At the Roadshow event themed “VPBankS Harmonizing Prosperity – Steadfastly Leading the Way,” Mr. Nguyễn Đức Vinh, Board Member and CEO of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB – the parent bank of VPBankS), emphasized that the bank’s ecosystem will provide a robust foundation for VPBankS’s future growth.

VPBank CEO Nguyễn Đức Vinh underscored the vision of building a leading financial conglomerate in Vietnam: “If we don’t take the lead, there’s no way we can operate effectively.” Thus, the bank’s leadership and major shareholders, including strategic foreign partners like SBMC, remain aligned on the strategy of “development – growth – leadership.”

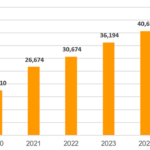

Over the past 15 years, VPBank has achieved an average annual growth rate of over 30%; in the last three years, this growth has been sustained despite market volatility. This highlights the bank’s ability to execute rapid, safe, and efficient growth objectives.

VPBank currently leads the private sector in total assets, consumer finance, auto loans, home loans, and is rapidly expanding in small and medium-sized enterprise lending, digital economy, and e-commerce. This success stems from over a decade of focused and sustainable development strategies, shared Mr. Vinh.

Capital remains a core driver of growth. VPBank is among the top three banks in terms of equity, thanks to strategic partnerships with major domestic and international investors.

From a securities company with a charter capital of just VND 36 billion when acquired by the bank, VPBankS has now entered the market’s top 5 and is projected to rise further. Along this journey, the entire ecosystem will actively support VPBankS.

According to Mr. Vinh, VPBankS’s IPO is part of a strategy to strengthen the capital foundation across the ecosystem, not only increasing capital for the securities company but also for the entire group. This will enable the group to pursue critical objectives. The transaction is expected to attract new investors, raising nearly USD 500 million.

Mr. Nguyễn Đức Vinh speaking at the event – Photo: Huy Khải

|

VPBankS is conducting an IPO of 375 million shares under the code VPX, with an offering price of VND 33,900 per share, aiming to raise over VND 12,712 billion. At this offering price, the company’s projected 2025 P/E ratio is 14.3 times, and P/B is 2.4 times, lower than the industry averages of 23.1 times and 2.7 times, respectively.

Two Key Drivers for VPBankS’s Robust Growth

According to bank leadership, VPBankS’s unique advantage lies in its synergy with the parent bank’s ecosystem of 30 million customers, including over 1 million high- and ultra-high-net-worth individuals.

The company also benefits from VPBank’s extensive lending and capital financing expertise, providing deep insights into the financial needs of businesses and investors—a rare advantage among securities firms.

VPBank boasts two powerful digital platforms, VPBank Neo and Cake, with Cake serving over 6 million customers and already turning a profit, demonstrating successful digital transformation. Additionally, the ecosystem encompasses consumer finance, insurance, investment, education, healthcare, and mobility, creating a comprehensive foundation for VPBankS to deliver integrated, accessible, and efficient investment services.

Furthermore, VPBank is preparing foundational platforms for digital asset ventures, ready for future deployment.

Two key drivers will fuel VPBankS’s high growth in the coming years: (1) a comprehensive investment ecosystem, integrating the securities company with the broader investment ecosystem, and (2) the debt capital market, a critical factor for rapid growth.

VPBank’s leadership pledges full support for VPBankS in capital, technology, customer access, and strategy. Drawing on the success of VPBank’s 2017 IPO, where over 80% of commitments to shareholders were fulfilled, the bank demonstrates its ability to realize ambitious plans.

– 17:58 15/10/2025

Eximbank Honored with “Asia’s Outstanding Enterprise” and “Fast-Growing Enterprise” Awards at APEA 2025

On October 9, 2025, Eximbank was honored at the Asia Pacific Enterprise Awards (APEA) 2025 with two prestigious accolades: the Corporate Excellence Award and the Fast Enterprise Award. This achievement marks a significant milestone, solidifying Eximbank’s growing prominence in the regional financial market.

SHB Boosts Capital to Strengthen Financial Resilience and Drive Growth in the New Era

SHB is set to seek shareholder approval via written consent for its 2025 charter capital increase plan. This strategic move aims to solidify its position as Vietnam’s leading private commercial bank, enhance its capacity to meet growing credit demands, and facilitate business expansion. By investing in digital transformation, SHB seeks to elevate customer experiences and strengthen its competitive edge in the next phase of growth.

MSB Honored as “Asia’s Outstanding Enterprise” and “Inspirational Brand”

Maritime Bank (HoSE: MSB) is proud to announce its recent recognition at the prestigious Asia Pacific Enterprise Awards (APEA) 2025, where it was honored with two distinguished accolades: “Outstanding Asian Enterprise” and “Inspiring Brand.”