OCI Holdings, a South Korean chemical industry giant established in 1959, strategically pivoted into solar energy materials in 2008. This move underscores its long-standing expertise and ambition in diversifying its portfolio.

With a reported revenue of approximately $2.6 billion in 2024, OCI’s strategy to build a supply chain outside China is driven by two key objectives: complying with U.S. supply chain regulations and capitalizing on favorable policies in the American market.

OCI Holdings has announced a $78 million investment through a Singapore-based SPV to acquire a 65% stake in a solar wafer manufacturing plant in Vietnam. The project, valued at $120 million, boasts an initial capacity of 2.7 GW annually, with potential to double upon an additional $40 million investment.

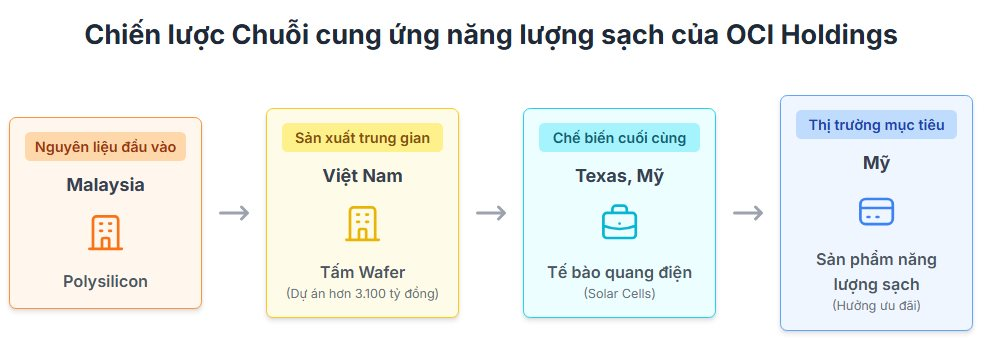

While initially appearing as a standard supply chain diversification, the plant’s polysilicon supply will originate from OCI’s facility in Malaysia. This marks the initial phase of establishing a production chain independent of China, aligning with broader geopolitical and economic strategies.

Simultaneously, OCI is investing $265 million in a solar cell manufacturing plant in Texas through its subsidiary, Mission Solar. Scheduled for commercial operation in early 2026, this facility mirrors the timeline of the Vietnam plant, signaling a coordinated global strategy.

This synchronized timeline suggests a clear roadmap: Polysilicon from Malaysia will be processed into wafers in Vietnam, then exported to Texas for final assembly into solar cells. This integrated approach ensures compliance with U.S. regulations and maximizes eligibility for clean energy incentives.

OCI’s strategy is designed to meet U.S. requirements, particularly the “Foreign Entity of Concern” (FEOC) clause. By excluding Chinese entities from its supply chain, OCI’s products will qualify for subsidies and tax credits under U.S. clean energy legislation, providing a competitive edge in the market.

OCI Holdings Chairman Woo Hyun Lee emphasized this goal in a statement to Korean media: “This strategic investment brings us closer to establishing a seamless supply chain for U.S. exports, reinforcing our global market position.”

For Vietnam, OCI’s decision to establish a production hub within its borders highlights the country’s growing role in the global supply chain. This reflects a broader trend of multinational corporations diversifying production to reduce reliance on single markets, positioning Vietnam as a key player in international trade and technology flows.