While gold has dominated headlines this year, silver has quietly surged, reaching record highs. Analysts predict its value could double in the coming years.

Last week, spot silver prices surpassed $50 for the first time before retracing. On Monday, the metal rallied further, exceeding $52 per ounce. Spot silver has climbed over 78% year-to-date, outpacing gold’s 50% gain.

Both metals benefit from a flight to safe-haven assets amid broader market volatility. Silver also faces potential supply-demand imbalances, adding to its appeal.

Paul Syms, Head of EMEA ETF Commodity & Fixed Income Product Management at Invesco, told CNBC that gold’s record rally has prompted investors to diversify into other precious metals. “Interest in silver surged as the gold-silver ratio topped 100 following gold’s rise,” he noted on Friday. “The only other time this century the ratio exceeded 100 was during the pandemic, followed by a sharp reversal.”

Syms added that investors now view silver as a store of value for multiple reasons. Gold has set 39 new records this year alone. Silver, however, offers practical applications that gold lacks.

“Gold’s industrial uses are limited,” he explained. “From an investor’s perspective, silver is also a store of value but has extensive industrial applications, particularly in electronics and renewable energy.”

While predicting silver’s next move is challenging, Syms emphasized that its 2025 rally has exceeded expectations. “Sentiment for gold and silver remains positive, and investor allocations are relatively low, so prices are unlikely to falter,” he said. “If sentiment holds, silver could continue rising.”

Silver at $100?

Paul Williams, CEO of Solomon Global, a gold and silver provider, attributed silver’s rise to “strong, tangible forces” rather than speculation, unlike its 1980 peak. “Deepening structural deficits, record industrial demand, and accelerating green technology investments are tightening supply and driving prices higher,” he noted.

“While silver lacks gold’s full safe-haven qualities, its dual role as an industrial metal and store of value continues attracting investors seeking stability and growth potential.”

Silver is essential in various industries, used in electrical switches, solar panels, mobile phones, and AI-driving semiconductors.

Williams added that silver’s market fundamentals show no signs of weakening, suggesting its rally could extend into 2026. “Despite record levels, silver remains undervalued compared to gold,” he said. “Under current conditions, $100 silver by late 2026 is entirely possible.”

Philippe Gijsels, Chief Strategist at BNP Paribas Fortis, shares this view. He predicted silver at $50 over a year ago and believes its value could double from current highs.

“Round numbers tend to attract investors like magnets,” he argued. “Once prices enter that gravitational field, we often see accelerated buying and peaks.”

However, he expects a pause before the next surge. “After such a strong rally, we typically see a lull—a sharp but brief pullback, prolonged sideways movement, or both. Technical overbought conditions need resolving.”

Long-term, Gijsels believes the drivers remain intact, leaving room for further gains. “Investors who entered this year understood correctly… in an inflationary world with volatility as the new normal, and central banks printing money to sustain the system, tangible assets are essential to protect purchasing power. These include real estate, stocks, fine wine, and especially precious metals.”

“We’re closer to the start than the end of one of history’s greatest bull markets,” he argued. “I wouldn’t be surprised to see silver far exceed $100 in the near future.”

Domestic Silver Hits Record Highs

Following global silver’s surge, domestic prices also rose sharply on October 14. At Phu Quy Jewelry, one tael of silver sold for 2.075 million VND, an all-time high. One-kilogram silver bars surpassed 55 million VND.

Over the past three months, domestic silver prices have risen 34%, and over 78% year-on-year.

Positive Outlook Persists in the Warrant Market for the Week of October 13-17, 2025

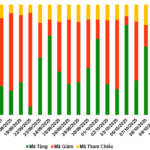

As the trading session closed on October 10, 2025, the market witnessed 164 stocks advancing, 67 declining, and 47 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 448,600 CW.

Da Nang Real Estate Leads Central Vietnam’s Price Surge as Hanoi Buyers Show Strong Interest

Following the merger, the new Da Nang City has emerged as the growth epicenter of Central Vietnam, boasting modern infrastructure, vast land reserves, and a surge in investment capital from Hanoi and Ho Chi Minh City. Real estate prices here have soared by 32% in just the first nine months of the year, marking the highest increase in the region.

Vietnam’s State Securities Commission: Market Upgrade Marks the Beginning of a New Development Phase

According to the State Securities Commission (SSC), this event marks a significant milestone, showcasing the robust growth of Vietnam’s stock market. It reflects the comprehensive reform efforts undertaken by the entire securities industry in recent years, aligning with the directives of the Party and the State to develop a transparent, modern, and efficient stock market that meets the highest international standards.

Vietnam Airlines Appointed Lead Investor for Three Cargo Projects Worth Over VND 5.6 Trillion at Long Thanh Airport

The Ministry of Construction has issued three decisions, numbered 1630, 1631, and 1632/QĐ-BXD (dated September 30, 2025), approving Vietnam Airlines (HOSE: HVN) as the investor for three aviation logistics projects at Long Thanh International Airport. The preliminary total investment for these projects is estimated at 5.602 trillion VND.