

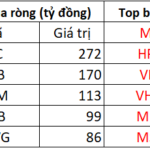

In the afternoon trading session, VIC emerged as the most heavily net-bought stock across the entire market, with a remarkable value of approximately 272 billion VND.