Bình Minh Plastics Joint Stock Company (HoSE: BMP) has released its consolidated financial report for Q3/2025.

In Q3/2025, Bình Minh Plastics recorded a net revenue of VND 1,532 billion, a 9% increase compared to Q3/2024. After deducting the cost of goods sold, the company’s gross profit reached VND 734 billion, up 21% year-over-year. The gross profit margin improved from 43.09% in Q3/2024 to 47.91% in Q3/2025.

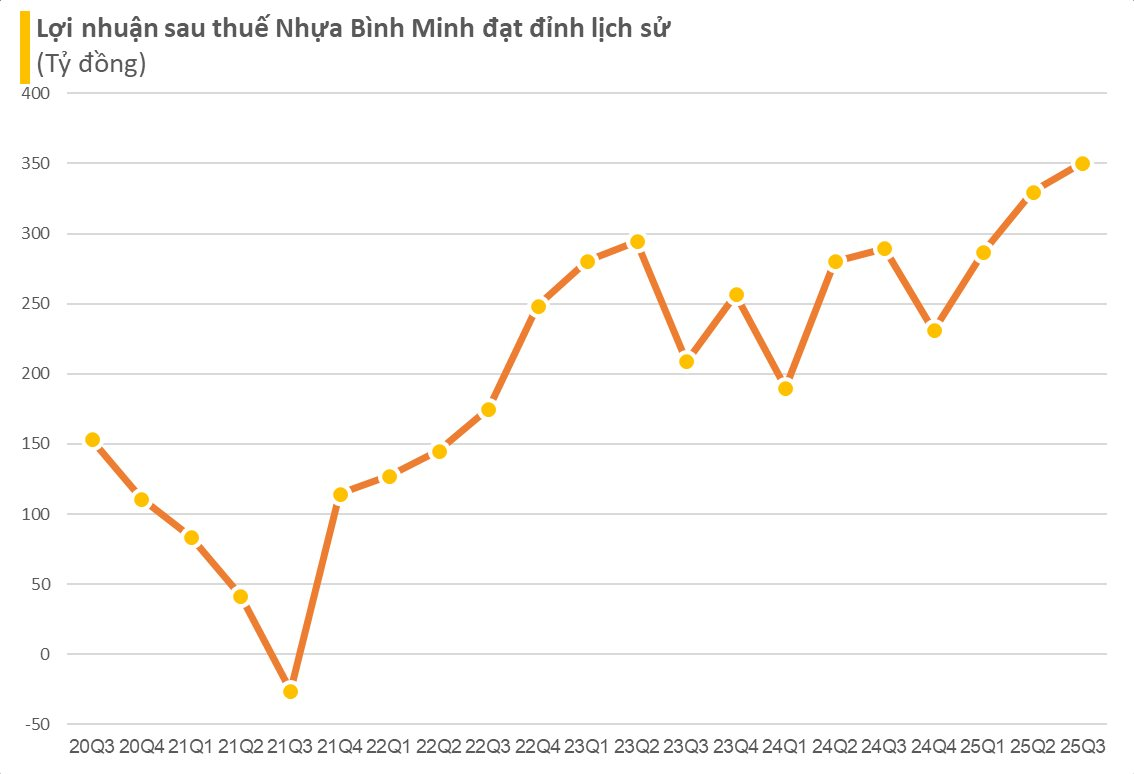

As a result, the company’s after-tax profit hit nearly VND 351 billion, a 21% rise compared to the same period last year.

This marks a new quarterly profit record since Bình Minh Plastics became a subsidiary of Nawaplastic Industries, a member of Thailand’s SCG Group, in early 2018. The figure surpasses the previous record of VND 330 billion set in the prior quarter.

For the first nine months of 2025, Bình Minh Plastics’ net revenue reached VND 4,224 billion, a 19% increase compared to the same period in 2024. After-tax profit stood at VND 967 billion, up 27% year-over-year.

As of September 30, 2025, the company’s total assets amounted to VND 3,971 billion, a 24% increase since the beginning of the year. Cash and bank deposits accounted for 69% of total assets, totaling nearly VND 2,733 billion.

On the liabilities side, BMP’s total payable debt at the end of Q3 was VND 823 billion, up 65% since the start of the year. Short-term loans and financial leases remained at VND 54.9 billion, with no long-term debt utilized.

Fertilizer Company Reports Staggering 1,000% Profit Surge in Q3 2025

The company attributes its revenue growth primarily to increased sales volume and a higher average selling price compared to the same period last year. Specifically, the average selling price for this period stood at 17.74 million VND per ton, marking a significant increase of 4.56 million VND per ton over the previous year.

Legal Concerns for Buyers: Navigating Property Purchase Risks

When asked about the “biggest risk concerns when buying real estate,” most customers express worries regarding project legality, construction delays, and the project’s liquidity, carefully considering these factors before committing their funds. In contrast, concerns about price fluctuations and rental potential are less prominent.

Q3/2025 Financial Report Update: Automotive Firm Lists Losses, Shareholder Equity Dips to -62 Billion VND

At present, the majority of companies that have released their Q3/2025 financial reports belong to the securities sector. Additionally, businesses in real estate, healthcare, construction materials, and electrical equipment have also disclosed their quarterly statements.