VPBank’s Total Assets Surpass Annual Plan After Just 9 Months

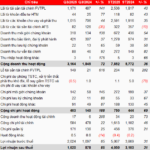

With a solid foundation in place, VPBank’s consolidated total assets exceeded the target set at the Annual General Meeting (AGM) by the end of Q3 2025, reaching VND 1,180 trillion—a 27.5% increase year-to-date. Individual assets stood at over VND 1,100 trillion.

Consolidated credit outstanding hit nearly VND 912 trillion, up 28.4%, driven by contributions from both the parent bank and subsidiaries. Individual credit reached VND 813 trillion, reflecting comprehensive growth.

In line with Resolution 68 on boosting the private sector, VPBank intensified its regional and sector-focused lending strategy, resulting in a 29.1% rise in SME loans. Personal loans for home purchases grew by 27.7%, supported by preferential packages aimed at helping individuals achieve homeownership.

VPBank’s balance sheet remains robust, with individual deposits and securities up 27.8% year-to-date, showcasing diversified product offerings and expanded customer reach. VPBank became Vietnam’s first private bank to enter the global ESG capital market by successfully issuing USD 300 million in international sustainable bonds. Key safety ratios—loans-to-deposits (LDR) at 82.8% and short-term funding for medium-to-long-term loans at 26.5%—remain within State Bank regulations.

Alongside growth, VPBank enhanced asset quality through diverse bad debt management. By Q3 2025, the consolidated NPL ratio (under Circular 31) fell below 3%, while individual NPLs improved to 2.23%. Recovered debt reached nearly VND 2.9 trillion in 9 months, with Q3 collections up 29.7% quarter-on-quarter. The legalization of Resolution 42 provides a strong framework for VPBank to accelerate bad debt recovery and strengthen its financial foundation.

VPBank pioneered the adoption of the Internal Ratings-Based (IRB) approach under Circular 14, aligning with Basel III capital management. As of September, the consolidated Capital Adequacy Ratio (CAR) exceeded 13%, maintaining a leading position.

9-Month Profit Hits 81% of Annual Target

Alongside robust growth, VPBank’s operational efficiency continued to improve. Consolidated pre-tax profit for Q3 2025 reached VND 20.396 trillion, up 47.1% year-on-year. Q3 profit alone hit VND 9.166 trillion—a 76.7% surge and the highest in 15 quarters. Nine-month profits surpassed full-year 2024 results, achieving 81% of the 2025 target.

Q3 growth was fueled by ecosystem synergies. The parent bank led with VND 6.378 trillion in pre-tax profit, up 39.9%, driven by core business strength: net interest income rose 22.7%, and fee income performed well.

Leveraging a vibrant stock market, VPBank Securities set new records, positioning for a landmark IPO. Nine-month pre-tax profit reached VND 3.260 trillion, quadrupling year-on-year, with margin loans hitting VND 27 trillion—ranking third industry-wide, and leaving VND 13.5 trillion in headroom. FE Credit sustained recovery, matching full-year 2024 profits in just 9 months.

After challenges, GPBank turned profitable from June 2025, marking a positive turnaround. Management aims for VND 500 billion in profit this year.

Ecosystem Synergies: Foundation for Future Growth

VPBank’s ecosystem strategy is evident in subsidiaries’ breakthroughs. VPBank Securities, the ecosystem’s sole brokerage, is offering 375 million shares at VND 33,900 each (USD 2.5 billion valuation), raising VND 12.713 trillion to strengthen finances and expand operations. VPBank Securities aims to lead in investment banking, offering tailored solutions across segments.

GPBank transformed under VPBank’s guidance, rebranding and launching GP.DigiPlus. Its philosophy, “For an Era of Prosperity,” aligns with VPBank’s vision for a “Prosperous Vietnam,” reflecting a commitment to sustainable customer partnerships.

Following VPBank K-Star Spark in Vietnam, VPBank became the title sponsor of G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI on November 8–9, reinforcing its leadership in cultural experiences and Vietnamese pop culture.

Despite Q3’s record GDP growth, Q4 uncertainties persist due to US-China tensions, natural disasters, and currency fluctuations. However, VPBank’s ecosystem strength—backed by robust capital, liquidity, technology, and governance—positions it for sustainable growth.

– 14:41 14/10/2025

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

Hue Holds Over 1,500 Residential Units in Real Estate Project Inventories

The real estate market in Hue City witnessed a significant surge in inventory during Q3/2025, with 1,512 residential units across various projects remaining unsold—a notable increase of 380 units compared to the previous quarter. Despite this, authorities have noted positive signs of recovery in the market.

VPBank Empowers Rikkeisoft’s Global Acceleration

On October 10, 2025, Rikkeisoft JSC and Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) officially signed a Memorandum of Understanding (MOU). This agreement marks a comprehensive partnership between a rapidly growing technology company and a leading commercial bank in Vietnam, with VPBank serving as a financial springboard to propel Rikkeisoft’s global expansion.