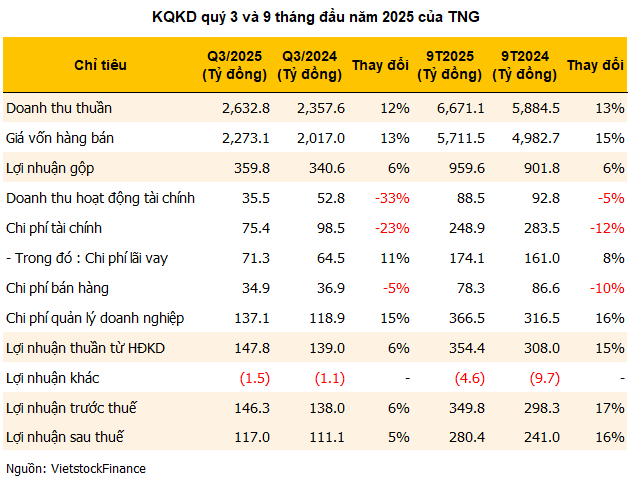

TNG recorded a revenue of nearly VND 2.633 trillion and a net profit of VND 117 billion in Q3/2025, marking a 12% and 5% increase, respectively, compared to the same period last year. These figures represent the highest quarterly milestones for the Thai Nguyen-based garment company.

Despite the cost of goods sold rising faster than revenue, causing the gross profit margin to drop to 13.7%—the lowest in two years—TNG successfully expanded its net profit through effective control of selling expenses and efficient currency hedging strategies.

|

Nine-month performance exceeds 80% of annual target

In the first nine months of the year, TNG achieved a revenue of over VND 6.671 trillion and a net profit of more than VND 280 billion, reflecting a 13% and 16% year-on-year growth, respectively. With these results, the company has fulfilled approximately 82% of its annual revenue and profit targets.

In contrast to its positive business performance, TNG’s stock price has been on a downward trend recently. As of the afternoon session on October 17, the stock was trading at around VND 18,500 per share, down 9% over the past month and losing over 18% in the past year, with average liquidity of approximately 1.5 million shares per session.

| TNG Stock Price Performance Over the Past Year |

Weakening cash flow, significant increase in debt

As of September 30, 2025, TNG’s total assets reached over VND 6.702 trillion, an increase of VND 885 billion (or 15%) compared to the beginning of the year. This growth was primarily driven by inventory exceeding VND 1.200 trillion, up 12%, and short-term receivables nearing VND 1.300 trillion, nearly double the year’s start. The company currently holds over VND 617 billion in bank deposits.

TNG’s total liabilities stood at over VND 4.748 trillion, a 21% increase from the beginning of the year, with financial debt accounting for more than VND 2.600 trillion, including over VND 2.200 trillion in long-term loans (up 38%).

The company’s operating cash flow also reversed, with a net cash outflow from operating activities of over VND 344 billion, compared to a positive VND 257 billion in the same period last year. This shift was primarily due to increased payments to suppliers and employees.

– 13:47 17/10/2025

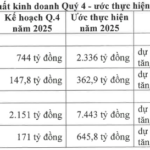

Phú Tài Aims to Surpass 2025 Profit Target by Over 35%

The Board of Directors of Phu Tai Corporation (HOSE: PTB) has approved the estimated consolidated business results for the first nine months of 2025, reporting a revenue of VND 5,292 billion and pre-tax profit of nearly VND 475 billion. This represents a 15% increase in revenue and a 36% surge in pre-tax profit compared to the same period last year.

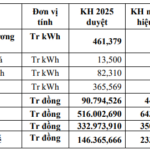

VPD Boosts 2025 Profit Target by 59%

On October 9th, the Board of Directors of Vietnam Power Development Joint Stock Company (HOSE: VPD) approved adjustments to its 2025 business plan, increasing its commercial electricity output target from 461 million kWh to nearly 579 million kWh, representing a growth of over 25% compared to the previous target.