According to the recently released Q3/2025 consolidated financial report, Ba Ria – Vung Tau Housing Development JSC (Hodeco, stock code: HDC, listed on HoSE) recorded a net revenue of VND 102 billion, an 18% decrease compared to the same period last year. The primary reason for this decline is the 87% drop in real estate sales, which generated only over VND 8 billion.

With revenue declining and production costs rising by 26%, gross profit fell to just over VND 17 billion, a 70% decrease year-over-year.

Notably, financial revenue for this period reached over VND 700 billion, compared to just over VND 2 billion in the same period last year. This was primarily due to a VND 696 billion profit from the sale of shares in Ocean Entertainment Construction Investment JSC Vung Tau.

Ocean Entertainment Construction Investment JSC Vung Tau is the developer of the Antares Ocean Tourism Complex project, spanning 19.6 hectares with a total investment of nearly VND 8.5 trillion.

As a result, Hodeco reported a record after-tax profit of nearly VND 539 billion, compared to just over VND 13 billion in the same period last year.

As of September 30, 2035, Hodeco’s total assets stood at VND 5.404 trillion, a 10.8% increase from the beginning of the year. Cash and cash equivalents rose from over VND 10 billion to more than VND 280 billion.

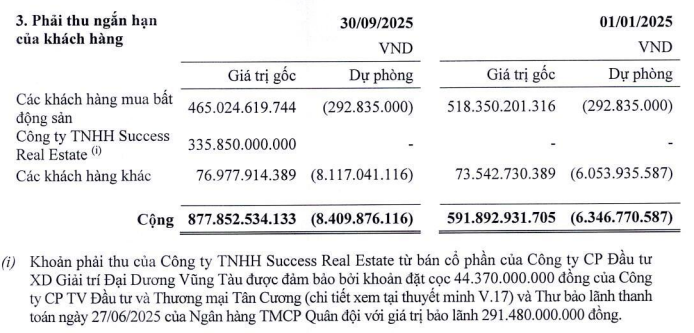

Notably, Hodeco recorded a short-term receivable of nearly VND 336 billion from Success Real Estate LLC, stemming from the sale of shares in Ocean Entertainment Construction Investment JSC Vung Tau. This receivable is secured by a VND 44 billion deposit from Tan Cuong Investment Consulting and Trading JSC, along with a VND 291 billion payment guarantee letter issued by MB Bank on June 27, 2025.

Source: Hodeco’s Q3/2025 Consolidated Financial Report

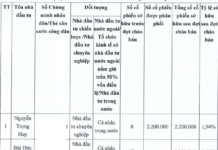

Additionally, HDC recorded a receivable of nearly VND 238 billion from Ms. Nguyen Thi Phuong Tam, an increase of VND 115 billion from the beginning of the year. HDC stated that this is the payment for the purchase of shares in Y Ngoc Binh Thuan Resort Real Estate Trading and Services JSC, as per the principle transfer agreement signed on November 25, 2021.

According to the Board of Directors’ Resolution No. 81/NQ-PTN dated August 7, 2025, the company changed its method of acquiring the Golden Stone Beach Tourism Complex project by splitting Y Ngoc Binh Thuan Resort Real Estate Trading and Services JSC into two legal entities. The company will own shares in the new entity, Y Ngoc Golden Stone Beach Real Estate Trading and Services JSC.

As of September 30, 2025, the company has not yet completed the separation of Y Ngoc Binh Thuan Resort Real Estate Trading and Services JSC.

Inventory increased by 5% from the beginning of the year to VND 1.433 trillion. This includes VND 934 billion in short-term work-in-progress costs for The Light City complex project and over VND 91 billion in real estate inventory.

Long-term work-in-progress costs totaled over VND 1.662 trillion, a 22% increase from the beginning of the year. This includes VND 794 billion for the Long Dien residential area (Ho Chi Minh City), VND 646 billion for the Co May urban area, and VND 205 billion for the Phuoc Thang urban area.

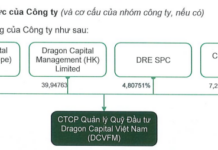

Hodeco’s investments in affiliated companies decreased significantly to nearly VND 288 billion, down from VND 812 billion at the beginning of the year, primarily due to the exclusion of investments in Ocean Entertainment Construction Investment JSC Vung Tau.

Regarding capital sources, total liabilities decreased slightly to VND 2.523 trillion. Short-term financial debt fell by 26% to VND 869 billion, mainly from bank loans.

Long-term debt stood at VND 757 billion, including VND 491 billion in bonds and VND 266 billion in bank loans.

In Q3/2025, Hodeco spent VND 1.1 billion on salaries, allowances, and bonuses for the Board of Directors, a more than 50% decrease compared to the same period last year.

Meanwhile, the company doubled its spending on salaries and bonuses for the Executive Board, totaling VND 10.6 billion. This included over VND 3.3 billion for Chairman Doan Huu Thuan and over VND 3 billion for CEO Le Viet Lien.

Văn Phú Expands Development into Southern Market

The Southern real estate market, centered around the emerging Ho Chi Minh City, is witnessing a significant investment surge from leading property developers. This wave of interest has sparked a multitude of large-scale projects, poised to transform the urban landscape dramatically.

Legal Concerns for Buyers: Navigating Property Purchase Risks

When asked about the “biggest risk concerns when buying real estate,” most customers express worries regarding project legality, construction delays, and the project’s liquidity, carefully considering these factors before committing their funds. In contrast, concerns about price fluctuations and rental potential are less prominent.