Illustrative image

Vietnam has reached a significant milestone in the biomass energy sector with the commercial launch of the IGEP black pellet production plant, operated by Idemitsu Green Energy Plant. Boasting a capacity of 120,000 tons annually—among the largest globally—this project not only signifies a technological leap but also opens new export opportunities for Vietnam in renewable energy. This development comes as the world increasingly shifts away from coal.

Over the past decade, more than 80 countries have announced plans to phase down or eliminate coal in power generation. The UN’s Powering Past Coal Alliance reports a 15% drop in global coal-fired electricity since its peak in 2013, while demand for biomass and low-carbon fuels has steadily risen.

Developed nations like Japan, South Korea, and European countries are ramping up imports of biomass pellets, a carbon-neutral fuel where CO₂ emissions from combustion are offset by absorption during plant growth.

Specifically, black pellets, produced through advanced torrefaction technology, can replace coal in existing power plants without modifying combustion systems. Compared to traditional white pellets, they offer higher calorific value, better moisture resistance, and easier storage—crucial for long-sea transport.

Vietnam’s Raw Material Advantages and Production Potential

Vietnam is well-positioned to develop its biomass industry. Annually, the forestry sector harvests over 20 million m³ of timber, primarily for furniture exports and paper production. However, a significant amount of by-products like sawdust, wood chips, bark, and branches remain underutilized, presenting an ideal feedstock for biomass pellet production.

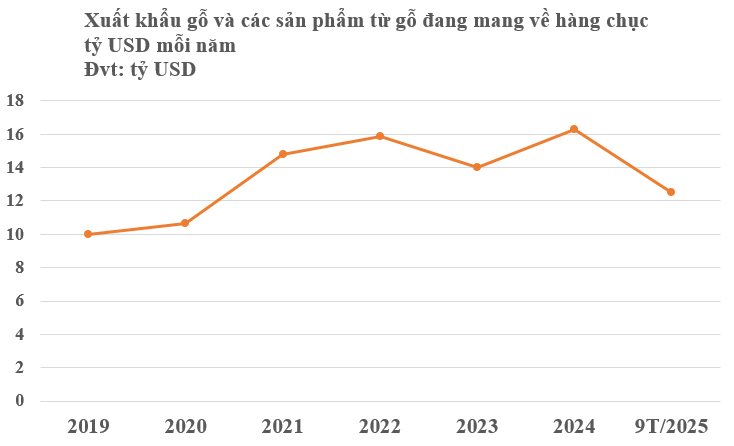

According to the Vietnam Administration of Forestry, by the end of 2024, the country had over 14.87 million hectares of forests, with more than 70% being short-rotation industrial plantations such as acacia, eucalyptus, and pine. Coupled with a thriving wood processing industry—exporting over $14 billion annually—Vietnam can leverage these by-products to create a sustainable and eco-friendly bioenergy value chain.

The commercial operation of Idemitsu’s IGEP plant marks not just a beginning but a signal of Vietnam’s entry into the global clean energy supply chain. The advanced thermal processing technology employed by IGEP transforms wood and forestry waste into black pellets with calorific values comparable to coal, enabling high-value exports to Japan, South Korea, and Europe—markets with surging demand for coal alternatives.

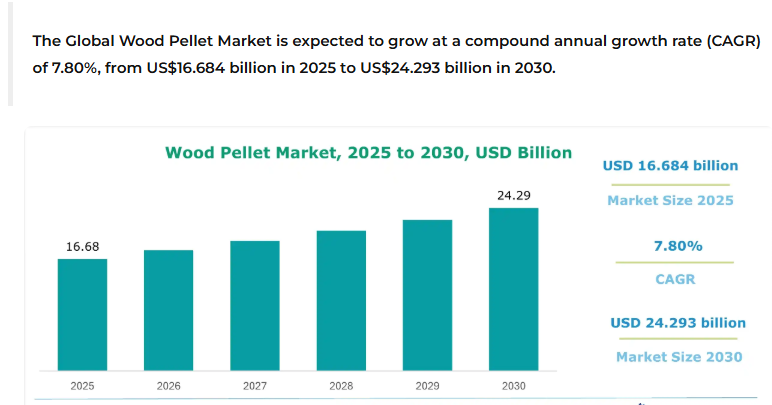

Global pellet demand is projected to reach nearly 60 million tons by 2030, according to the International Energy Agency (IEA), doubling current levels. The black pellet market alone is forecast to exceed $24 billion by 2030, growing at a CAGR of 7.8%. Japan and South Korea account for approximately 30% of total imports, primarily for coal-to-biomass converted power plants.

With its proximity to these markets, competitive logistics costs, and abundant wood supply, Vietnam holds a distinct advantage over many regional competitors. In fact, Vietnam is already among the world’s top three white pellet exporters, shipping over 4.5 million tons in 2023, primarily to South Korea and Japan. The emergence of black pellets—priced 30–40% higher than standard pellets—promises to elevate Vietnam’s position in the green energy supply chain.

Beyond economic benefits, the pellet industry contributes to reducing greenhouse gas emissions, aligning with Vietnam’s COP26 commitment to achieve net-zero emissions by 2050. When properly managed, utilizing forestry by-products for energy production can alleviate pressure on natural forests, create rural jobs, and support green growth objectives.

Challenges Facing Vietnam

Despite its potential, the pellet industry faces challenges. By-product feedstock remains poorly planned, leading to supply instability in some regions. Additionally, rising domestic timber prices due to competition from wood chip exports and paper production may squeeze biomass plant profitability.

Furthermore, sustainability certifications (FSC, PEFC) are becoming mandatory for biomass products in developed markets. This requires Vietnam to establish clear traceability systems and invest heavily in processing technology, forest management, and logistics.